- Blogs

- /

- 4 Inspiring Credit Repair Success Stories

4 Inspiring Credit Repair Success Stories

Struggling with bad credit can feel overwhelming and discouraging, leaving you frustrated and exhausted as you watch the credit repair process unfold at a snail’s pace.

Understandably, repairing your credit is not just about improving a three-digit number; it’s about taking control of your financial future. So, it’s perfectly normal to have doubts and concerns regarding your credit scores and the credit repair journey.

Yet, there’s no better way to instill confidence in the process than by hearing the remarkable tales of people who once found themselves in the same challenging situation as you but emerged victorious with amazing credit repair success stories.

Therefore, to make repairing your credit less daunting and to help you feel more relaxed about the process, we’ll share real-life examples of individuals who have successfully improved their credit and valuable tips and insights to help you also achieve credit repair success.

Key Takeaways:

- Credit repair success stories inspire and motivate individuals facing credit challenges, offering hope and belief in personal financial transformation.

- Credit repair is not just about numbers; it’s about transforming lives, opening doors to better employment, achieving personal goals like homeownership or starting a business, and illustrating the real-world impact of credit repair.

- Effective credit repair strategies include paying off debts, disputing inaccuracies, working with reputable credit repair companies, and building a positive payment history.

- These credit repair success stories emphasize that anyone can improve their credit score with determination and perseverance by taking proactive steps, seeking professional guidance, and staying committed.

- Understanding factors that cause credit score drops, such as late payments, high credit utilization, closing old accounts, applying for new credit lines, collections, and bankruptcies, is crucial for credit improvement.

N/B: All success stories on this page are authentic and include a link to the source. However, we changed their names for privacy.

The Power of Credit Repair Success Stories

Credit repair success stories have the power to inspire and motivate individuals who are struggling with bad credit. These stories prove that it is possible to overcome credit challenges and achieve great results, and they can also instill a sense of hope and belief that you can also turn your credit situation around. Others include:

1. Learn about different approaches to credit repair that may work for you as well.

Credit repair is not a one-size-fits-all process. What works for one person may not work for another. That’s why it’s essential to explore different approaches and find strategies that align with your unique circumstances.

The key is to find an approach that suits your comfort level and aligns with your financial goals. It may take some trial and error to discover what works best for you but don’t be discouraged. Remember that every step forward is progress towards improving your credit score and achieving financial success.

2. Demonstrating the Effectiveness of Various Strategies

Credit repair success stories provide tangible evidence of how different strategies and techniques can effectively improve one’s credit score. When you read about individuals who have successfully repaired their credit, you get a glimpse into the approaches they took and the steps they followed. This insight allows you to learn from their successes and avoid common pitfalls.

Some common strategies employed by successful individuals include:

- Paying off outstanding debts: Many credit repair reviews highlight how paying down debt plays a significant role in improving their credit score.

- Disputing inaccuracies: Professional credit repair often involves identifying errors on your credit report and debating them with the relevant authorities.

- Working with reputable companies: Credit repair companies specialize in helping individuals navigate the complexities of repairing their credit.

- Managing student loan debt: Student loans can be a significant burden on your overall financial health, so finding ways to manage them effectively is essential.

- Building a positive payment history: Consistently making timely payments demonstrates financial responsibility and positively impacts your credit score.

By understanding these strategies of credit repair success stories, you can develop an informed plan of action to address your credit problems.

3. Learning from Successful Individuals

Credit repair success stories offer valuable lessons to guide your credit repair journey. By studying the experiences of those who have achieved great credit, you can gain insights into what worked for them and apply those lessons to your situation.

These success stories can inspire you to take control of your financial future. They show that with determination and perseverance, it is possible to overcome even the most challenging credit issues. These stories serve as a reminder that you are not alone in your struggles and that there is hope for a brighter financial future.

4. Find motivation in knowing that others have achieved significant results through diligent efforts.

It’s important to remember that repairing your credit takes time and effort; it won’t happen overnight. However, by hearing about the experiences and successes of others who have gone through similar journeys, you can find motivation to stay committed and focused on your goals.

Knowing that people can overcome financial challenges and improve their credit scores should give you hope that you can do the same. By taking proactive steps, seeking professional guidance if needed, and staying persistent, you’ll find that you can also achieve significant results and regain control of your financial future.

From 510 – 700 FICO: A Remarkable Journey

Three years ago, Marie’s life was spiraling out of control. She was nearly thirty, broke, with a terrible credit score of 510. Marie spent her nights partying and making poor choices, a college dropout far from where she aspired to be.

