- Blogs

- /

- How Long Does an Eviction Stay on Your Record

How Long Does an Eviction Stay on Your Record

Summary

How long does an eviction stay on your record? It can stay up to seven years. Sometimes, it can last up to ten years on your report. Here’s why.

Evictions can have a significant impact on your credit reports. They can affect your ability to secure future housing, get loans, or even find employment. But just how long does an eviction stay on your record? The answer may surprise you.

Understanding the duration of evictions on your record is vital in making informed decisions about your financial future.

So, if you’ve ever been curious about the lasting effects of evictions and want to know how they can impact your life, then come with us as we explore how long an eviction stays on your record and what it means for your financial well-being.

Key Takeaways

- An eviction can stay on your public records for seven years. In some cases, it can stay up to ten years.

- Evictions don’t directly affect your credit score; however, they can indirectly impact your creditworthiness if they lead to unpaid debts or collections accounts.

- An eviction can lower your credit score, show up on your tenant screening report, impact your renting prospects, and make it challenging to secure low-interest loans.

- If you believe an eviction was unjustified or unlawful, you can take action against your landlord and fight it in civil court.

- State laws play a significant role in influencing how long an eviction stays on your record.

How Long Does an Eviction Stay on Your Record?

To get a complete picture of the impact of evictions on your rental and credit history, we need to look at how evictions appear on your credit report and public records.

Why? Because the duration of an eviction on public records often differs from its impact on credit reports.

Let’s dive into it and explore the differences between these two aspects.

Public Records: Longer Eviction Histories

Public records generally show a longer duration compared to credit reports. Court records—which fall under public records—typically include detailed information about past evictions.

And these records can be accessed by landlords, property managers, and other people who may need to evaluate your rental history.

You see, having an eviction on your public record can have long-lasting consequences, as it could stay visible for seven years. That’s because the exact duration varies depending on the state laws and regulations where the eviction occurred.

Sometimes, an eviction can remain on a public record for up to seven years or even longer in certain states.

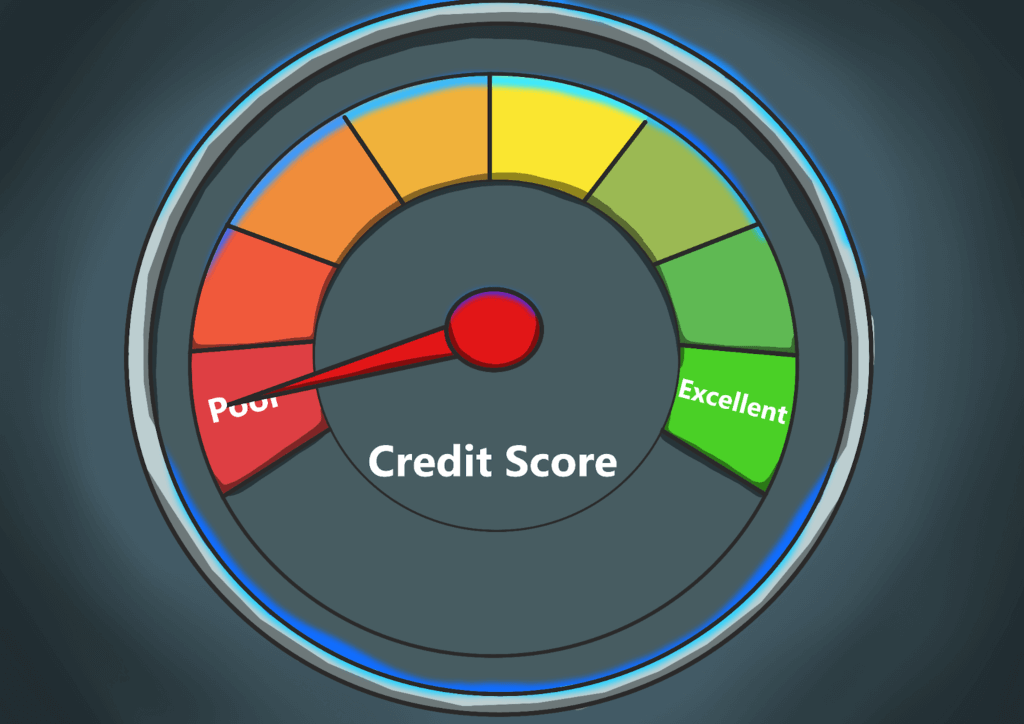

Credit Reports: Impact on Creditworthiness

Although evictions can significantly affect your rental history as reflected in public records, their effect on credit reports is somewhat different. Credit reports primarily focus on your financial behavior and creditworthiness rather than specific details about past evictions.

