- Blogs

- /

- How To Repair Credit After Identity Theft

How To Repair Credit After Identity Theft

In today’s digitally interconnected world, we all face the danger of identity theft, and falling prey to such an incident sometimes has dire consequences. One of these consequences is a negative impact on one’s credit. If you have found yourself a victim of this crime, then there’s a high chance that you are facing an uphill task of credit repair.

While you might have struggled with repairing your credit after an identity theft, rest assured that your goal of seeking credit repair is not impossible. This article will serve as your comprehensive guide on how to repair credit after identity theft.

Our aim with this article is to walk you through detailed preventative measures, immediate actions, and long-term strategies to rebuild your credit. We request that you stay with us as this might be the article that decides the fate of your credit.

Steps To Follow To Repair Credit After Identity Theft

Now, getting down to business, repairing your credit after an identity theft will take a great deal of work on your part. You can follow these steps to repair your credit. If you follow these steps to the letter, you can recover slowly but fully from identity theft.

Step1: Stay Alert and Don’t Ignore The Signs

Spotting signs of Identity theft is the crucial first step toward repairing your credit. Some major red flags that can mean your identity has been compromised are having unusual activities and unauthorized purchases on your credit card statement.

You mustn’t dismiss any unusual activity on your credit card statement, regardless of how small it is, as a clerical error. In situations like this, record-keeping is essential. Furthermore, you must store these suspicious records digitally or physically, as they will be instrumental in the next steps.

Moreover, understanding the power of documentation and paying attention to these early signs will put you on the right path toward fully repairing your credit after identity theft.

Step 2: Review Your Credit Reports and Statements

In the event you suspect potential identity theft, your immediate step should be to conduct a thorough audit of your financial accounts. Don’t downplay the situation as an isolated episode. This is because doing so might expose your finances and credit rating to severe threats.

You should diligently scrutinize recent bank summaries, credit card transaction records, and loan documents. More importantly, you should request for your credit reports. Take your time to verify its accuracy, as it can provide decisive insights into any illicit activities under your name.

Step 3: Terminate Unauthorised Card and Loan Activities

If you identify any irregularities, such as unknown transactions on your credit card statements, or suspect unauthorized loans, it’s essential to react quickly. Contact the relevant financial institutions or card issuers, requesting immediate closure of these accounts. Most issuers will issue a new card and account number and typically won’t hold you accountable for fraudulent charges if reported promptly.

In cases where your identity has been used to open new loans or credit card accounts, it’s crucial to connect with the concerned financial institutions at the earliest and insist on an immediate account closure. This swift action will help minimize the damage caused by identity thieves.

Step 4: Create an Identity Theft Report with the FTC

You can report identity theft to the Federal Trade Commission (FTC) either by calling (877) 438-4338 or online at https://www.identitytheft.gov/. Although both ways work, the FTC website simplifies the process by guiding you step-by-step and offering a user-friendly checklist. This ensures you’ve covered all the needed steps to file a comprehensive identity theft report.

Step 5: Report To The Police

Since identity theft is a criminal act, it’s vital to get a police report for it. Visit your local police station with your FTC identity theft report and all the evidence of the fraudulent activities. Remember to ask for a copy of the police report, as you will need it to contest unauthorized purchases or accounts.

Step 6: Contest Fraudulent Activities

Armed with your police report and FTC identity theft report, you’re now ready to contest any illegitimate charges or accounts formally. Initiate by sending letters to all three credit bureaus – Equifax, Experian, and TransUnion. These letters should cite the dubious charges and accounts, accompanied by your identity theft and police reports.

You can kick start this process online with Equifax, Experian, and TransUnion, or ring them at Equifax (1-866-349-5191), TransUnion (1-800-916-8800), and Experian (1-866-200-6020). The credit bureaus are obliged to respond within 30 days of getting your letter and will address your dispute.

In addition, you should communicate this dispute to any creditors or lenders linked to the fraudulent charges. Request them to block those charges from your credit reports, which can further safeguard your credit score.

Step 7: Freeze Your Credit

Lastly, protect your financial future by implementing a credit freeze with the three main credit bureaus: Experian, Equifax, and TransUnion. Good news, it won’t cost you a penny.

A credit freeze hinders lenders from viewing your credit, reducing the chance of additional fraud. However, if you want to apply for new credit or loans, you will need to lift this freeze temporarily.

How Long Does It Take To Repair Credit After Identity Theft?