Surviving on a meager $35,000 income, she could barely make ends meet. Renting a room in a house was her only affordable option, as her poor credit prevented her from securing her own place. Debt collectors relentlessly harassed her and seized her wages. She battled depression and shame, silently carrying her burdens.

Turning point

Then, about a year and a half ago, she landed a remarkable, well-paying job, offering her a taste of financial freedom. However, her credit problems continued to haunt her until an unexpected turn of events, the COVID-19 pandemic, forced her indoors. With newfound time and determination, she delved into credit repair strategies, employing secured credit cards, pay-to-delete tactics, and debt validation, ultimately raising her FICO score to a commendable 700.

Current Situation

Fast-forward to today, Marie has triumphed. She recently secured her own apartment and obtained her first ‘real’ credit card with an impressive $11,000 limit. Moreover, she saved $25,000 over the past year and slashed her student loan debt to $10,000. The best part? All her credit cards are now consistently paid off each month.

Her journey, though daunting, serves as an inspiring tale of transformation and resilience. Despite initial reservations about sharing her story, Marie’s triumphs convey a message of hope to anyone facing similar struggles. Her once-undisclosed battles are now an inspiration for those who dream of a brighter future.

Understand the long-term benefits of diligently working towards a higher credit rating.

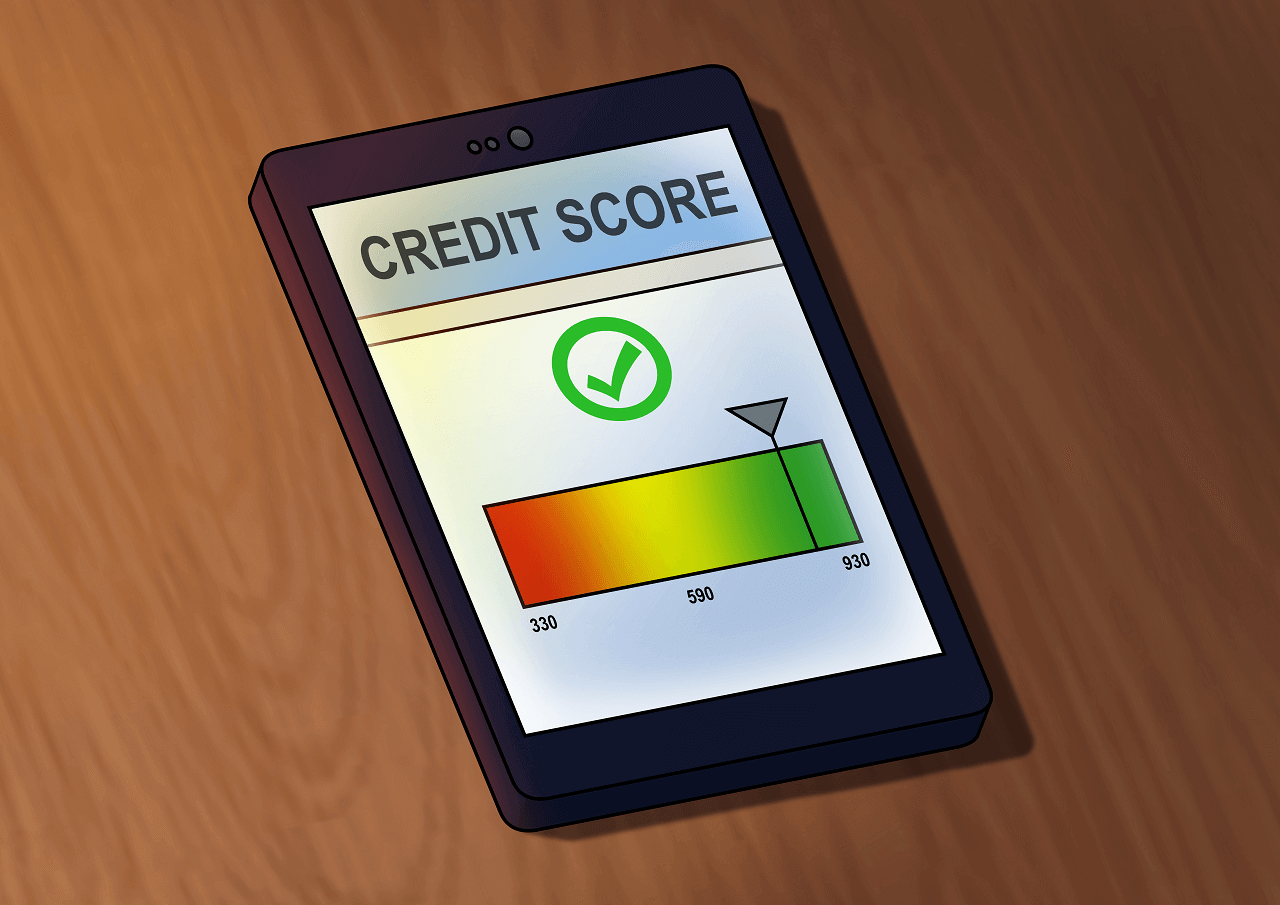

Marie’s journey towards a credit score of 700 not only improved her financial situation but also opened doors to new opportunities. With a higher credit rating, she gained access to higher credit and, subsequently, lower interest rates.

Moreover, having a good credit score allowed Marie to secure favorable terms when renting an apartment. By rebuilding her creditworthiness and achieving an impressive 700 score, Marie regained control over her financial future and set herself up for success in various aspects of life.

Tips for Boosting Your Credit Score

1. Understand the Importance of Credit Scores

Your credit score plays a vital role in your financial life. It’s like a report card that shows how responsible you are with borrowed money. Lenders, landlords, and potential employers often rely on your credit score to assess your trustworthiness. So, it’s crucial to have a good credit score to achieve your financial goals.

2. Check Your Credit Reports Regularly

To improve your credit score, check your credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. Look for any errors or inaccuracies that could be dragging down your score. Dispute any incorrect information and request corrections.

3. Pay Your Bills on Time

One of the most significant factors affecting your credit score is payment history. Late payments can harm your creditworthiness. Pay all bills, including loans, credit cards, and utilities, on time every month.

- Set up automatic payments or reminders to ensure you never miss a due date.

- Consider enrolling in online banking services that offer bill-pay options for added convenience.