An eviction itself doesn’t directly affect your credit score; however, it can indirectly impact your creditworthiness if it leads to unpaid debts or collections accounts.

Let’s say you fail to pay rent, which results in a judgment against you, or you owe money to a landlord or property management company; those negative marks could appear on your credit report.

Having such negative marks on your credit report can lower your credit score and make it more challenging for you to secure loans, get favorable interest rates, or even rent another property in the future.

So, ensure you quickly address any outstanding debts resulting from an eviction and work towards improving your creditworthiness.

Two Vital Factors Influencing How Long an Eviction Stays on Your Record

Now that you’ve got the answer to, ‘How long does an eviction stay on your record?’ you might wonder what factors determine how long evictions remain on your record.

Well, my friend, let’s check out two vital factors influencing their duration on your record.

1. State Laws and Individual Circumstances

One of the most significant factors that shape how long an eviction stays on your record is the state laws where you reside.

Each state has unique regulations regarding eviction records, so it’s essential to familiarize yourself with these laws. In some states, an eviction may remain on your record for a specific number of years; in others, it could be indefinite.

Your circumstances also come into play when determining the length of time an eviction stays on your record. Contesting the eviction, reaching a settlement agreement with your landlord, or having any legal proceedings can impact how long it remains visible.

So, understand your state’s laws and know how your circumstances are evaluated. Doing this can help you navigate the aftermath of an eviction more effectively.

2. Severity and Type of Eviction

The severity and type of eviction can also influence how long it stays on your record. Some evictions are considered more severe than others based on the reason for the eviction or any damages caused during the tenancy.

For example, let’s say you got evicted due to non-payment of rent or violating lease terms but left the property in good condition without causing significant damage.

Then, your eviction could have a shorter duration on your record than cases involving severe property damage or illegal activities.

Different types of evictions have other implications as well. For instance, if you were evicted from public housing or Section 8 housing due to lease violations or criminal activity, it could have longer-lasting consequences than being evicted from a private rental property.

Here’s How an Eviction Can Affect Your Credit Score and Tenant Screening

An eviction can seriously affect your financial health and future housing prospects. Let’s take a closer look.

1. Lowers Your Credit Score

When you face an eviction, it can significantly lower your credit score. That’s because your credit score reports on your financial responsibility, and lenders and creditors consider an eviction a negative signal.

This means that when potential landlords or lenders check your credit history, they’ll see the eviction listed, making them hesitant to approve you for housing or loans.

2. Shows Up on Your Tenant Screening Report

Landlords often use tenant screening services to evaluate applicants. These services compile a tenant screening report detailing your rental history, including any evictions you must’ve had.

When landlords review these reports, they pay close attention to negative information like evictions, which indicates a potential risk in renting their property to you.

3. Difficulty in Securing Loans

Having evictions or collections on your record can make it harder for you to secure loans when you need them the most. Lenders often view these negative marks as signs of financial irresponsibility, leading them to consider you a higher-risk borrower.

As a result, you may face challenges in obtaining personal loans, auto loans, or even mortgages.

4. Higher Interest Rates

Even if you manage to secure a loan with evictions or collections on your record, the consequences don’t end there. Lenders may offer you less favorable interest rates due to the perceived risk associated with your credit history.

This means that not only will it be more challenging for you to get approved for a loan, but you may also end up paying more interest over time.

5. Impacts Your Rental Prospects

Having an eviction on your record can make it more challenging to secure future housing. You see, landlords see evictions as red flags, which could indicate that you might not be a reliable tenant.

That’s because they want to ensure that their properties are occupied by responsible people who’ll pay rent on time and take care of the property.

To better understand the effects of an eviction on your rental prospects, put yourself in the shoes of a landlord. Imagine you have two applicants: one with a clean rental history and another with an eviction on their record.

