- Blogs

- /

- What Credit Score is Needed to Buy a Car

What Credit Score is Needed to Buy a Car

Summary

There isn’t a one-sized approach to knowing what credit score is needed to buy a car. But you’ll always get a low-interest loan with a 661 to 850 credit score.

Your credit score significantly determines your ability to get an auto loan and the terms you’ll receive. To be well-prepared for the process, you must understand the relationship between credit scores and car financing.

Your credit history and other factors, like your income, will impact your chances of loan approval and the interest rates you qualify for. And that’s because each lender has different criteria, but generally, higher credit scores offer better loan options.

But you don’t need a high credit score to get an auto loan with great interest rates, and we’ll show you how to get the best rates irrespective of your situation.

We’d also explore what credit score is needed to buy a car, , and show you some reputable auto loan providers catering to people with varying credit histories.

Let’s jump in.

Key Takeaways

- You need a credit score between 661 and 850 to get an auto loan with the best interest rates.

- Getting an auto loan is often more challenging for people with credit scores below 600.

- Before giving you a loan, lenders consider factors like your credit score history, income, down payments, vehicle conditions, and loan terms

- Even if you’ve got a bad credit score, getting a Subprime loan, using Buy-herepay-here, and getting a cosigner can help you secure an auto loan.

- Before accepting a car loan, consider the loan’s interest rate, loan term, and repayment options.

- Also, it’s vital to look beyond the interest rate and consider other costs associated with getting an auto loan, like fees, down payments, and potential penalties.

What Credit Score is Needed to Buy a Car?

If you’re considering buying a car, you might wonder what precise credit score you need to make that dream areality.

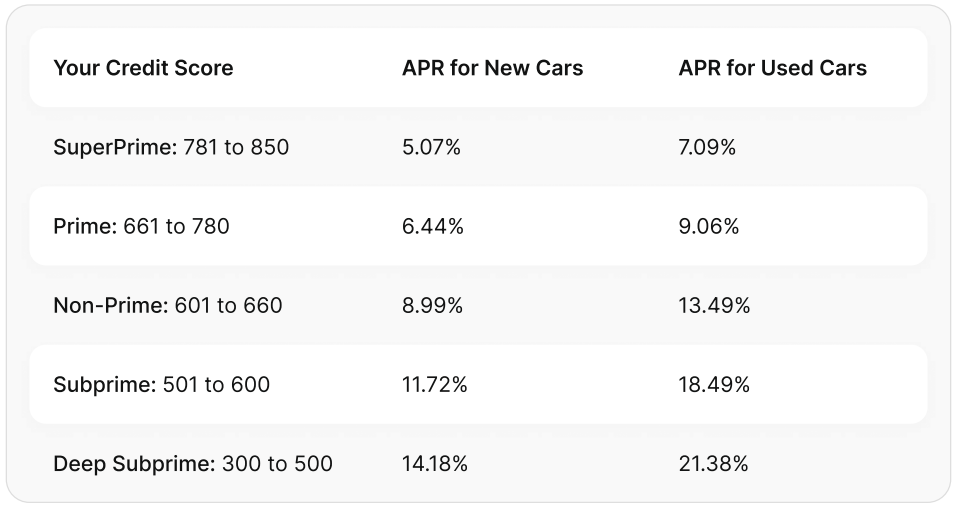

Well, we looked through Experian’s report on the automotive market in 2023.

Here’s what we found:

The report clarifies that folks with Subprime and Deep Subprime credit scores pay far more than their

counterparts with Prime and Super Prime credit scores.

And if the Federal Reserve continues raising interest rates, we could see the interest rate and APR—which

includes the interest plus extra costs and fees on car loans rise even higher than they currently are.

This means that getting an auto loan would be even more challenging for people with credit scores below 600

to get an auto loan.

Seven Vital Criteria Lenders Consider Before Approving Auto Loans

Depending on your credit score, different lenders may have varying criteria for approving auto loans.

Let’s check out some of these criteria so we can get a solid picture of what credit score is needed to buy a car.

Simply put, your current balance is the total amount you owe the credit card company. This balance constantly changes with every new transaction and payment you make.

1. Your Credit Score and History

Your credit score stands at the forefront of every lender’s consideration. And that’s because your credit score paints a solid picture of your creditworthiness.

Having a higher credit score translates to more favorable loan terms, including lower interest rates and higher loan amounts.

2. Your Income and Employment Stability

Lenders access your ability to repay the auto loan. They assess your income to ensure it aligns with the loan amount and monthly payments.

A stable employment history is also crucial because it gives lenders confidence that you’d be consistent and reliable in repaying the loan.

Regular income signals to lenders that you have the financial means to meet your repayment obligations.