4. Reduce Debt and Utilization Ratio

High levels of debt can negatively affect your credit score. Aim to reduce outstanding balances by paying off debts systematically.

- Create a budget: Track your income and expenses to identify areas where you can cut back.

- Prioritize debts: Focus on paying off high-interest debts first while making minimum payments on others.

- Pay more than the minimum: Whenever possible, pay more than the minimum monthly payment to accelerate debt repayment.

- Avoid maxing out credit cards: Keep the utilization ratio (the amount of available credit you’re using) below 30% for each card.

5. Develop Good Credit Habits

Building good habits is essential for long-term success in improving and maintaining good credit:

- Maintain a mix of credit types: A healthy mix of credit, such as credit cards, loans, and mortgages, can positively impact your credit score.

- Keep old accounts open: The length of credit history is an essential factor in determining your score. Avoid closing old accounts unless necessary.

- Limit new credit applications: Applying for multiple lines of credit within a short time can negatively affect your score. Only apply for new credit when needed.

6. Deal with Negative Items

Negative items on your credit report, such as late payments or collections, can significantly lower your score. While they may stay on your report for several years, there are steps you can take to mitigate their impact:

- Communicate with creditors: If you’re struggling to make payments, contact your creditors and explain the situation. They may be willing to work out a payment plan or negotiate a settlement.

- Consider professional help: Credit repair companies specialize in helping individuals address negative items on their reports and improve their scores.

- Patience and persistence: It takes time and effort to repair damaged credit. Stay committed to paying bills on time and reducing debt.

By following these tips consistently over time, you’ll be well on your way to boosting your credit score and achieving financial success.

Overcoming Financial Struggles: Celebrating a New Remarkable Credit Score

Ken’s story is a remarkable journey from financial despair to newfound triumph. In 2018, he faced 48 missed payments on four loans, and his credit score was nothing to write home about. He had seemingly resigned himself to a lifetime of financial hardship and debt.

But fast forward to 2020, Ken’s fortunes turned for the better. His business thrived, enabling him to pay off many of his loans. While his credit score began its slow recovery, those missed payments still loomed over him. He knew he had to wait patiently for the 7-year mark when they’d naturally drop off, and his prospect of purchasing a house seemed like a distant dream, possibly as late as 2025.

Then, an email arrived like a bolt from the blue. He woke up one day to discover that all his late payments had miraculously vanished from his credit history. His FICO score had skyrocketed to an impressive 777. What’s more, he had just made a hefty $24,000 payment towards his $28,000 federal loans, and that monumental step had not even registered on his credit report yet.