Who would you choose? You would most likely select the applicant without the eviction because it seems less risky.

Here’s How to Minimize the Impact of Evictions on Your Credit Report

If you’ve experienced an eviction, you might be concerned about how long it’ll stay on your record and how it’ll impact your credit. Although an eviction can have negative consequences, there are practical steps you can employ to minimize its impact over time.

Here’s how:

1. Focus on Rebuilding Your Credit Score

One way to reduce the harmful effects of an eviction on your credit score is by focusing on rebuilding it. And the best way you can do that is by consistently making timely bill payments.

Paying bills like rent, utilities, and other debts on time shows future creditors that you’re reliable and capable of meeting financial obligations.

2. Explore Second-Chance Programs

Some landlords offer second-chance programs or flexible leasing options for individuals with past evictions or less-than-perfect credit.

These programs may involve higher security deposits or additional requirements, but they can provide an opportunity to secure housing despite having an eviction on your record.

3. Consider Alternative Housing Options

Besides exploring second-chance programs, considering alternative housing options can also help minimize the impact of an eviction. Renting from individual landlords rather than large property management companies might present more flexibility regarding tenant screening criteria.

When evaluating potential tenants, individual landlords may be more willing to consider personal circumstances and factors beyond a credit score.

4. Building Positive Rental History

Building a positive rental history after experiencing an eviction is crucial for minimizing its long-term impact.

When searching for new housing opportunities, staying open and honest about your previous eviction while highlighting any positive rental experiences since then can demonstrate your growth and responsibility as a tenant.

The best way to prove your reliability is to:

- Provide references from current or previous landlords who can vouch for your reliability.

- One great way to boost the landlord’s confidence in renting to you is by offering to pay a higher security deposit or provide a co-signer if necessary.

- Maintain open lines of communication with your landlord and address any issues promptly. Remember to stay honest and transparent with potential landlords.

- If you’ve got an eviction on your record, ensure you explain the circumstances surrounding the eviction and provide references or proof of improved financial responsibility.

5. Get Legal Help

If you believe that the eviction on your record was unjust or unlawful, seeking legal assistance could help you clear it from your records. An attorney specializing in tenant rights can help evaluate your case, explore potential legal solutions, and determine if any actions can be taken to have the eviction removed from your record.

Two Ways to Remove an Eviction from Your Record

Removing an eviction from your record can seem challenging, but it’s legally possible. Here’s how to go about it.

