- Blogs

- /

- Bankruptcy vs. Credit Repair: Everything You Need to Know

Bankruptcy vs. Credit Repair: Everything You Need to Know

Dealing with financial difficulties is overwhelming. But when faced with mounting debt, it’s essential to explore the best options and pick the most suitable path forward. And most times, it boils down to bankruptcy vs. credit repair.

Yes, both options aim to soften your financial burdens, but they differ significantly in their methods and outcomes.

You see, bankruptcy involves legal proceedings that can eliminate or reduce debt, giving folks facing insurmountable financial challenges a fresh start. On the other hand, credit repair focuses on improving credit scores by addressing negative items on credit reports and adopting responsible financial habits.

But how do you decide which is the right option for you? Well, come with us as we dig deeper and show you the differences between bankruptcy and credit repair.

Key Takeaways

- One of the most significant benefits of filing for bankruptcy is that it allows you to wipe the slate clean and start anew, but it hurts your credit score, which could last ten years.

- Unlike bankruptcy, which can have a significant negative impact on your credit score, credit repair comes with a more favorable outcome.

- Every bankruptcy comes with waiting periods. For Chapter 7 bankruptcy, you’ll have to wait eight years before you can another Chapter 7 case. For Chapter 13, you’ll have to wait four years.

- Always consult an attorney specializing in bankruptcy law to understand how your prior debt settlements may affect your eligibility for bankruptcy relief.

- Consider your income level, the amount of debt you have, your ability to repay debts, and your future financial goals before picking your preferred solution to your financial problems.

Bankruptcy vs. Credit Repair

Why Credit Repair is a Great Option

1. Dispute Errors and Negative Items

Mistakes happen, and sometimes incorrect information can enter your credit history. A study found that 34% of Americans had at least one error in their credit report. Credit repair lets you dispute every error and negative item on your credit report.

By identifying these errors and working with credit bureaus to remove them, you can quickly raise your credit score over time.

2. Avoid Significant Negative Impact

Unlike bankruptcy, which can have a significant negative impact on your credit score, credit repair comes with a more favorable outcome. How? Because bankruptcy can stay on your credit report for up to ten years, the effect of credit repair is generally less severe.

This means that by focusing on repairing your credit rather than resorting to bankruptcy, you can minimize the negative consequences for your financial future.

3. Maintain Access to Credit Options

Another advantage of opting for credit repair is that it allows you to maintain access to various types of financing options. However, when you file for bankruptcy, lenders may view you as high-risk and hesitate to extend new lines of credit or offer you favorable terms.

On the other hand, by actively working on repairing your credit, lenders may see an improved financial situation and become more willing to extend loans or lines of credit in the future.

Why Credit Repair Isn’t a Great Option

Credit repair programs may seem like a good option for those struggling with debt, but they have their fair share of drawbacks. Let’s look at some disadvantages of credit repair and why it may not be the quick fix you hope for.

1. Dispute Stretch Over an Extended Period

One major downside to credit repair is that disputing negative items on your report can often require many months. This means you’ll have to keep at it before seeing significant progress in your credit score.

2. No Guarantee of Winning Disputes

Another drawback is that there is no guarantee that the credit bureaus will remove the negative items on your report. And that’s because they cannot remove truthful negative items from your report.

Why Bankruptcy is a Great Option

Lots of folks view bankruptcy as a game-changer for regaining financial control. Let’s take a deeper look and see why that’s the case.

1. Bankruptcy Provides a Fresh Start

One of the most significant benefits of filing for bankruptcy is that it allows you to wipe the slate clean and start anew. When you go through the bankruptcy process, you eliminate or reduce your debts significantly, giving you a chance to rebuild your financial life.

2. Chapter 7 Bankruptcy Eliminates Unsecured Debts

Chapter 7 bankruptcy—often called the ‘liquidation’—involves selling non-exempt assets to repay creditors.

However, many people are surprised to learn that most unsecured debts, such as credit card bills and medical expenses, can be discharged entirely just a few months after filing for Chapter 7.

This means you can get rid of those burdensome debts quickly and move forward with a clean financial slate.

