- Blogs

- /

- What is a Flexible Spending Credit Card? A Smart Spender’s Secret

What is a Flexible Spending Credit Card? A Smart Spender’s Secret

Summary

Everyone knows a credit card’s limit is a pre-set lending ceiling credit card issuers place on a card. This limit determines how much you can spend from your card within a specific lending period, and it works best for small to medium purchases.

But what if you wanted to make a big purchase? What if you’re facing an emergency? What if you needed to spend above your card’s limit?

Usually, going above your limit is impossible, but thankfully, flexible spending credit cards exist. They’ve helped millions of people cover occasional large purchases and handle big emergency spending.

And today, we’ll discuss what is a flexible spending credit card? How these cards work, how to use them correctly, what to look out for when using them, and some great alternatives to flexible spending credit cards.

Let’s jump in!

Key Takeaways

- Flexible spending credit cards allow you to spend above your credit limit on the card.

- Flexible spending cards can help you make large purchases without worrying about paying over-limit charges.

- Over-relying on a flexible spending credit card can lead to high credit utilization, harming your credit score.

- Getting a high-limit credit card and asking your card issuer to increase the limit on your card are excellent alternatives to flexible spending credit cards.

- Credit card issuers consider your credit score, spending habits, income, and payment history before giving you a flexible credit card.

- NPSL, or No Pre-Set Spending Limit, cards don’t have a predetermined maximum spending cap.

What is a Flexible Spending Credit Card?

A flexible spending credit card is a special credit card with a flexible limit that allows cardholders to spend over their credit limit without any extra fees.

It’s worth noting that credit card issuers don’t typically advertise these as ‘flexible credit cards’ to protect themselves from unnecessary risks and prevent their customers from misusing them.

And before approving a flexible credit card, card issuers often evaluate your credit history and compare it to the intended amount of over-limit expenditure. But they also consider different factors like your:

- Credit score.

- General spending habits.

- Income (plus capacity to pay).

- Payment history.

- How often you try to get credit above your limit.

- How much you want in terms of over-limit credit.

These factors collectively contribute to the issuer’s decision on an appropriate variable credit limit for you. Keep in mind that building a good credit score is key to unlocking the benefits of a higher and more flexible credit limit on this type of card.