Let’s check out some of them

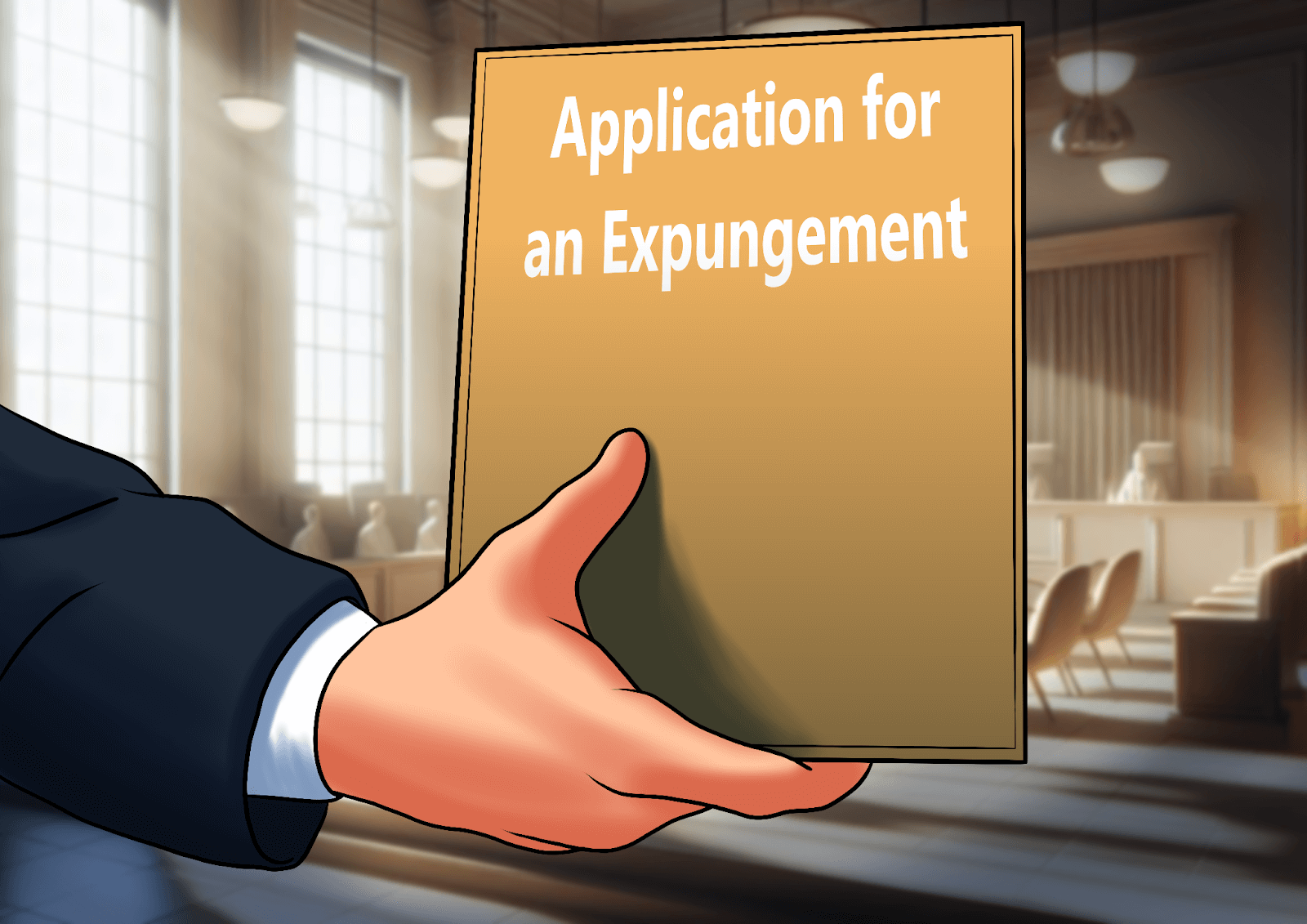

1. Apply for an Expungement

Expungement is a legal process that allows you to erase or seal certain records, including evictions, from public view. You must file an application with the appropriate court to begin the expungement process.

This application typically requires detailed information about the eviction case and why you believe it should be removed from your record.

Benefits of Expungement

- It removes the eviction from public view.

- It can improve your chances of finding new housing or securing loans in the future.

Disadvantages of Expungement:

- The expungement can be complex and time-consuming.

- There is no guarantee that your application will be approved.

2. Vacating the Eviction Judgment

Vacating an eviction judgment involves challenging the legality or validity of the original eviction order.

But to pursue this option, you must gather evidence and present a compelling argument to the court as to why the judgment should be overturned. But ensure you get legal counsel before attempting to vacate an eviction judgment.

Benefits of Vacating an Eviction Judgment

- It helps you remove the negative impact of an eviction from your record.

- Provides an opportunity to present evidence that may have been overlooked during the initial proceedings.

Disadvantages of Vacating an Eviction Judgment

- It requires solid evidence and a persuasive argument.

- It can get costly if legal representation becomes necessary.

Considering the Time, Cost, and Success Rate

Before deciding on which method to pursue when removing an eviction from your record, it’s crucial to weigh factors like:

- Cost: Decide if you can afford the expenses associated with the chosen method, such as court fees or legal representation.

- Time: Consider the time commitment required for each option. Expungement applications and vacating eviction judgments can take several months to process.

Success Rate:

Research the success rates of expungement and vacating eviction judgments in your jurisdiction. Understanding how likely you’d be to get a favorable outcome will help you make an informed decision.

How to Take Control of Your Rental History and Credit Future

Learning from past mistakes and taking proactive steps can help you regain control over your rental history and credit future. Building a positive rental history with responsible tenancy can help offset the impact of eviction over time.

So, let’s look into how you can improve your financial situation.

Start Building a Positive Rental History

One way to mitigate the effects of an eviction on your record is by building a positive rental history. The best way to do this involves being a responsible tenant and maintaining good relationships with landlords.