Ken stood on the cusp of breaking into the illustrious 800 Club, a testament to his resilience and financial turnaround. His journey is a source of inspiration for anyone facing economic adversity, reminding us all that even the bleakest situations can be transformed with determination and that it doesn’t always take too long before you reach a great credit score.

Discover the specific actions taken to achieve such a remarkable improvement in Ken’s credit score.

Over time, Ken saw improvements in his credit scores as he diligently followed these steps:

- Paying off debts: Ken focused on paying off outstanding debt. This allowed him to reduce his debt burden and improve his credit utilization ratio.

- Building a positive payment history: By consistently paying bills on time, Ken demonstrated responsible financial behavior, which positively impacted his credit score over time.

Determination and Discipline: The Key Ingredients of Credit Repair

Three years ago, Suzy was in a financial nightmare with a credit score languishing around 420–430. However, her story was about to become a testament to determination and resilience as she overcame her lowest point and transformed her financial life.

Taking the First Step

Her journey to recovery began when she received a substantial sum from her grandfather and decided to seize control of her destiny. Suzy returned to full-time work and took on a side gig, determined to dig herself out of the financial hole. With unwavering dedication, she managed to settle and pay off most of her credit cards, and her credit score saw an impressive jump of over 100 points.

Rebuilding Trustworthiness

Suzy’s accounts included a diverse mix of challenges. She resolved a credit card with First Financial Bank USA, settling a $1,078 balance past due for approximately four months for a reduced amount of $616. Her determination paid off, even though this was the only case where she didn’t receive direct confirmation.

Seeking Professional Help

Another victory came with her Bank of America credit card, carrying a hefty $3,600 balance and lingering unpaid for roughly six months. She contacted a credit repair agency, agreeing with BofA to settle at 55% of the original debt, or $1,977.77. It took some time for BofA to report the settlement, but Suzy’s patience prevailed.

Suzy also tackled a Citibank credit card with a $1,845 balance and one month of missed payments. Citibank presented her with a non-negotiable settlement offer of 50%, which she accepted and promptly paid. The documentation arrived promptly via email and mail, sealing another victory.

In the case of her Discover credit card, featuring a $2,650 balance and three months of missed payments, a unique resolution was reached. Discover offered her a two-year repayment plan with a 0.99% APR, allowing her to pay in full once the two-year period concluded. She seized the opportunity and stashed her money in a high-yield savings account.

Building Positive Credit History: Secured Credit Cards and Responsible Borrowing

Suzy’s efforts extended to opening new credit cards, including the First Latitude Card, OpenSky Plus Card, and Capital One Platinum Secured, each contributing to her credit journey and plans.

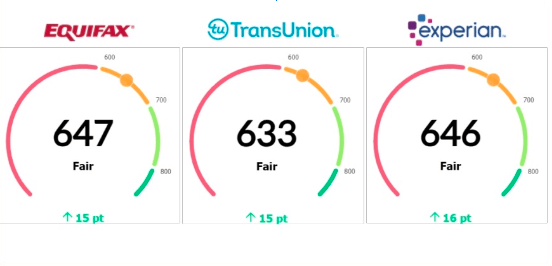

To further enhance her credit, she ventured into a credit-builder account with KikOff and initiated a credit-builder loan, diligently managing both to boost her profile. Suzy’s journey, filled with ups and downs, now reflects a FICO score of 541 via Experian, 556 via TransUnion on her Discover account, and 577 on Vantage Credit Karma via Equifax.

Inspiring Others

Suzy’s story is a beacon of hope for anyone facing financial adversity. With determination, strategic planning, and perseverance, she’s on her way to a brighter financial future, confidently proclaiming, “It is possible! Keep working at it. I’ll be at 660 in no time!”

Self-Help Tips for Effective Credit Repair

1. Create a Budget and Stick to It

One of the first things you should do when working towards credit repair is creating a budget. This will give you a clear understanding of your income, expenses, and how much money you have available to pay off any outstanding debts. By sticking to your budget, you can prioritize payments toward your debts while covering essential expenses.

2. Pay Your Bills on Time

Late payments can have a significant negative impact on your credit score. Make it a priority to pay all your bills on time each month. Consider setting up automatic payments or reminders to ensure you never miss a due date.

3. Reduce Your Debt

High levels of debt can weigh heavily on your credit score. Take steps to reduce your overall debt by paying more than the minimum monthly payment whenever possible. Focus on paying off high-interest debts first; this will save you money in the long run.