Types of Flexible Credit Cards

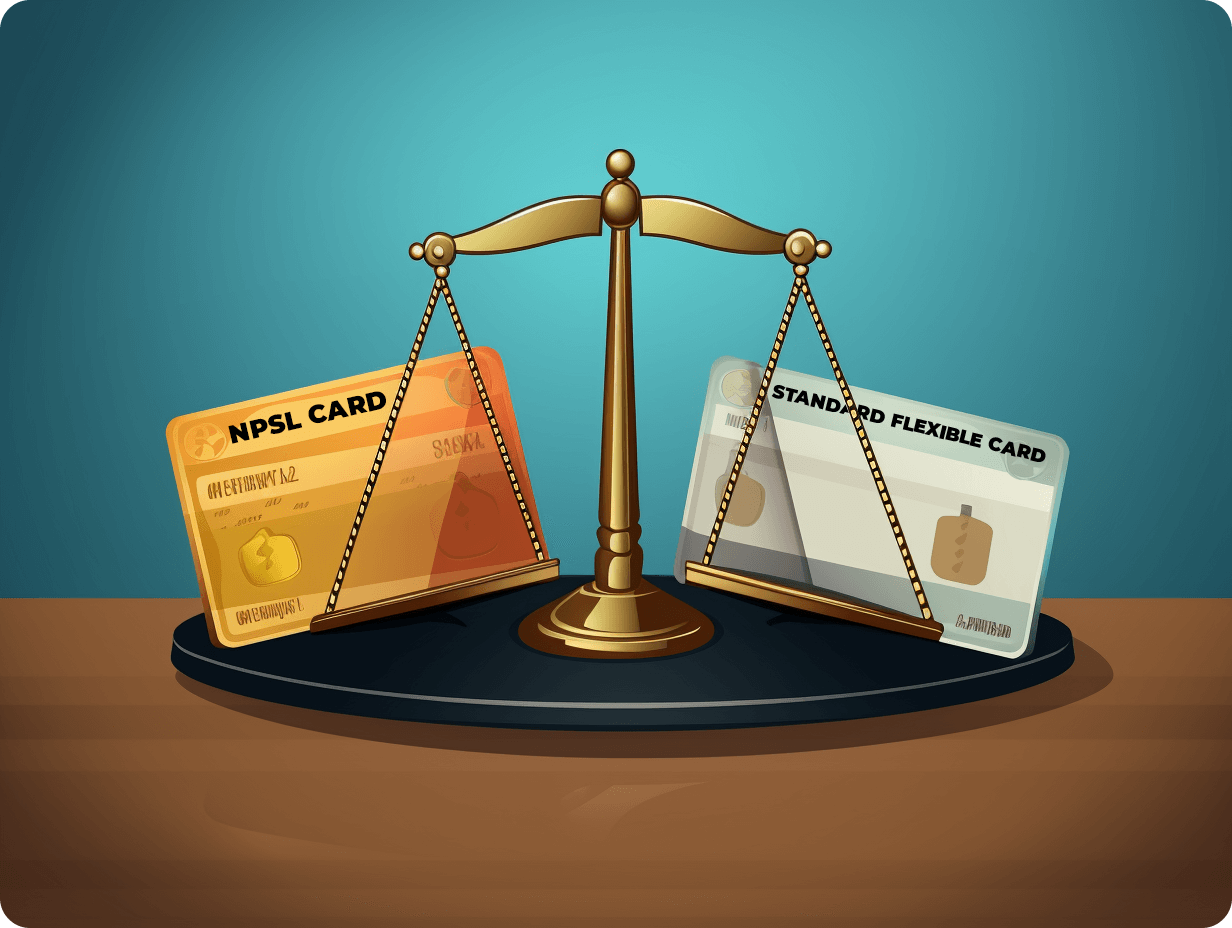

Now that you know what is a flexible spending credit card, let’s take a quick look at the two major types.

1. The Standard Flexible Spending Credit Card

Unlike traditional credit cards with fixed spending caps, the typical flexible spending cards offer soft credit limits. This means the amount you can spend isn’t predetermined but varies based on factors like income and creditworthiness.

How does this work? Let’s say your flexible credit card has a soft monthly limit of $7,000. But that month, your pickup truck’s repairs cost you an extra $2,000. With a flexible card, you can make the $9,000 payment without getting penalized.

This way, if you’ve suddenly increased monthly expenditures or need to make an unexpectedly large purchase, flexible spending cards can help you handle them without being constrained by a set limit like a regular credit card.

The absence of predefined boundaries gives you greater financial freedom and purchasing power than standard credit cards. The best part is that it can function as a regular credit card if you don’t spend above the limit.

2. No Preset Spending Limit Cards (NPSL)

NPSL, or No Pre-Set Spending Limit, cards are a unique type of credit card that doesn’t have a predetermined maximum spending cap. You see, unlike traditional credit cards with fixed limits, NPSL cards provide users with flexibility in spending based on their financial profile.

How does it work? First, instead of having a specific monthly spending limit, the card issuer assesses your income, credit score, and overall financial situation to determine the funds they can allocate.

Remember that even though NPSL cards lack a pre-set spending limit, you must pay the entire balance at the end of every month.

Benefits and Drawbacks of Flexible Spending Credit Cards

Benefits of Using a Flexible Credit Card

Flexible spending credit cards offer flexibility in how you spend your funds, giving you more control over your purchases. These cards come in handy in the case of an emergency when you need to make a purchase that’s above your credit limit.

However, since it fundamentally functions like a regular credit card, you can use it for the same things you can use your credit card for.

Whether grocery shopping, online transactions, or medical bills, you can use a flexible credit card to pay for your expenses.

Flexible spending cards also give you more purchasing power as they enable you to spend past the credit limit on the card without any added cost. This extra wiggle room will help you avoid situations where you’d typically receive a declined notice when purchasing.

Note: Some flexible cards offer cash-back rewards or incentives for qualified purchases, depending on the issuer’s program.

