- Blogs

- /

- The Truth About CPN and Credit Repair

The Truth About CPN and Credit Repair

During credit repair, shortcuts and quick fixes can be tempting. Credit Privacy Numbers (CPNs) are one of the quick fixes that seem most promising for most individuals with a bad credit score, presenting a fresh start and a shortcut to a great credit score.

But as with many things too good to be true, the reality surrounding CPN and credit repair is often shrouded in misinformation, myths, and potential legal pitfalls. In this article, we’ll unveil the truth about CPNs and their place in legitimate credit repair.

Key Takeaways

- Using a Credit Privacy Number (CPN) instead of your Social Security number to obtain credit is illegal under federal law (18 U.S.C. § 1028) and can lead to prosecution.

- CPNs shouldn’t be used for personal credit repair or obtaining loans.

- Employers and financial institutions are not allowed to accept CPNs for credit-related purposes.

- Using a CPN for fraud can result in fines, imprisonment, and permanent damage to your credit history. Fraud can be any deception intended to result in financial or personal gain.

- Sharing personal information with unauthorized CPN sources can put you at risk of identity theft and fraud. These scammers often target vulnerable individuals with promises of quick credit fixes through CPNs.

- Instead of a CPN, legitimate credit repair addressing inaccuracies, errors, and negative items on your credit report can be used. Hiring a credit repair lawyer is a good option.

The Truth About the Legality of CPN and Credit Repair

Misunderstandings about Credit Privacy Numbers (CPNs) and their use in credit repair have led many individuals to believe that they can replace their Social Security number with a CPN for obtaining loans or other forms of credit. However, it is essential to understand the legal implications surrounding CPN and credit repair before considering its use.

1. Using a CPN instead of your Social Security number is illegal under federal law.

Under federal law (18 U.S.C. § 1028), using a CPN in place of your Social Security number to obtain credit is considered illegal. It is crucial to note that this applies to individuals who attempt to misrepresent a CPN as a valid Social Security number, and businesses that knowingly accept CPNs for credit-related purposes could face severe consequences, including criminal charges, fines, and imprisonment.

2. Employers and financial institutions cannot accept CPNs for credit-related purposes.

Employers and financial institutions aren’t allowed to accept or use CPNs. Hence, using a CPN on job or loan applications to improve one’s chances of approval can have serious legal consequences. Instead, individuals should focus on building good credit through responsible financial practices over time.

3. Fraudulent activities using a CPN can result in severe penalties.

Engaging in fraudulent activities using a CPN can lead to significant penalties. These penalties may include fines, imprisonment, or both. It is essential to recognize that attempting to deceive lenders or credit bureaus by misrepresenting a CPN as a valid Social Security number is illegal and can have long-lasting consequences for an individual’s financial and legal standing.

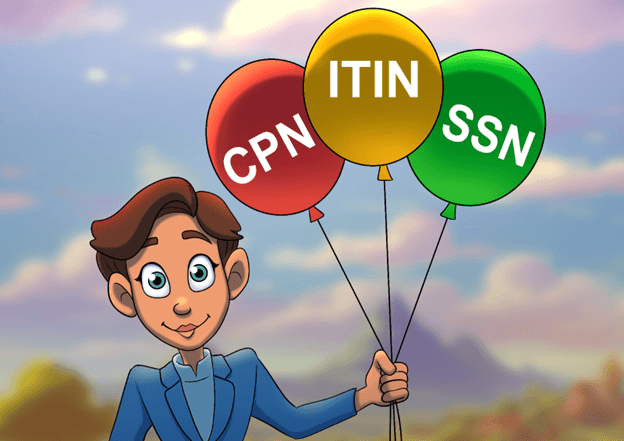

Differences Between CPNs, ITINs, and Social Security Numbers

It’s important to understand these distinctions to safeguard your personal information and avoid falling victim to scams or false claims.

1. SSNs: Government-Issued Identification for Tax Purposes

A Social Security number is a unique nine-digit identification number issued by the government. Its primary purpose is for tax filing and identification purposes. When you are born in the United States, you may receive an SSN shortly after birth. SSNs are crucial in your life, such as in employment, healthcare, education, and financial transactions.