So ensure you:

- Always pay your rent on time: Consistently paying your rent on time is the best way to show your commitment and financial responsibility.

- Always communicate: If you’re going through tough times affecting your ability to pay rent or fulfill your lease obligations, ensure you communicate openly with your landlord.

- Maintain the property: Always take care of the rental property as your own. Keep it clean, report maintenance issues promptly, and follow any rules or regulations the landlord sets.

By demonstrating these three qualities, you can show prospective landlords that you have learned from past mistakes and are now a reliable tenant.

Focus on Rebuilding Your Credit

Besides building a positive rental history, you need to work on rebuilding your credit score. Rebuilding your credit score can help you avoid the negative impact an eviction can have on your credit score.

Here’s how you can go about it:

1. Obtain a copy of your credit report: Request a copy of your credit report from major credit reporting agencies like Experian, Equifax, or TransUnion. Review it carefully for any errors or inaccuracies.

2. Dispute inaccurate information: If you find any incorrect information related to the eviction or other negative marks on your credit report, file a dispute with the credit reporting agency.

3. Make timely payments: Ensure you pay all bills and debts on time. Making timely payments is the best way to build positive credit habits and boost your credit score.

4. Use credit wisely: If you have access to credit, such as a credit card, use it responsibly. Keep your credit utilization low and pay off the total amount each month.

5. Seek professional help: Consider working with a credit repair company or financial advisors who can guide you on improving your credit.

Rebuilding your credit takes time and patience, but you can gradually improve your financial standing with consistent effort.

How Long Does Bad Rental History Stay on Your Record?

A bad rental history can have long-lasting effects on your ability to secure future rental applications. Typically, bad rental history remains on record for several years, so it’s crucial to understand how it can impact your housing options.

Impact of Bad Rental History

A bad rental history tells landlords you’ve had issues with previous landlords or property management companies. These issues could include late rent payments, failure to pay rent, eviction notices, or any other negative incidents related to your tenancy.

How Long Does Bad Rental History Stay on Your Record?

The duration of a bad rental history on your record depends on the severity of the incidents and the specific guidelines followed by landlords or property management companies.

Sometimes, a bad rental history can stay on your record for several years. And this information is accessible to future landlords when they conduct background checks.

Removing Bad Rental History From Your Records

Removing bad rental history from your record can be challenging, but it’s possible with consistent, responsible tenancy practices over time.

Here are a few things to keep in mind:

- 1. Timeframe: It may take some time to get your history clean, and that’s because bad rental history typically remains on record for several years.

- 2. Improvement Over Time: Consistently demonstrating responsible behavior as a tenant and avoiding any further negative incidents will help you gradually improve your rental history and mitigate the impact of past issues.

Fighting Evictions in Civil Court

If you believe an eviction was unjustified or unlawful, you can fight it in civil court. This would involve legal action against your landlord and presenting your case before a judge.

Here are some critical points to consider when fighting an eviction in civil court:

1. Gather Evidence Supporting Your Case

When contesting an eviction judgment, presenting evidence supporting your case is crucial. This evidence can include documents such as your tenancy agreement, receipts for rent payments, communication records with your landlord, and any other relevant documentation.

This evidence can help demonstrate that due process wasn’t followed and the eviction was unjustified.

2. Seeking Legal Advice or Representation

Navigating the legal process can be complex, especially if you are unfamiliar with the law or court proceedings. Seeking legal advice or representation from an attorney specializing in landlord-tenant disputes can significantly increase your chances of success in court.

They can guide you through the process, help you gather the necessary evidence, and present a strong argument on your behalf.

3. Understanding Your Rights and Obligations

Before heading to civil court to fight an eviction, you must understand your rights and obligations as a tenant. Familiarize yourself with local tenancy laws and regulations that govern evictions in your area.

This knowledge will empower you to defend yourself against unjust evictions and ensure your landlords follow proper procedures.

Three Alternatives to Eviction Lawsuits

While going to civil court may seem like the only option when facing an unjust eviction, there may be alternatives worth considering, like:

- Mediation: In some cases, mediation between landlords and tenants can help resolve conflicts without litigation.