3. Your Debt-to-Income Ratio

Lenders calculate your debt-to-income ratio by comparing your monthly debt payments to your gross monthly income. This ratio gives them insight into your financial capacity and your ability to take on additional debt.

A lower debt-to-income ratio indicates a healthier financial profile and increases your chances of getting your auto loan approved.

4. The Down Payment You Make

The size of your down payment can significantly influence your loan’s approval. Making a substantial down payment won’t just reduce the amount you need to borrow but also show lenders they wouldn’t be taking too much risk by giving you the loan.

Lenders often view a higher down payment favorably, which could increase your chance of getting better loan terms.

5. Your Loan-to-Value Ratio

Your loan-to-value ratio is the relationship between your loan amount and the vehicle’s appraised value. Lenders prefer a lower LTV ratio since it indicates a more negligible risk for them.

That said, making a larger down payment can help you achieve a favorable LTV ratio, potentially leading to a more attractive loan offer.

6. The Vehicle’s Condition and Age

Lenders often have restrictions on the age and condition of the car, and some may offer better terms for new or certified pre-owned vehicles. The vehicle’s value and reliability contribute to the lender’s risk assessment and can influence if you get an auto loan.

7. The Terms of the Loan

Getting an extended auto loan results in paying higher interest over time. But lenders could also raise interest rates on longer-term loans because there’s an increased chance overall interest rates may increase, and you could default on the loan.

It’s important to understand that different lenders may have different thresholds for approval. While one lender may require a higher credit score, another might be more lenient.

Six Factors that Determine Your Credit Score

Several factors contribute to determining your credit score, from your payment history to utilization ratio, credit mix, length of credit history, and new credit applications.

1. Payment History

Your payment history is crucial in determining your credit score. In fact, your payment history influences 35% of your credit score.

Making timely payments on your bills and loans demonstrates responsible financial behavior and positively affects your score. On the other hand, late or missed payments can lower your score significantly.

2. Utilization Ratio

Another factor is your utilization ratio, which refers to the available credit you use. We recommend keeping this below 30% to maintain a solid credit score. For example, if you have a total available credit of $10,000 across all your accounts, try not to use more than $3,000.

3. Credit Mix

Credit mix also influences your score. Having a diverse range of accounts, from mortgages to student loans and credit cards, can demonstrate that you can handle different debts responsibly.

4. Length of Credit History

The length of your credit history is another important factor lenders consider when evaluating your application for an auto loan. Generally speaking, the longer you’ve had established credit accounts in good standing, the better it reflects on your overall financial responsibility.

5. Newly Opened Accounts

Opening new accounts or making frequent applications for new lines of credit can negatively impact your score temporarily, and that’s because they trigger more inquiries into your credit report.

The best thing you can do is to limit your applications for new lines of credit when planning to secure an auto loan since it’ll help you maintain a favorable credit rating.

6. Bankruptcies and Collections

Bankruptcies and collections are significant red flags lenders always look for. These negative marks on your credit report can severely impact your chances of securing a car loan.

So ensure you resolve these issues and rebuild your credit before applying for an auto loan; otherwise, you could risk getting loan options with higher interest rates.

Four Tips for Improving Your Credit Before Buying a Car

Although you can get a car loan with bad credit, improving your credit score is always best before applying for an auto loan.

Here’s how you can do that:

1. Pay Your Bills on Time

Consistently paying your bills by or before their due dates is one of the best ways to show lenders that you’re responsible and capable of managing your finances. Doing this will improve your credit score over time.

2. Reduce Your Debt

High debt levels will negatively impact your credit score. So, focus on paying off any outstanding debts to improve your creditworthiness.