3. Avoid Creditor Harassment and Wage Garnishment

If you’re drowning in debt, then you’ve probably experienced relentless calls from creditors demanding payment. Filing for bankruptcy puts an immediate end to these harassing phone calls and collection efforts.

If your wages are being garnished due to unpaid debts, filing for bankruptcy can put an immediate stop to this as well. Doing this can give you much-needed relief from the constant stress and pressure caused by aggressive creditors.

4. May Prevent Foreclosure or Asset Loss

If you’re facing foreclosure on your home or repossession of other essential assets like your car, filing for bankruptcy may provide some protection. When you file for bankruptcy, an automatic stay goes into effect, temporarily halting any collection actions against you.

This gives you time to explore options for keeping your home or negotiating with creditors to prevent the loss of other vital assets.

Why Bankruptcy Isn’t a Great Option

Bankruptcy may seem like sunshine and rainbows, but before you file for bankruptcy, here is some additional information you must know.

1. Revoked Discharges

One of the potential pitfalls of bankruptcy is that if fraudulent activities are discovered, your discharged debts can be revoked. This means that even though your debts were legally eliminated through bankruptcy, there’s still a chance they could come back to haunt you.

It’s crucial to be honest and transparent throughout the entire bankruptcy process to avoid any complications down the line.

2. Credit Score Damage

Filing for bankruptcy will undoubtedly harm your credit score. Your credit score is a numerical representation of your creditworthiness, and it plays a significant role in determining your ability to secure new lines of credit or loans.

Unfortunately, declaring bankruptcy can damage your credit score, making it challenging to rebuild your financial standing.

That’s because bankruptcy stays on your credit report for up to 10 years, which means that lenders and creditors will see this negative mark whenever they review your credit history. This can make it difficult for you to obtain new lines of credit or secure favorable interest rates in the future.

It’s essential to recognize that filing for bankruptcy should not be taken lightly due to its long-lasting impact on your financial reputation.

But while these disadvantages may sound discouraging, it’s crucial not to lose hope. Despite the challenges posed by bankruptcy, there are steps you can take toward rebuilding your credit and regaining control over your finances:

- Get Professional Guidance: Consider consulting with a reputable credit counseling agency or financial advisor specializing in helping individuals recover from bankruptcy.

- Create a Budget: Develop a realistic budget that allows you to manage your expenses while gradually paying off any remaining debts.

- Maintain Positive Credit Habits: Over time, you can start rebuilding your credit by making timely payments on any new credit accounts or loans you obtain.

Bankruptcy vs. Credit Counseling

Now that we’ve explored bankruptcy vs. credit repair let’s compare bankruptcy vs. credit counseling and see how they affect your credit score.

1. Impact on Credit Score

Credit counseling typically has a less severe effect on your credit score than bankruptcy. With credit counseling, you work with a professional who helps you create a budget, negotiate with creditors, and develop a repayment plan. This allows you to maintain a positive payment history as you gradually pay off your debts.

On the other hand, bankruptcy provides a quicker resolution but has a more significant negative impact on your credit score. Filing for bankruptcy stays on your credit report for several years and can make it challenging to obtain new lines of credit or loans in the future.

2. Rebuilding Your Credit Score

While both options may initially harm your credit score, there are ways to rebuild it over time.

With credit counseling, since you are making consistent payments towards your debts as part of the negotiated repayment plan, you can demonstrate responsible financial behavior.

By maintaining regular payments and reducing outstanding debt balances through credit counseling, you can slowly rebuild your credit score over time.

Bankruptcy—although it has a more substantial negative impact upfront—also offers an opportunity to rebuild your credit score. After filing for bankruptcy and receiving a discharge from eligible debts, you can start working towards improving your financial situation.

This could involve practicing good financial habits, such as paying bills on time or applying for secured cards that help establish a positive payment history.

Deciding Between Bankruptcy vs. Credit Counseling?

You must consider several factors before choosing a solution to your financial situation. Your income level, the amount of debt you have, and your future financial goals all play a crucial role in determining which option is best for you.