Potential Concerns of Using a Flexible Spending Credit Card

Despite how awesome and luxurious flexible spending credit cards can seem, ensure you don’t overlook the risks and concerns it brings. One major drawback is the risk of overspending and accumulating debt by relying too heavily on the available funds.

If you have a flexible credit card, exercise caution when making purchases so you won’t exceed your ability to pay it off monthly. Remember, just because you can spend above the limit on your card doesn’t mean you should unnecessarily.

Irresponsibly using flexible spending credit cards can lead to high credit utilization, which could lead to severe penalties if you fail to pay the debt at the end of the billing cycle.

Always remember that despite its usefulness in a pinch, you must remember that you’ll be responsible for paying off any debt you take on.

Think of a variable credit limit on a credit card as a helpful feature, not an invitation to borrow more than you can pay back.

Credit card interest rates are usually very high, making it expensive to borrow for longer periods. It’s always best to use your credit card wisely and avoid carrying a balance to save on interest costs.

How to Get a Flexible Spending Credit Card

You must satisfy a few criteria before applying for a flexible spending credit card. First, understand those card issuers only give these cards to people with an excellent credit score and above—average income. Anything less than these, and you may not qualify for one.

Another thing to remember is that the scoring method card issuers use to determine flexible spending credit card eligibility often considers your employment status and income stability.

This means that applicants with irregular or unstable incomes might not meet the criteria set by the card issuer.

Approval Process

Getting approved for a flexible spending credit card depends on your financial history, credit score, payment habits, and overall financial management.

Card issuers pay special attention to your existing debts, outstanding balances, and payment history with other lenders before making decisions.

And unlike traditional credit, the approval process is quicker because it doesn’t require extensive underwriting processes.

Comparing Credit Card Options

Traditional vs. Flexible Credit Cards

Choosing the right credit card is vital for managing your finances effectively. Two common types are traditional credit cards and flexible spending credit cards.

Let’s dive into their key differences so you can easily make an informed decision.

Traditional Credit Cards

Traditional credit cards come with a pre-set credit limit, which means you can only spend up to a specified amount. You may attract extra charges if you exceed this limit or carry a balance.

Also, payments with traditional credit cards are usually on a fixed monthly schedule, not to mention that the approval process involves a comprehensive credit check.

Flexible Spending Credit Cards

On the other hand, flexible spending credit cards offer a dynamic spending capability without a pre-set credit limit.

With a flexible card, folks can spend beyond traditional limits, but they may need to settle the balance promptly. Also, it’s worth noting that the approval process is quicker than that of traditional cards.

Two Alternatives to Flexible Spending Credit Cards

If you don’t like the idea of using a flexible spending credit card and would like to use an alternative, consider asking your credit card issuer for an increase in the credit limit of your current card.

Yes, you can do this online or by phone with most credit card issuers. You can get them to increase your credit card’s limit if you’ve been making regular, punctual payments on debt and keeping a good credit utilization.

Also, you can check out high-limit credit cards. These credit cards are known for offering high credit limits with increased spending power for the cardholder. Getting high-limit cards can significantly boost your purchasing power.