4. Negotiate with Creditors

If you’re struggling to make payments or facing financial hardship, don’t hesitate to contact your creditors directly. Many creditors are willing to work with individuals who are proactive about finding solutions. You can negotiate lower interest rates, reduced monthly payments, or even settle for less than you owe.

5. Monitor Your Credit Report Regularly

Keeping an eye on your credit report is crucial for identifying any errors or fraudulent activity that could negatively impact your score. Request free copies of your credit report from each major credit bureau and review them carefully. If you spot any inaccuracies, report them immediately to have them corrected.

6. Build a Positive Credit History

Building a positive credit history is essential for improving your credit score. Consider applying for a secured credit card or becoming an authorized user on someone else’s account to build a positive payment history. Just be sure to use these accounts responsibly and make all timely payments.

7. Seek Professional Help if Needed

If you’re overwhelmed or unsure how to proceed with your credit repair journey, don’t hesitate to seek professional help. There are reputable credit counseling agencies and financial advisors who specialize in helping individuals improve their credit scores and manage their finances more effectively.

Taking Charge of Your Financial Future: Disputing Errors and Paying Off Debts

Hank’s credit score, recently checked through TransUnion, brought him an exciting revelation – it had reached an impressive 861, marking the highest point it had ever achieved.

Facing Reality: Assessing the Damage

Ten years ago, Hank’s credit history told a different story, one scarred by the consequences of youthful financial missteps, leading to a dire state. However, driven by the dream of homeownership, he decided to transform his financial landscape, focusing on rebuilding and enhancing his creditworthiness.

Financial Freedom

The journey wasn’t without challenges and sacrifices, but Hank’s persistence paid off. He began by meticulously clearing off his credit card debt. He watched as the weight of old missed payments gradually lifted from his credit report, granting him a newfound sense of financial freedom.

Today, when he looks at his credit report, he sees a testament to his unwavering commitment. Not a single missed or late payment stains his record. Instead, it showcases a mortgage in good standing, a 0% interest car loan (made possible by his excellent credit) that’s already 50% paid off, a generous $26,000 credit card limit with near-zero utilization, and a $20,000 personal line of credit with a pristine zero balance.

The Takeaway: You Can Repair Your Credit Too!

Hank’s journey, paved with hard-earned financial and credit lessons, gives him immense pride in how far he’s come regarding personal finances and credit management. His advice to anyone grappling with poor credit is unequivocal – start your credit repair journey today.

It’s a step he once hesitated to take, but confronting and taking control of his credit issues not only improved his financial standing but also relieved a significant amount of stress and anxiety in the long run. If he could turn back time, he’d have started fixing it sooner, a testament to the transformative power of taking charge of one’s financial destiny.

Understanding Credit Score Drops and Improvement Strategies

Credit Score Drops: What Causes Them?

Sometimes, our credit scores take a hit, which can be frustrating. But understanding the reasons behind these drops is essential to improving our financial standing. There are a few common factors that can cause a decrease in your credit score:

- Late or Missed Payments: When you don’t make your payments on time or skip them, it can negatively impact your credit score. Lenders want to see that you’re responsible and reliable.

- High Credit Utilization: If you’re using a significant portion of your available credit, it can signal to lenders that you may be relying too heavily on borrowed funds. Aim to keep your credit utilization below 30% of your available credit limit.

- Closing Old Accounts: While counterintuitive, closing old accounts can lower your credit score. This is because the length of your credit history determines part of your score. If you close an old account, you lose that history and potentially decrease the average age of your accounts.

- Applying for Multiple New Credit Lines: Each time you apply for new credit, whether it’s a loan or a new credit card, an inquiry is made on your report. Too many inquiries in a short period can raise red flags for lenders and lead to a drop in your score.

- Collections or Bankruptcies: Having unpaid debts sent to collections or filing for bankruptcy can have long-lasting negative effects on your credit score.

Our Take and Inspiring Testimonials

Let’s face it: credit repair can be a daunting task. It requires research, hard work, and dedication. But don’t worry; you’re not alone on this journey! Many people have successfully repaired their credit and achieved remarkable results.

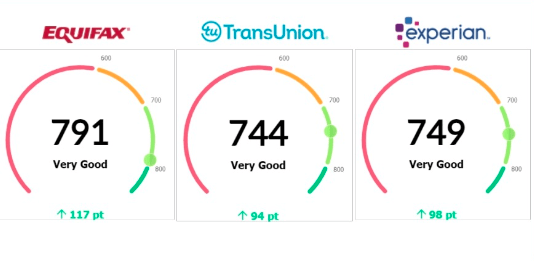

Celebrating Clients’ Progress and Results

Courtesy: GreatCreditFast

Credit repair isn’t just about fixing numbers on a report; it’s about transforming lives. The stories of past clients serve as a beacon of hope for those currently struggling with their credit. These success stories highlight the power of perseverance and the potential to turn things around.