2. ITINs: Alternative Identification for Non-Eligible Individuals

On the other hand, an Individual Taxpayer Identification Number (ITIN) is for individuals who do not qualify for an SSN but still need a taxpayer identification number for tax filing purposes. ITINs serve as a legal alternative for those who cannot obtain an SSN due to their immigration status or other specific circumstances.

The Internal Revenue Service (IRS) gives ITNs to enable individuals to fulfill their tax obligations without an SSN. They allow taxpayers to report income accurately, claim certain deductions or credits, and comply with tax laws.

3. CPNs: Unauthorized Alternatives that Lack Legitimacy

Now, let’s talk about Credit Privacy Numbers (CPNs). Unlike SSNs and ITINs, CPNs are not government-issued identification numbers recognized by financial institutions or lenders.

CPNs can be SSNs stolen from children, the elderly, or the deceased. They are called Secondary Social Security Numbers or Credit Profile Numbers and promise a fresh start because this would market them better.

It’s essential to note that using a CPN to deceive lenders or creditors is illegal. CPNs are not a legitimate means of establishing creditworthiness or obtaining credit. Financial institutions and lenders do not accept CPNs as valid forms of identification when evaluating credit applications.

Understanding the Risks of Using a CPN

Using a CPN (Credit Privacy Number) could seem like an easy solution to repair your credit, but it comes with significant risks. It’s crucial to know these risks before considering using a CPN for credit repair.

1. Permanent Damage to Your Credit History and Reputation

When you use a CPN, you use someone else’s identification number instead of your own Social Security Number (SSN). This practice is illegal and can result in severe consequences. Financial institutions and credit bureaus are well aware of the misuse of CPNs. If they detect fraudulent activity associated with using a CPN, they will report it to law enforcement agencies.

Using a CPN can lead to negative marks on your credit report, including potential criminal charges for identity theft or fraud. These marks can stay on your record for an extended period, making it challenging to rebuild your credit in the future.

Lenders may view this as indicating that you engaged in deceptive practices, which could impact your ability to secure loans or obtain favorable interest rates.

2. Compromised Personal Information

Illegitimate sources offering or selling CPNs pose significant risks to your personal information. Scammers often target individuals seeking quick fixes for their credit issues through alternative methods, like using a CPN. Engaging with these sources puts you at risk of identity theft or becoming a victim of other fraudulent activities.

These illegitimate sources may require sensitive personal information from you, such as your SSN or financial details. Providing this information allows scammers to exploit it for their gain. They might sell this data on the dark web or use it for illegal activities, leaving you vulnerable to financial loss and potential legal troubles.

3. Scammers Targeting Vulnerable Individuals

Scammers know that many individuals are desperate for quick solutions to their credit problems. They prey upon this vulnerability and offer CPNs a seemingly easy fix. However, these scammers are only interested in taking advantage of people already in difficult financial situations.

By promising a quick boost to your credit score through a CPN, scammers entice individuals who may not fully understand the potential consequences. They often charge exorbitant fees for obtaining and using a CPN, further exploiting those seeking help.

It’s essential to be cautious and skeptical of any offers that sound too good to be true. Always remember that there is no shortcut to repairing your credit. It requires time, effort, and responsible financial management.

Making Informed Decisions About CPN and Credit Repair

To make informed decisions about CPN and credit repair, you must educate yourself about the risks and legalities associated with using a CPN. Before making any decisions, take the time to research credible sources such as government agencies, consumer protection organizations, and financial experts for accurate information on credit repair options.

1. Educate Yourself About the Risks and Legalities

Using a CPN could sound like an appealing option for repairing your credit, but it’s crucial to understand the potential risks involved. While there are legitimate uses for CPNs, such as protecting personal information in certain circumstances, they should not be a quick fix for bad credit. It is important to note that using a CPN to misrepresent your identity or deceive lenders is illegal.

2. Research Credible Sources

It’s essential to rely on accurate information from reliable sources. Government agencies like the Federal Trade Commission (FTC) provide valuable resources on credit repair scams and how to avoid them. Consumer protection organizations like the Consumer Financial Protection Bureau (CFPB) can also offer guidance on reputable credit repair practices.

Financial experts who specialize in credit repair can provide valuable insights into the steps you need to take to improve your credit score legitimately. They can guide you through disputing inaccurate information on your credit report and offer advice on building a positive credit history over time.