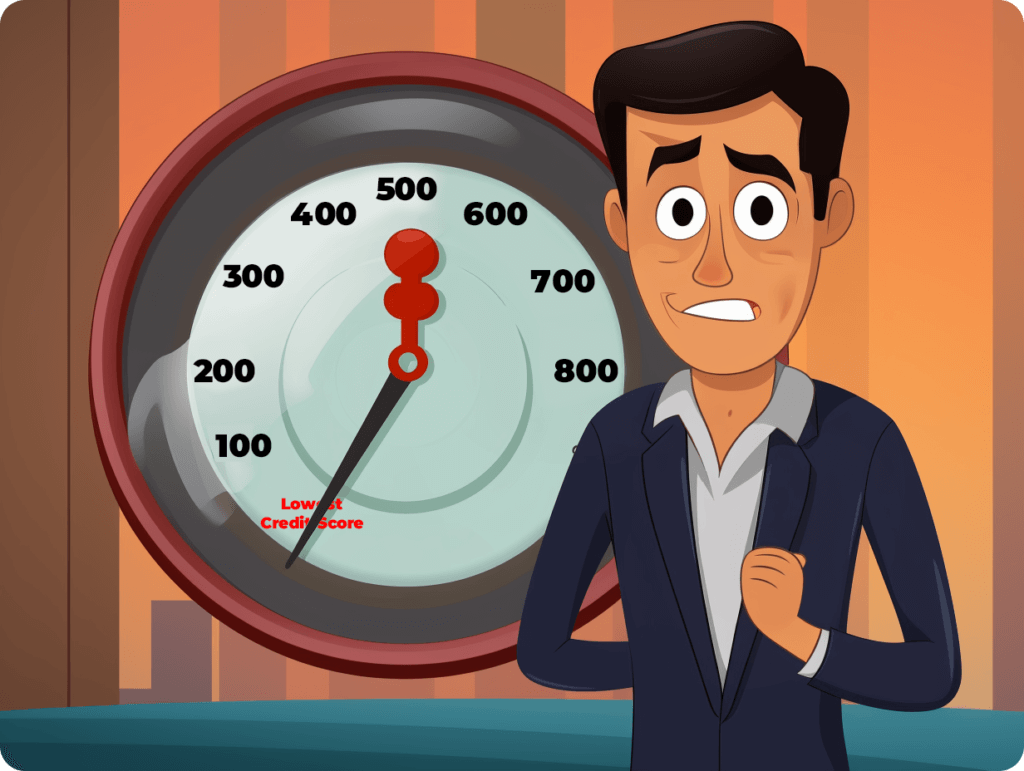

Here’s How Flexible Spending Cards Impact Your Credit Health

Your credit utilization is vital in determining your credit score. Simply put, your credit utilization refers to how much credit you’ve used versus how much credit you can use monthly.

The lower your utilization rate, the better your credit score will be. And that’s because your credit utilization contributes 30% to your FICO scores.

And yes, flexible spending cards are not excluded from this aspect of credit health. Credit bureaus keep track of how much of your available credit you’re using. If you consistently max out your flexible spending card, it could negatively impact your credit score.

On the other hand, keeping a low balance relative to your limit can positively affect your overall financial standing.

Good financial behavior and responsible use of credit cards can lead to higher card limits over time. And that’s because when folks demonstrate that they can manage their finances well, credit card issuers reward them by raising their credit limit and increasing their spending power.

Leverage the Benefits

Now that you understand ‘what is a flexible spending credit card’ and how it can transform your financial management, the key is to leverage its benefits wisely.

Flexible spending credit cards are some of the best financial tools to help you manage your expenses more smoothly. So, whether you’re considering getting one or comparing options, ensure you take the time to understand the benefits and drawbacks of flexible cards.

Also, consider how they align with your financial goals and spending habits. With the proper knowledge, you can leverage these cards to enhance your financial well-being and make informed decisions about your credit options.

FAQs

What is a flexible spending credit card?

A flexible spending credit card is a unique card that allows cardholders to spend above the set limit on their credit cards without paying over-limit charges on the loan.

How does a flexible spending credit card work?

When making an over-limit purchase on your flexible spending credit card, a few factors come into play.

These factors include your credit history and score, overall spending habits, income, and how often you make over-limit purchases. These factors determine whether or not your purchase will be accepted or declined.

What are the benefits of using a flexible spending credit card?

Flexible spending credit cards give you more purchasing power since they allow you to spend more than the pre-set limit on the card. It also gives you that chance to settle emergencies or buy items you wouldn’t have been able to before because of the credit limit.

Are there any drawbacks to using a flexible spending credit card?

There is always a risk of running a high credit utilization ratio when using your flexible card to make over-limit purchases. This high utilization could translate to unwanted credit card debt you cannot cover at the end of the billing cycle.

Our Latest Blogs:

FREE Strategy Session to Fix Your Credit Blogs / In today’s digitally interconnected world, we all face the danger...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / In a society where credit scores can significantly influence economic...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Your credit score is...

ThisIsJohnWilliams

ThisIsJohnWilliams

ThisIsJohnWilliams