Assessing Your Ability to Repay Debts

Before deciding, it’s vital to assess your ability to repay your debts through credit counseling. This involves working with a credit counselor who can help you create a plan to manage and pay off your debts over time.

Credit counseling can be an effective solution if you have a steady income and can make regular payments toward reducing your debt.

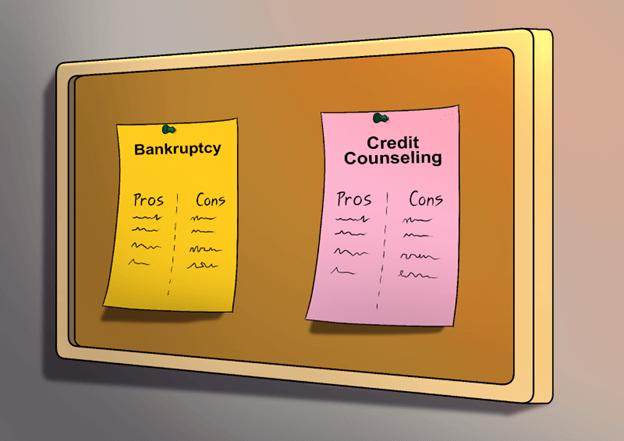

Pros:

- Credit counseling allows you to develop a realistic plan for paying off your debts.

- It can help improve your credit score as you make consistent payments.

Cons:

- It may take longer to pay off your debts compared to other options.

- There may not be a significant reduction in Interest rates on existing debts.

Determining if Bankruptcy is Necessary

In some cases, bankruptcy may be the best option for achieving a fresh start financially. If you find yourself overwhelmed by debt with no feasible way of repaying it, bankruptcy could provide relief by eliminating or restructuring certain debts.

Pros:

- Bankruptcy provides immediate relief from creditor harassment and collection efforts.

- It offers a clean slate and a chance to rebuild your finances.

Cons:

- Bankruptcy has long-term effects on credit scores and can remain on your credit report for up to ten years.

- Certain assets may risk being liquidated or sold during bankruptcy proceedings.

Seeking Professional Guidance

The best way to navigate the complexities of bankruptcy and credit counseling effectively is to consult with professionals like financial advisors or bankruptcy attorneys. They have the expertise necessary to evaluate your specific situation and guide you toward the best option.

Pros:

- Professionals can provide personalized advice based on your unique financial circumstances.

- They can help you understand the legal implications and requirements of bankruptcy and credit repair.

Making a Decision on Bankruptcy vs. Credit Repair

Besides your income level, the amount of debt you have, and your financial goals, here are some of the vital factors you must consider when it comes to bankruptcy vs. credit repair.

1. Long-term Consequences

Before choosing between bankruptcy and credit repair, it’s crucial to think about the long-term consequences of each option. Bankruptcy may provide immediate relief from overwhelming debt, but it can affect your financial future.

On the other hand, credit repair aims to improve your credit score by addressing negative items on your credit report over time.

2. Impact on Credit Score and Borrowing Opportunities

One significant factor is how each option may affect your credit score and future borrowing opportunities.

Bankruptcy can have a severe impact on your credit score, making it challenging to obtain new lines of credit in the future. It stays on your credit report for several years, potentially hindering your ability to secure loans or favorable interest rates.

In contrast, credit repair services focus on improving your credit score gradually. By disputing inaccuracies and working with creditors to remove negative items from your report, you can rebuild your creditworthiness over time. This opens up possibilities for better borrowing opportunities in the future.

3. Emotional and psychological effects

While finances are primarily about numbers and figures, it’s essential not to overlook the emotional and psychological effects of bankruptcy and credit repair.

Bankruptcy can be emotionally draining, as it involves admitting financial hardship publicly and going through a legal process that may feel overwhelming.

Credit repair services offer an alternative that allows individuals to take control of their financial situation without going through the emotional toll of bankruptcy. It provides a sense of empowerment as you work to improve your financial standing.

To summarize:

- Bankruptcy offers immediate relief but has long-term consequences.

- Credit repair focuses on gradual improvement without severe impacts.