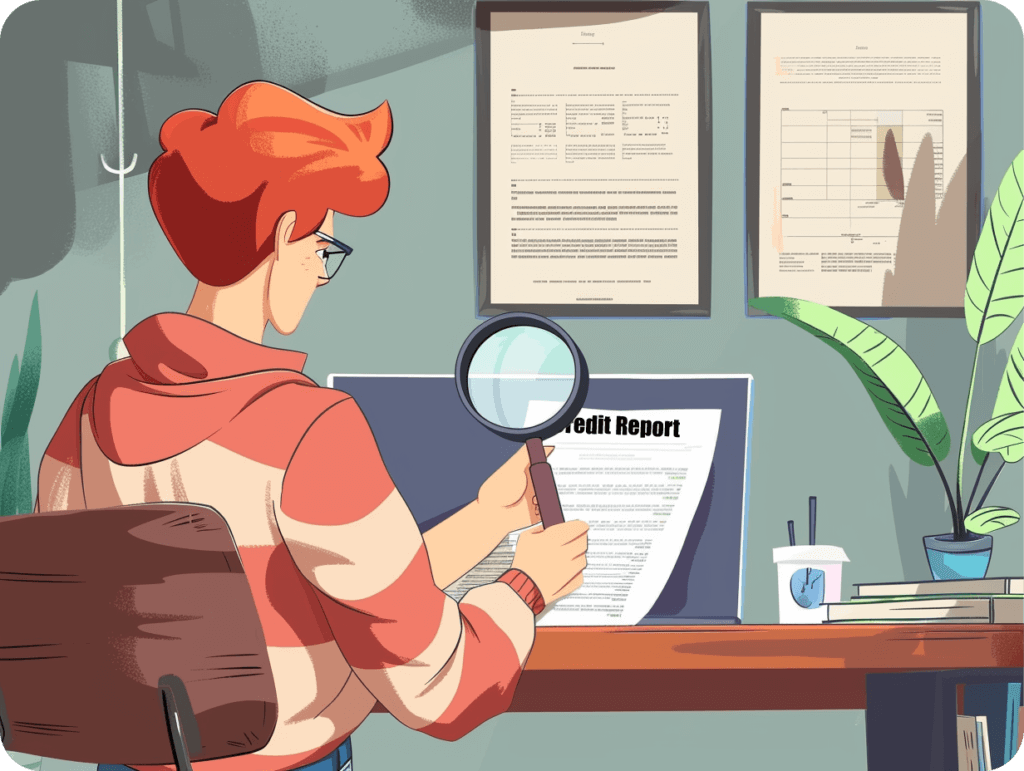

3. Correct All Errors on Your Credit Report

Sometimes, mistakes happen, and these errors can drag down your credit score. A recent study found that more than one-third of Americans found errors on their credit report.

So, ensure you check your credit report at least once a month and dispute any inaccuracies you find.

4. Build a Positive Payment History

If you’ve got some existing lines of credit, like a credit card or a personal loan, make sure to use them responsibly. Always make timely payments and keep the balances low to demonstrate financial responsibility.

Following these steps can gradually improve your credit score over time. This will increase your chances of getting approved for an auto loan and help you secure better interest rates and terms.

Three Reliable Ways You Can Get a Car with Bad Credit

Getting Subprime Auto Loans

If you have a low credit score, don’t worry! There are still several options available that can help you buy a car. One option is to explore subprime auto loans. These loans are specifically designed for folks with bad credit.

And although they may come with higher interest rates and stricter terms, they still allow you to get behind the wheel of your own car.

Yes, subprime auto loans can be helpful, but it’s essential to understand that their higher interest rates mean you’ll end up paying more over the life of the loan.

So, before signing on the dotted line, consider your budget and whether you can comfortably afford the monthly payments.

Using Buy-Here-Pay-Here Dealerships

Another alternative you should consider is buy-here-pay-here dealerships. These dealerships often finance vehicles directly without relying on traditional lenders.

They usually have less stringent credit requirements and may be more willing to work with folks with bad credit. However, it’s essential to carefully review the terms and conditions of these deals, as they often come with high-interest rates.

Getting a Cosigner

If neither subprime auto loans nor buy-here-pay-here dealerships seem like the best options for you, consider finding a cosigner.

A cosigner is anyone with good credit who agrees to take responsibility for the loan if you fail to make payments. Getting a cosigner can help reassure lenders that they won’t lose money by lending to someone with bad credit.

Remember, buying a car with bad credit is possible, but weighing the options available is crucial. So, don’t forget to take the time to consider the pros and cons of subprime auto loans, buy-here-pay-here dealerships, and cosigners before deciding.

Three Places You Can Get an Auto Loan

When it comes to finding the right place to get an auto loan, there are several options you can consider. Let’s take a look at some of them.

1. Online Lenders

Online lenders are becoming increasingly popular for borrowers seeking auto loans. These lenders operate exclusively online, allowing you to complete the loan application process from the comfort of your home.

Here’s why using online lenders is great.

- Convenience: Applying for a loan online is quick and easy, without the need to visit a physical branch.

- Competitive Rates: Online lenders often offer competitive interest rates due to lower overhead costs.

- Multiple Options: There are many online lenders in the auto industry offering a wide range of lending options to buyers.

Here’s why online lenders aren’t a great idea.

- Limited Personal Interaction: With online lenders, you may miss out on the personal touch and face-to-face assistance that traditional banks provide.

- Potential Scams: The internet is flooded with risky payment platforms and outright scams. There’s a risk of encountering fraudulent or predatory lending practices with these online lenders. So, ensure you research and choose reputable online lenders.