3. Be Wary of Promises That Sound Too Good To Be True

When exploring credit repair options, be cautious of promises that sound too good to be true. If someone guarantees quick fixes or guaranteed results through a CPN, it’s essential to approach them with suspicion. Legitimate credit repair takes time, effort, and adherence to proper procedures outlined by relevant authorities.

Remember that improving your credit involves addressing negative items on your credit report, building a positive credit history, and demonstrating responsible financial behavior. There are no magical shortcuts that can instantly erase your bad credit or dramatically boost your credit score overnight.

4. Consult with Professionals

Navigating the world of credit repair can be complex, mainly if you have limited knowledge or experience in this area. That’s why it’s wise to consult with professionals specializing in ethical and lawful approaches to credit repair. These experts can provide personalized guidance based on your unique situation and help you develop a plan to improve your credit health.

Credit repair professionals understand the inner workings of the financial system and have extensive knowledge of how lenders evaluate loan applications. They can work with you to identify areas for improvement, dispute inaccurate information on your credit file, and guide you on establishing new lines of credit responsibly.

By working with reputable professionals, you can gain peace of mind knowing that you’re taking the proper steps toward improving your credit without resorting to questionable practices.

Why You Shouldn’t Use a CPN

Although using a CPN instead of your Social Security number might sound tempting, it’s essential to understand the potential consequences and risks involved. Here are some reasons why you should avoid it.

1. Your credit history could be permanently damaged if caught using a CPN.

Misusing a CPN can have long-lasting effects on your credit history. If discovered by credit reporting agencies or lenders, your fraudulent activity associated with the CPN will likely be reported and documented. This negative information can remain on your credit report for an extended period, potentially impacting your ability to secure loans, obtain favorable interest rates, or even rent an apartment.

2. Financial Institutions and Credit Bureaus Have Detection Systems

While some companies may market CPNs as a way to protect your personal information or improve your credit score, these claims are often misleading.

Financial institutions, lenders, and credit bureaus have sophisticated systems in place to detect the use of fraudulent identification numbers like CPNs. They regularly cross-reference information provided by individuals with their databases to verify identities. If they discover that you’re using a CPN instead of your legitimate Social Security number, it can raise red flags.

3. Legal Consequences and Damage to Future Credit Opportunities

There can be severe consequences for using a CPN for credit repair. It is equivalent to committing identity theft or fraud and can result in criminal charges, fines, or even imprisonment, depending on the jurisdiction and severity of the offense. These consequences serve as a deterrent and emphasize avoiding activities involving CPNs.

Moreover, if financial institutions or credit bureaus discover that you’ve used a fraudulent identification number like a CPN, it will damage your credibility and trustworthiness as a borrower.

4. Legitimate Credit Repair Methods Offer Better Solutions

Instead of resorting to illegal tactics, there are legitimate credit repair methods available that offer more effective and lawful ways to rebuild your credit score. Here are a few options worth considering:

- Review and Dispute Errors: Start by obtaining copies of your credit reports from the major credit bureaus and reviewing them carefully for errors or inaccuracies. If you find any, dispute them with the respective credit bureau to have them corrected or removed.

- Pay-Off Debts: Pay outstanding debts to improve your credit utilization ratio. This ratio compares the amount of credit you use to the total available. Lowering this ratio can positively impact your credit score.

- Establish Positive Payment History: Consistently making on-time payments for bills and loans demonstrates responsible financial behavior. It shows lenders that you are trustworthy with borrowed money.

- Seek Professional Help: Consider working with a reputable credit counseling agency or a legitimate credit repair company. They can provide guidance, negotiate with creditors on your behalf, and help create a personalized plan to improve your financial situation.

Remember, rebuilding your credit takes time and patience. By following legitimate methods and making responsible financial choices, you can gradually improve your creditworthiness.

How to Research Reputable Credit Repair Companies

Given the importance of complying with the Credit Repair Organizations Act (CROA), it is crucial to research reputable credit repair companies before engaging in their services. Here are some tips for finding trustworthy organizations:

- Check State Licensing: Some states require credit repair companies to obtain licenses or registrations to operate legally. Verify if the company you are considering in your state is a licensed one.