- Bankruptcy may hinder future borrowing opportunities, while credit repair provides better credit options.

- Bankruptcy can be emotionally draining, while credit repair offers a sense of empowerment.

Paying for Bankruptcy and Hiring an Attorney

Filing for bankruptcy is a significant financial decision that can have long-term implications. It’s essential to understand the costs involved and the benefits of hiring an attorney to guide you through the process.

Let’s take a closer look at what you need to know.

Filing for Bankruptcy: Costs and Fees Involved

When filing for bankruptcy, there are various expenses to consider, from court fees to attorney fees and other associated costs that may vary depending on the complexity of your case.

And so, it’s crucial to be aware of these expenses before deciding.

- Court Fees: The bankruptcy court charges filing fees, which differ depending on the type of bankruptcy you file for. For example, as of 2021, Chapter 7 bankruptcy has a filing fee of $335.

- Attorney fees: Hiring an experienced bankruptcy attorney can ensure that all legal requirements are met during the process. Attorneys typically charge different rates based on their experience and location.

It’s essential to research and find an attorney who fits your budget while also providing quality legal representation.

- Other associated costs: Besides court and attorney fees, there may be other expenses related to your bankruptcy case. These could include credit counseling fees, debtor education course costs, or any additional paperwork required by the court.

Why You Should Consider Hiring a Bankruptcy Attorney

Yes, even though you can choose to DIY when filing bankruptcy, it’s advisable to get professional assistance from a bankruptcy attorney. And that’s because Navigating through complex legal procedures can be challenging without proper guidance.

Here are some reasons why you should consider hiring an attorney:

- Expertise in Bankruptcy Law: A qualified attorney specializes in bankruptcy law and understands the intricacies of the process. They can provide valuable advice tailored to your unique situation.

- Navigating Complex Paperwork: Filing for bankruptcy involves submitting detailed documentation and completing numerous forms accurately. An attorney can help you gather the necessary information and ensure all paperwork is completed correctly.

- Protection From Creditors: Once you file for bankruptcy, an automatic stay goes into effect, preventing creditors from pursuing collection actions against you.

Filing for Bankruptcy After Debt Settlement

If you’ve previously settled some debts through negotiation or debt settlement programs, you might wonder if filing for bankruptcy is still an option.

Well, the answer is yes; it can still be an option for you. However, there are a few things you need to consider before making that decision.

Previous Debt Settlements and Discharged Debts

One important thing to remember is that creditors may challenge discharged debts if they were previously settled at reduced amounts. This means that even though you paid your debts before, the creditors may argue that they should not be discharged in bankruptcy because they were already satisfied through settlement.

It’s crucial to consult with an attorney specializing in bankruptcy law to fully understand how your prior debt settlements may affect your eligibility for bankruptcy relief. They will be able to provide you with guidance based on your specific situation and help you navigate through any potential challenges from creditors.

Pros and Cons of Filing for Bankruptcy After Debt Settlement

Let’s take a look at some pros and cons of filing for bankruptcy after going through debt settlement:

Pros:

- Fresh Start: Filing for bankruptcy can give you a fresh start by eliminating or reducing your debts.

- Legal Protection: Once you file for bankruptcy, an automatic stay goes into effect, which prevents creditors from taking further collection actions against you.

- Structured Repayment Plan: Depending on the type of bankruptcy you file (Chapter 13), you may have the opportunity to create a structured repayment plan to pay off your remaining debts over time.

Cons:

- Credit Impact: Filing for bankruptcy will have a significant negative impact on your credit score and remain on your credit report for several years.

- Asset Liquidation: In certain types of bankruptcies (Chapter 7), your assets could get liquidated to repay creditors.

- Public Record: Bankruptcy is a public affair, which means anyone searching for your financial history will see it.

Multiple Filings for Bankruptcy: Understanding the Limits

Filing for bankruptcy is a big decision that can have long-lasting effects on your financial future. It’s essential to understand the rules and limitations surrounding multiple filings before considering this option.

Let’s delve into the critical information you need to know.