2. Traditional Banks

Traditional banks have long been a go-to option for borrowers looking for auto loans. Here’s what you need to know about obtaining an auto loan from a bank:

Here’s why traditional banks are great.

- Established Reputation: Banks have been in the lending business for decades and have built consumer trust. There’s almost zero chance of getting scammed by a bank.

- In-Person Assistance: If you prefer face-to-face interactions and personalized guidance, traditional banks are the best for you.

- Relationship Building: Establishing a relationship with a bank through an auto loan could give you access to other financial products in the future.

Here’s why banks aren’t such a great idea.

- Complex Approval Criteria: Banks typically have stricter credit requirements than other lenders, making it more challenging for borrowers with lower credit scores.

- Lengthy Approval Process: The approval process at banks can be time-consuming compared to online lenders or local dealerships.

3. Local Dealerships Offering Financing

Another option is financing directly from the dealership where you plan to purchase your car.

Here’s what makes this option great:

- Convenient One-Stop Solution: When you finance through a dealership, you can complete the car purchase and loan application in one place.

- Special Promotions: Dealerships may offer special financing promotions or incentives that can save you money.

- Flexibility: Dealerships often work with multiple lenders, allowing them to find financing options tailored to your credit score and financial situation.

Here’s why this option isn’t a great idea:

- Potentially Higher Interest Rates: In some cases, dealership financing may have higher interest rates than other lenders.

- Limited Options: While dealerships work with multiple lenders, their selection may be more limited than online or traditional banks.

When choosing the right lender for your auto loan, you must consider factors such as your credit score, financial situation, and personal preferences.

Take the time to research different lenders, compare interest rates and terms, and choose an option that best suits your needs.

What You Must Know When Comparing Auto Loans

Comparing auto loan options is essential because not all loans are created equal. Different lenders offer different interest rates, loan terms, and repayment options.

And comparing auto loans can help you choose the best deals and save you significant money in the long run.

So, before you jump in and sign on the dotted lines, here’s what you must know.

1. Understand the Essentials

- Interest Rates: The interest rate determines how much you’ll pay in addition to the principal amount borrowed. Lower interest rates mean lower monthly payments and less money spent over the life of the loan.

- Loan Terms: The length of your loan term affects your monthly payment and overall interest costs. Shorter loan terms typically have higher monthly payments but result in less interest paid over time.

- Repayment Options: Some lenders offer flexible repayment options, like bi-weekly or automatic payments, which can help you stay on track and save on interest costs.

2. Evaluating Total Costs

When comparing auto loans, it’s vital to look beyond the interest rate and consider other costs associated with borrowing money, such as:

- Fees: Some lenders may charge origination fees or prepayment penalties. Be sure to factor these into your decision-making process, as they can add up quickly.

- Down Payments: Depending on the lender and your credit score, you may need to make a down payment on your car purchase. Consider how much you can put down and how it’ll affect your loan amount.

- Potential Penalties: Understanding the potential penalties for late payments or defaulting on your loan is crucial. These penalties can have long-term consequences, so don’t ignore the fine print.

Evaluating all these can help you make a more informed decision about which auto loan is best for you.

Take Action

Now that you better understand what credit score is needed to buy a car and how your credit score affects your ability to get an auto loan, it’s time to take action. If you’ve got a less-than-ideal credit score, focus on paying your bills on time, reducing your debt-to-income ratio, and checking for any errors in your credit report.

FAQs

What credit score is needed to buy a car?

To buy a car, the credit score you need will vary depending on several factors. Although there isn’t a specific number, you’ll typically need a credit score between 661 and 850 to enjoy the best interest rates.

Can I get a car loan with bad credit?

Yes, you can still get a car loan with bad credit. However, it might be more challenging and come with higher interest rates. All you need to do is shop around, compare offers from different lenders, and consider improving your credit before applying.

How does my credit score affect my car loan?

Your credit score plays a crucial role in determining the interest rate for your car loan. A higher score usually means lower interest rates and better loan options. Lenders use your credit history to assess the risk of lending you money.

What is considered a good credit score for buying a car?

Yes, requirements may vary among lenders; generally, a good credit score for buying a car falls within the 660–850. An excellent credit score (above 720) will give you even better loan terms.

Can I still buy a car if I have no credit history?

Yes, it’s possible to buy a car without any credit history. Some lenders offer special programs for individuals with limited or no credit history. You should also consider getting a cosigner or making a larger down payment to increase your chances of approval.

Our Latest Blogs:

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary For most people, rent...

ThisIsJohnWilliams

ThisIsJohnWilliams

ThisIsJohnWilliams

ThisIsJohnWilliams

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Sometimes, our credit scores aren’t as high as we want....