- Look for Positive Reviews and Testimonials: Reading reviews and testimonials from past clients can give you insights into the experiences others have had with a particular credit repair company. Look for companies with a track record of success and satisfied customers.

- Evaluate Transparency: Reputable credit repair organizations will be upfront about their services, fees, and guarantees. Avoid companies that make unrealistic promises or fail to disclose important information.

- Seek Recommendations: Ask friends, family members, or financial advisors if they have any recommendations for reputable credit repair companies. Personal referrals often provide valuable insights and help you find trustworthy options.

By taking the time to research reputable credit repair organizations that comply with CROA, you can navigate the credit repair process effectively while protecting your rights as a consumer.

How to Spot a CPN Scam

Scammers are everywhere these days, and unfortunately, the world of credit repair is no exception. It’s essential to be cautious and vigilant. Let’s dive into how to spot a CPN scam and protect yourself from falling victim to fraud.

1. Offer of Quick Fixes and Guaranteed Results

One of the telltale signs of a CPN scam is the promise of quick fixes and guaranteed results. Scammers often prey on people who are desperate to improve their credit quickly. They may claim that using a CPN will automatically erase negative information from your credit report or guarantee an increase in your credit score overnight. However, it’s important to remember that repairing your credit takes time, effort, and legitimate strategies.

2. Unauthorized Sources

It is a scam when individuals or companies offering these CPNs do so without proper licensing or accreditation. Legitimate credit repair agencies comply with regulations and industry standards.

A financial institution asking for a CPN or promoting it is a major red flag. Your Social Security Number (SSN) is the only accepted form of identification for establishing your creditworthiness with reputable lenders. If someone tells you otherwise or tries to convince you that a CPN can replace your SSN for credit purposes, proceed cautiously.

3. Claims of Legal CPNs and Too Good-to-Be-True Claims

If something sounds too good to be true, it probably is. Keep an eye out for deceptive advertisements or marketing materials that make CPNs sound like a legal and authorized method for credit repair.

4. Requests for Sensitive Information

Scammers may ask for personal information such as your Social Security number, date of birth, and financial details, claiming they need it to generate a valid CPN. Sharing such information with unauthorized sources can lead to identity theft.

5. Pressure Tactics and Lack of Transparency

Scammers use high-pressure sales tactics to push you into obtaining a CPN quickly. Legitimate credit repair professionals provide information and give you time to make an informed decision.

Furthermore, it is also a red flag if a CPN provider fails to provide clear and detailed information about the CPN, its legality, and the credit repair process. Reputable organizations are transparent about their services and fees.

6. No Mention of Credit Reporting Agencies

Legitimate credit repair involves working with credit reporting agencies to dispute inaccurate information. Be cautious if the CPN provider does not discuss how their services interact with these agencies.

7. High Upfront Fees

Legitimate credit repair services typically charge reasonable fees and may offer a free consultation. Be wary of CPN providers who demand substantial upfront fees for acquiring or using a CPN.

How to Protect Yourself from CPN Scams and False Claims

Many people are eager to find quick fixes or guaranteed results. However, it’s crucial to approach these claims with skepticism, especially when they involve using a Credit Privacy Number (CPN).

1. Be Skeptical of Quick Fixes and Guaranteed Results

It’s essential to be cautious when encountering advertisements or individuals promising instant credit repair or guaranteed results through a CPN. While it may be tempting to believe in a quick fix for your credit issues, the reality is that repairing credit takes time and effort. There are no shortcuts or magic solutions that can instantly improve your credit score.

2. Research Credible Sources

Before engaging in any credit repair methods involving CPNs, it is crucial to conduct thorough research. Rely on credible sources such as government agencies like the Federal Trade Commission (FTC), consumer protection organizations, and financial experts. These sources can provide valuable insights into the legality and effectiveness of CPNs for credit repair purposes.

3. Consult Professionals Specializing in Ethical Approaches

Instead of relying on potentially fraudulent practices involving CPNs, consider consulting professionals specializing in ethical approaches to repairing your credit. Credit counselors or reputable credit repair companies can guide you through legitimate strategies that comply with legal guidelines. They can help you develop a personalized plan based on your financial situation.

4. Protect Personal Information

One way to avoid falling victim to CPN scams is by protecting your personal information. Unauthorized individuals may offer or sell unauthorized identification numbers like CPNs, claiming they will help improve your credit score. However, sharing personal information with these sources puts you at risk of identity theft and fraud.