1. Limitations on Bankruptcy Filings and Discharges

Bankruptcy isn’t a get-out-of-jail-free card. There are restrictions on how frequently you can do so and receive a discharge. If you have previously received a discharge in a bankruptcy case, there are waiting periods before you can file again.

These waiting periods vary depending on the type of bankruptcy you filed previously and the one you intend to file now.

For instance, if you previously filed for Chapter 7 bankruptcy—which involves liquidating assets—there is an eight-year waiting period before you can file another Chapter 7 case. However, if you want to file for Chapter 13 bankruptcy—which involves creating a repayment plan—the waiting period is reduced to four years.

On the other hand, if your previous filing was under Chapter 13 bankruptcy—which typically lasts three to five years—you must wait two years before filing another Chapter 13 case.

And if your goal is to switch from Chapter 13 to Chapter 7, then there is a six-year waiting period.

2. Determining Viability Based on Rules Regarding Multiple Filings

Here are some factors to consider in determining whether multiple bankruptcy filings are a viable option for your current financial situation:

- Your Financial Stability: Have you addressed the underlying issues that led to your previous bankruptcy filing? You must ensure that any new filing will provide lasting relief rather than being a temporary solution.

- Waiting Periods: Consider how long it has been since your last discharge and whether enough time has passed for you to be eligible for another filing.

- Debt Management Alternatives: Explore alternatives to bankruptcy, such as credit repair or debt settlement, before considering another filing. These options help you improve your financial situation without the long-term consequences of bankruptcy.

Why You Need to Check Your Credit Report and Dispute Every Error

Regularly reviewing your credit report is crucial because it allows you to identify any errors or inaccuracies that may negatively impact your credit score. By taking the time to sift through your credit report, you can ensure that all the information listed is accurate and up-to-date.

Disputing errors with credit reporting agencies can have a significant impact on improving your credit score. If you encounter any incorrect information, such as late payments or accounts that don’t belong to you, it’s crucial to take action immediately.

Disputing errors can help you remove them from your credit report, which will help improve your overall creditworthiness.

Taking proactive steps to ensure the accuracy of your credit report is essential when considering both bankruptcy and credit repair options.

Whether you’re considering filing for bankruptcy or trying to repair your credit through other means, having an accurate credit report is vital in understanding where you stand financially.

Here are a few reasons why checking your credit report regularly and disputing errors is so necessary:

1. Helps You Identify Errors or Inaccuracies

Reviewing your credit report allows you to spot any mistakes that may exist. These errors could include incorrect personal information, outdated account statuses, or fraudulent activity. Catching these errors early on can help prevent damage to your credit score.

2. Improves Your Credit Score

Disputing errors with the appropriate credit bureaus can lead to positive changes in your overall credit score. Removing inaccurate negative entries from your report can help boost your score significantly.

This improvement in your creditworthiness will open up opportunities for better loan terms and interest rates in the future.

3. Increase Your Loan Approval Chances

Having an accurate and error-free credit report increases the likelihood of loan approvals. Lenders rely heavily on this information when evaluating loan applications.

By ensuring that there are no inaccuracies in your report, you present yourself as a reliable borrower, increasing your chances of obtaining credit when needed.

4. Protects Against Identity Theft

Regularly checking your credit report is an essential practice that can help you stay on top of your financial health. By doing so, you can not only keep track of your credit score but also detect any signs of identity theft or fraudulent activity.

Identity theft can lead to unauthorized charges on your accounts, new accounts, or loans being opened in your name without your knowledge. By regularly monitoring your credit report, you can quickly identify any suspicious activity and take immediate action to mitigate the damage.

Comparing Debt Settlement, Debt Consolidation and Bankruptcy

As we discussed early on, dealing with financial difficulties can be overwhelming, but options are available to help you regain control of your finances.

But besides bankruptcy and credit repair, two other typical approaches that individuals consider when facing debt problems are debt consolidation and debt settlement.

While both have their advantages and disadvantages, it’s essential to understand the differences between them before making a decision.

Debt Consolidation: Combining Debts for Lower Payments

Debt consolidation involves merging multiple debts into one loan with lower interest rates or monthly payments. This approach aims to simplify repayment by consolidating various debts, such as credit card bills, personal loans, or medical expenses, into a single payment plan.