A few months ago, a client contacted our credit repair agency after facing numerous rejections when applying for jobs. Her low credit score was holding her back from securing employment opportunities that aligned with her goals. With the guidance of our professionals, she embarked on a journey to improve her creditworthiness.

After months of hard work and following expert advice, she witnessed significant improvements in her credit score. She not only secured a job that she had been dreaming of but also saw positive changes in other areas of her life. This is just one example of how individuals have successfully repaired their credit and opened doors to new possibilities.

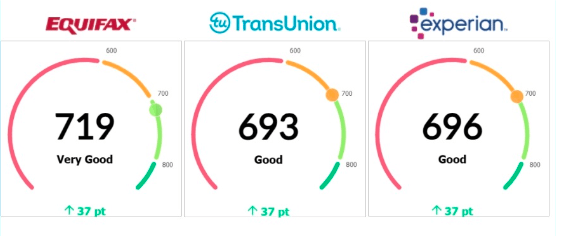

Inspiring Others with Real-Life Success Stories

Courtesy: GreatCreditFast

The impact of these success stories extends beyond individual achievements; they inspire others to take control of their financial well-being as well. When people hear about someone else’s triumph over adversity, it gives them hope that they too can overcome their challenges.

For instance, a year earlier, we had a client struggling with his credit for years due to past mistakes. He felt trapped by his financial circumstances until he stumbled upon an article featuring success stories from individuals who had repaired their credit through professional assistance. Motivated by their achievements, he decided to take action and seek our credit repair services.

With dedication and support from our credit repair company, he gradually improved his credit score. He could secure a loan for a new car, which had seemed impossible before. This story not only transformed his life but also inspired others in similar situations to believe in the possibility of change.

The Power of Credit Repair: Changing Lives for the Better

Courtesy: GreatCreditFast

These success stories highlight the incredible impact credit repair can have on people’s lives. It’s not just about boosting credit scores; it’s about providing individuals with opportunities they may have thought were out of reach.

Imagine being able to confidently apply for that dream job without worrying about your credit history holding you back. Picture the satisfaction of purchasing your first home or starting your own business because you took control of your financial situation. These are the possibilities that become attainable through credit repair.

Contact Us for Your Credit Repair Journey

If you’re feeling overwhelmed by your current credit situation, remember that there is hope. The success stories shared here are proof that positive change is possible. Don’t hesitate to contact professionals specializing in credit repair like GreatCreditFast—we can guide you through the process and help you achieve your goals.

So why wait? Reach out today and let us help you create your own success story!

FAQs

Why should I pay attention to credit repair stories?

Realizing that others have faced similar credit problems and come out on top can give you the confidence to tackle your issues head-on. By learning from their experiences, you can gain valuable insights into what strategies and techniques work best for repairing credit.

How long does it take to repair my credit?

Repairing your credit is not an overnight process. It takes time and effort to improve your credit score. Generally, you can see noticeable improvements within six months to a year if you consistently follow good financial habits, such as paying bills on time, reducing debt, and disputing errors on your credit report.

Can I repair my credit, or should I hire a professional?

While it’s possible to repair your credit by following the right strategies and being diligent about managing your finances, some individuals prefer to seek professional help. Credit repair companies have expertise in navigating the complex world of credit reporting agencies and can provide guidance tailored to your situation.

Will credit repair guarantee loan approval?

Repairing your credit will significantly increase your chances of loan approval since lenders consider a good credit score an indicator of responsible borrowing behavior. However, other factors such as income stability and debt-to-income ratio also come into play during the loan approval process. It’s important to work on improving all aspects of your financial profile.

Can I remove accurate negative information from my credit report?

Accurate negative information, such as missed payments or collections, generally cannot be removed from your credit report until the specified period has passed. However, you can still rebuild your credit by focusing on positive financial habits and adding positive information to counterbalance negative marks.

How can I maintain a good credit score once it’s repaired?

Maintaining a good credit score involves consistent effort and responsible financial management. Paying bills on time, keeping credit card balances low, avoiding unnecessary debt, and regularly monitoring your credit report for errors are essential practices that will help you sustain a healthy credit score in the long run.