5. Stay Informed about Current Scams

Scammers are constantly coming up with new tactics to deceive individuals seeking alternative methods for credit repair. It’s crucial to stay informed and up-to-date on the latest scams targeting people who are vulnerable or desperate to improve their credit. By being aware of these scams, you can better protect yourself from becoming a victim.

Legitimate Credit Repair Methods

In the world of credit repair, it’s important to separate legitimate methods from scams. While there are plenty of shady operators out there promising quick fixes and magical solutions, it’s crucial to focus on approaches that actually work. Here, we’ll explore critical strategies for repairing your credit effectively and legitimately.

1. Addressing Inaccuracies, Errors, and Negative Items

One of the primary goals of legitimate credit repair is to address any inaccuracies, errors, or negative items that may be dragging down your credit score. Reputable organizations will guide you through disputing inaccurate information directly with creditors and credit bureaus. This involves submitting formal disputes and providing supporting documentation to back up your claims.

2. Building Positive Payment History

A fundamental aspect of improving your credit score is building a positive payment history. This means making timely payments on all your bills and debts. By consistently paying your obligations on time, you demonstrate financial responsibility and reliability to potential lenders. Over time, this can have a significant impact on improving your overall credit profile.

Here are a few tips for building a positive payment history:

- Set up automatic payments: Consider setting up automatic payments for bills such as utilities or subscriptions to ensure you never miss a due date.

- Budget effectively: Create a budget that allows you to allocate funds towards paying off debts each month.

- Prioritize high-interest debts: Focus on paying down high-interest debts first while making at least minimum payments on other accounts.

3. Utilizing Secured Credit Cards Responsibly

Secured credit cards can be an effective tool for rebuilding your credit profile when used responsibly. Unlike traditional credit cards, secured cards require an initial deposit that serves as collateral against the line of credit extended to you. By using a secure card and making regular payments, you can establish a positive payment history.

Consider these tips when utilizing secured credit cards:

- Choose a reputable issuer: Look for established financial institutions that offer secured cards with reasonable fees and interest rates.

- Keep your credit utilization low: Aim to keep your credit utilization ratio (the amount of available credit you’re using) below 30%.

- Make timely payments: Pay off your balance in full each month, or at least make the minimum payment on time, to avoid negative impacts on your credit score.

4. Seeking Professional Advice

If you’re unsure about navigating the world of credit repair on your own, it’s wise to seek professional advice from experts who specialize in ethical approaches. Reputable credit repair services and companies can provide guidance tailored to your situation. They can help you understand the intricacies of the process, provide personalized strategies, and advocate on your behalf when dealing with creditors and credit bureaus.

Remember, not all credit repair companies are created equal. Do thorough research, read reviews, and choose a reputable organization that has a track record of success and positive customer experiences.

How to Rebuild Your Credit Score Without a CPN

There are several key steps you can take to rebuild your credit score without resorting to using a CPN. By focusing on addressing negative items, making a plan to pay off outstanding debts, establishing a positive payment history, regularly monitoring your credit report, and maintaining patience and persistence, you can work towards improving your creditworthiness.

1. Address Negative Items on Your Credit Report

One of the first steps in rebuilding your credit score is to address any negative items that may be dragging it down. These could include late payments, collection accounts, or charge-offs. Start by carefully reviewing your credit report to identify these negative items.

2. Make a Plan to Pay Off Outstanding Debts

Once you have identified the negative items on your credit report, it’s essential to make a plan to pay off any outstanding debts associated with them. Create a budget and allocate funds towards paying off these debts systematically. Consider prioritizing high-interest debts or those close to being sent to collections.

3. Negotiate with Creditors for Removal of Negative Items

After paying off outstanding debts, consider reaching out to creditors or collection agencies and negotiating for the removal of negative items from your credit report. Some creditors may be willing to remove the negative information once the debt has been resolved. Be persistent and advocate for yourself during these negotiations.

4. Establish a Positive Payment History

Building a positive payment history is crucial when rebuilding your credit score. Make it a priority to pay all bills on time and in full each month, not only loans and credit card payments but also utility bills and rent payments if they are reported to the credit bureaus.