Pros:

- Lower interest rates: By consolidating your debts, you can secure a loan with a lower interest rate than what you were previously paying.

- Streamlined payments: Instead of managing multiple monthly payments, debt consolidation allows you to make a single payment towards your consolidated loan.

- Enjoy Peace of Mind: With debt consolidation, you don’t have to worry about repaying multiple credit accounts every month; you just need to make one payment.

Cons:

- Extended Repayment Period: While debt consolidation can provide relief in terms of lower monthly payments, it often comes with an extended repayment period. You may pay more in the long run due to accumulated interest.

- No Reduction in the Total Amount Owed: Unlike bankruptcy, debt consolidation does not eliminate or reduce the total amount owed. You will still need to repay the entire principal balance over time.

Debt Settlement: Negotiating Your Way Out

One option to consider is debt settlement, which involves negotiating with creditors to settle your debts for less than what you owe.

This can be an attractive choice for those who want to avoid the more severe consequences of bankruptcy. However, it’s essential to understand the implications before proceeding.

Pros:

- Potential reduction in total debt amount.

- Avoidance of bankruptcy’s long-lasting impact on credit score.

Cons:

- There is no legal protection from creditor actions such as lawsuits or wage garnishment.

- Creditors may not agree to settle or negotiate your debts.

Bankruptcy: A Fresh Start for Financial Recovery

Bankruptcy can help individuals or businesses that cannot repay their debts by providing them with a fresh start financially.

Pros:

- Discharge of Debts: One significant advantage of bankruptcy is that it can eliminate certain unsecured debts. This means that after completing the bankruptcy process, you may no longer be responsible for repaying those debts.

- Protection From Creditors: An automatic stay comes into effect when you file for bankruptcy. This prevents creditors from taking collection actions against you, such as wage garnishment or foreclosure.

Evaluating Your Financial Goals

When comparing debt settlement with bankruptcy, it’s crucial to evaluate how each option aligns with your overall financial goals.

Consider the following factors:

- Credit Score Impact: Debt settlement may have a less severe impact on your credit score than bankruptcy; however, both options will have some negative effects. If rebuilding your credit is a priority, debt settlement might be worth exploring further.

- Tax Implications: Debt forgiven through settlement may be considered taxable income by the IRS, potentially resulting in a tax liability. In bankruptcy, however, debt discharge is generally not taxable.

Frequently Asked Questions

Can I Repair My Credit Without Professional Help?

Yes, it’s possible to repair your credit without professional help. You can start by reviewing your credit report for errors and disputing inaccuracies.

Adopting good financial habits like paying bills on time and keeping balances low can gradually improve your credit score.

Will Filing for Bankruptcy Ruin My Chances of Getting Future Loans?

Filing for bankruptcy will have an impact on your ability to obtain loans in the future. However, it doesn’t mean you’ll never be able to borrow again.

It may take some time before lenders are willing to extend new lines of credit or offer favorable terms. However, with responsible financial management post-bankruptcy, you can rebuild your creditworthiness over time.

Is Credit Counseling a Quick Fix for My Debt Problems?

Credit counseling is not a quick fix for debt problems. It involves working with a counselor to create a budget, develop a repayment plan, and potentially negotiate with creditors.

While it can provide valuable guidance and support, it requires commitment and effort to follow the recommended strategies.

Can Bankruptcy Help Me Eliminate All My Debts?

Bankruptcy can eliminate many types of debt, including credit card balances, medical bills, and personal loans. However, certain obligations, such as student loans, child support payments, and tax debts, may not be dischargeable through bankruptcy.

Consult an attorney or financial professional to understand which debts can be removed in your specific situation.

How Long Does Bankruptcy Stay on My Credit Report?

A Chapter 7 bankruptcy filing remains on your credit report for ten years from the filing date. However, a Chapter 13 bankruptcy will stay on your credit report for seven years after filing.

While these entries may have a significant impact on your credit score initially, their influence diminishes over time as you establish positive financial habits and demonstrate responsible borrowing behavior.