How long to restore your credit after identity theft can vary greatly, depending on the severity of the situation.

Sometimes, removing negative items from your credit can take a long time. However, it can even take a longer time and effort to clear your name after being victimized by fraud. In general, the entire repair process can span across weeks or potentially even months.

Suppose fraudulent accounts or transactions are spread across all three main credit bureaus. In that case, you are required to send individual dispute letters and persistently follow up on them until they are rectified, likely making your recovery period longer by 2-3 months.

Certain circumstances that may further extend the process of restoring your credit include:

- Scammers opening new bank accounts or acquiring loans using your identity.

- There exist unsettled credit card charges that you need to dispute.

- Fraudsters tried to attain government aid or loans in your name.

How can someone prevent identity theft from happening to them in the future?

If you have had your identity compromised before, you need to put in place steps to ensure it doesn’t happen again. Here are some easy steps to follow to prevent identity theft from happening in the future.

- Ensure all documents that have your personal information are kept safe at work or home. These documents include your financial documents, credit cards, and your Social Security number.

- Ensure you only share your personal and financial information through email and over the internet if you trust the person requesting it 100%.

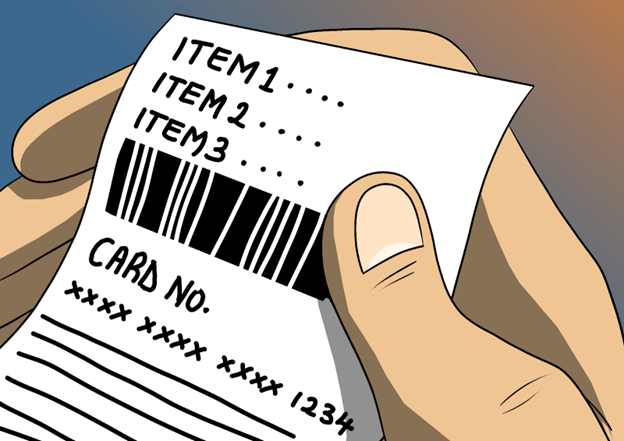

- You should inspect your credit card receipts when you make a purchase. Ensure that the receipt does not show more than your card’s last four digits. If your receipt shows more than the last four digits, then you should take it up with the office of the Attorney General.

- Always use a secure mailbox while also picking up your mail promptly.

- Endeavor to shred your credit applications, bank statements, receipts, credit offers, bank statements, and insurance forms when you no longer need them.

- Having to remember multiple passwords can be a daunting task. However, it is important for you to use different passwords for each of your accounts to avoid compromising your accounts.

- Finally, always get rid of your personal information on any laptop, mobile device, or computer before you dispose of it.

Documents To Keep When You Suspect Credit Card Identity Theft

If you suspect credit card identity theft, you should keep hold of the following types of documentation:

- Police Report: You should immediately report suspected identity theft to your local police department and make sure to obtain a copy of the report. This can protect you in the future if there’s any legal dispute.

- Financial Statements: Keep all bank, credit card, and other financial statements that might show unauthorized charges or suspicious activity.

- Credit Reports: Obtain your credit reports as soon as you suspect identity theft from all three major bureaus (Experian, Equifax, TransUnion) and keep a copy. Monitor your credit reports regularly.

- Identity Theft Report: File an Identity Theft Report with the Federal Trade Commission (FTC). Secure a copy of the report, as it will act as your proof of the crime.

- Correspondence: Keep track of letters, emails, or other correspondence you have with financial institutions, credit bureaus, or law enforcement regarding identity theft.

- Evidence of Fraud: Maintain any other evidence of fraud, such as fraudulent bills, envelopes, etc.

Remember to keep copies of everything and avoid sending original documents. These may serve as essential evidence if you need to prove the theft to creditors, banks, or the authorities.

Conclusion

In conclusion, repairing credit after identity theft may prove challenging. However, it’s not insurmountable. The process requires vigilance, prompt actions, and tenacity to dispute fraudulent charges, close unauthorized accounts, and continually monitor your financial health.

By consistently following these highlighted steps and equipping yourself with the necessary knowledge, you can slowly but surely regain control over your financial identity and salvage your credit health.

In addition, remember that you are not alone in this journey. Relevant authorities, credit bureaus, and financial institutions are structured to aid you throughout this recovery process. By adopting vigilant financial habits in the future, you can mitigate the risk of falling victim to identity theft. Keep faith, take action, and remember that the recovery journey may be protracted, but full recovery is indeed achievable.