5. Regularly Monitor Your Credit Report

It’s essential to regularly monitor your credit report for any inaccuracies or errors that may negatively impact your score. You can request free copies of your credit reports from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year. Review these reports for discrepancies and report them promptly to the credit bureaus.

6. Patience and Persistence Are Key

Rebuilding your credit score takes time, and it requires patience and persistence. It’s important to understand that there are no quick fixes or shortcuts. Avoid falling into the trap of using illegal methods like obtaining a CPN (Credit Privacy Number), as this can lead to severe consequences.

Remember, rebuilding your credit score is a journey, not a sprint. It may take months or even years to see significant improvements in your creditworthiness. Stay committed to making positive financial choices, paying debts, and maintaining responsible credit behavior.

Tips for Preventing Identity Theft

1. Regularly Monitor Your Credit Report

It’s crucial to regularly monitor your credit report to keep an eye out for any suspicious activity or unauthorized accounts. By reviewing your credit report, you can quickly identify any potential signs of identity theft and take immediate action to mitigate the damage.

2. Protect Personal Information

Protecting your personal information is paramount to preventing identity theft. Keep sensitive details such as your Social Security number, bank account information, and credit card details out of reach of potential identity thieves. Be cautious about who you share this information with and ensure it is stored securely.

3. Use Strong Passwords

Using strong passwords for your online accounts adds an extra layer of security against identity theft. Avoid using easily guessable passwords like “123456” or “password.” Instead, create unique and complex passwords that combine letters, numbers, and special characters. Refrain from reusing the same password across multiple platforms.

4. Beware of Phishing Attempts

Phishing attempts are common tactics used by identity thieves to trick individuals into revealing their personal information. Be vigilant when receiving emails or phone calls requesting sensitive data such as account numbers or passwords. Legitimate organizations will never ask you to provide personal information through unsecured channels.

5. Consider Identity Theft Protection Services

Identity theft protection services can be valuable allies in the fight against fraudulent activities. These services often provide real-time monitoring of your personal information, alerting you immediately if any suspicious activity is detected. They may also offer assistance in resolving issues related to identity theft, should it occur.

By following these tips and incorporating them into your daily routine, you can significantly reduce the risk of falling victim to identity theft. Protecting your personal information is essential to safeguarding against malicious schemes to steal your identity.

Conclusion

Building good credit is to demonstrate responsible financial behavior over time. By trying to take shortcuts through illegitimate means like using a CPN, you’re not addressing the underlying issues that caused your credit problems in the first place but instead adding to them.

Remember that rebuilding your credit won’t happen overnight. It requires patience and persistence. By following legitimate methods and avoiding shortcuts like CPNs, you’ll be on the right track toward improving your credit score.

FAQs

Can I use a CPN to boost my credit score quickly?

No, using a CPN is not a legitimate or recommended method for boosting your credit score quickly. While some individuals may claim otherwise, relying on a CPN can lead to severe consequences, such as legal issues or further damage to your credit history. It’s best to avoid these shortcuts and focus on legitimate ways to rebuild your credit.

Are all credit repair organizations trustworthy?

Not all credit repair organizations are trustworthy. Some may make false promises or engage in unethical practices that could worsen your financial situation. It’s essential to do thorough research before working with any organization offering credit repair services. Look for reputable companies with positive reviews and seek advice from trusted financial advisors.

How long does it take to rebuild my credit score?

The time it takes to rebuild your credit score depends on various factors, such as the severity of past financial issues and how consistently you follow good credit habits. While there is no fixed timeline, with dedication and responsible financial behavior, you can start seeing improvements in your credit score within a few months to a year.

Can I repair my credit score on my own?

Yes, it’s possible to repair your credit score on your own. By understanding the factors that affect your credit and implementing good financial habits, like paying bills on time, reducing debt, and disputing any inaccuracies on your credit report, you can make significant progress in rebuilding your credit without relying on outside help.

Will using a CPN guarantee loan approval?

Using a CPN does not guarantee loan approval. Lenders typically consider various aspects of your financial history when evaluating loan applications, including your credit score, payment history, income stability, and debt-to-income ratio. Using a CPN may raise red flags for lenders and result in denial or additional scrutiny during the application process. It’s best to focus on improving your legitimate credit profile instead.