- Negotiating with the Landlord: Openly communicating with your landlord about any issues or concerns might lead them to reconsider the eviction.

- Legal Aid: If you don’t have enough finances to hire a lawyer, you may be eligible for legal aid or pro bono services in your area.

The Possibilities and Challenges of Disputing Evictions with Credit Bureaus

Disputing an eviction directly with credit bureaus can be challenging, primarily because they rely heavily on accurate public records data.

However, if you identify any errors or inaccuracies in your eviction information, there are possibilities for disputing them with the credit bureaus. Understanding these possibilities and limitations is crucial to effectively navigating the process.

Challenges with Disputing Evictions

There are a few challenges you may encounter:

1. Reliance on Accurate Public Records Data: Credit bureaus heavily rely on public records data to compile your credit reports.

This includes information about evictions from various sources, such as court records and property management companies. As a result, it can be difficult to dispute an eviction that is accurately reflected in these records.

2. Limited Control Over Reporting Agencies: Credit bureaus play a significant role in compiling credit reports; they don’t have direct control over the information reported by landlords or property management companies.

So, disputing an eviction may require contacting the reporting agency to resolve any issues or discrepancies.

Possibilities for Disputing Evictions

Disputing your eviction will be challenging, but you can still succeed if you identify errors or inaccuracies in your eviction information.

So, ensure you:

1. Review Your Credit Report: Get a copy of your credit report from each of the major credit bureaus: Equifax, Experian, and TransUnion. Carefully review the section that contains public records data to ensure its accuracy.

2. Identify Errors or Inaccuracies: If you encounter any errors or inaccuracies related to your eviction information while reviewing your credit report, note them. These could include incorrect dates, amounts owed, or even mistaken identities.

3. File a Dispute: Once you have identified errors or inaccuracies, file a dispute with the credit bureau reporting the eviction. You can do this online through their websites or by mailing a written dispute letter.

Provide clear and concise explanations of the inaccuracies and include any supporting documentation you may have.

4. Credit Bureau Investigation: Once they’ve got your dispute letter, the credit bureau will investigate the accuracy of the eviction information. They’ll contact the reporting agency and request verification of the details provided.

Don’t Let Evictions Define Your Future

Now that you know the answer to the age-old question, ‘How long does an eviction stay on your record,’ it’s time to make your move.

We’ve explored the guidelines for how long an eviction should remain on your record, its effects on credit scores and tenant screening, strategies to minimize its impact, methods for removing it from your record, and even tips for fighting evictions in civil court.

With this knowledge, you’re ready to take control of your rental history and credit future. Remember, just because you may have had an eviction in the past doesn’t mean it has to define your future.

FAQs

1. How long does an eviction typically stay on public records?

An eviction can typically stay on public records for up to seven years. During this time, it may be visible to anyone conducting a background check or searching public housing or legal records.

2. Can I remove an eviction from my record before seven years?

Yes, removing an eviction from your record before seven years is challenging, but there are some methods you can try.

These methods include negotiating with your landlord or property management company, seeking legal assistance if there were errors in the eviction process, or working with a credit repair agency specializing in these situations.

3. Will having an eviction affect my ability to rent another property?

Having an eviction on your record can make it more difficult to rent another property. Landlords often consider evictions as red flags when evaluating potential tenants.

But there are steps you can take to minimize its impact by improving other aspects of your rental application, like providing strong references or offering a higher security deposit.

4. Can an eviction affect my credit score?

Yes, an eviction can hurt your credit score. Even though an eviction alone may not be directly reported to credit bureaus, related factors like unpaid rent or legal judgments can result in collection accounts or court records that negatively affect your creditworthiness.

5. How long does it take for an eviction to show up on my credit report?

The timeframe for an eviction to appear on your credit report can vary. Generally, it may take a few weeks to a couple of months after the initial filing before it appears as a negative item on your credit report.

But it’s vital to note that this timeline isn’t set in stone and depends on various factors, like how quickly the landlord or property management company reported the information.

Our Latest Blogs:

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Say you’ve finally found...

ThisIsJohnWilliams

ThisIsJohnWilliams

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Get your financial freedom...

ThisIsJohnWilliams

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / As a company involved in credit repair, you understand that...