- Blogs

- /

- What is a Statement Balance?

What is a Statement Balance?

A statement balance is the total amount of money a credit cardholder owes at the end of a specific billing cycle. It represents the full outstanding balance on your credit card account, including any purchases, fees, and interest charges applied since your previous statement.

Understanding your statement balance is crucial because it directly impacts your financial well-being. Knowing how much you owe and when it’s due can help you effectively manage your finances and avoid late payment fees or interest charges.

So, we’ve prepared this comprehensive guide on ‘What is a statement balance?’ so you can understand why it matters and how it affects you as a credit card user.

Ready? Let’s dive in!

Key Takeaways

- The statement balance is an essential aspect of managing your credit card finances. It indicates your outstanding debt and helps you determine the minimum payment you must make to avoid late fees.

- Your current balance gives you a real-time view by reflecting all the recent transactions on your credit card account.

- Paying off your statement balance in full each month and avoiding carrying over any debt into subsequent billing cycles will minimize your interest expenses and keep you in good standing with your credit card company.

- Carrying a balance on your credit card puts you in a position where your card issuer charges you interest on the remaining amount.

What is a Statement Balance?

Your statement balance is the total amount you owe on a credit card at the end of a billing cycle. It represents all the purchases, payments, and fees you incurred during that specific period.

Calculating the statement balance involves adding all transactions and subtracting any credits or returns.

The statement balance is an essential aspect of managing your credit card finances. It indicates your outstanding debt and helps you determine the minimum payment you must make to avoid late fees.

Understanding your statement balance can help you stay on top of your financial obligations and maintain a good credit standing.

Here’s how.

1. It Shows Your Total Amount Owed

Your statement balance encompasses all charges on your credit card within a specific billing cycle, including purchases, cash advances, balance transfers, and any applicable fees or interest charges. It reflects the net amount you owe to the credit card issuer at the end of that period.

2. It Reflects Every Transaction

Your statement balance takes into account every transaction made during the billing cycle. This includes both in-store and online purchases, as well as recurring payments like subscriptions or utility bills.

One of the best parts of checking your statement balance is that it gives you a comprehensive snapshot of your spending habits within a specific timeframe.

3. It Deducts All Credits and Returns

Any credits or returns are deducted from your total transactions when calculating the statement balance. For example, if you returned an item or received a refund for a purchase made during the billing cycle, these amounts would be subtracted from your overall balance owed.

4. It Shows Your Minimum Payment Due

Your statement balance determines the minimum payment required to avoid late fees and penalties. Credit card issuers like American Express, MasterCard, and Discover all set their minimum payment percentage (usually around 1-3% of the total balance).

Meeting this requirement ensures that you remain in good standing with your creditor. It’s vital to note that while paying only the minimum amount due may prevent late fees, it can result in accumulating interest charges over time.

So, ensure you pay off your statement balance in full whenever possible to avoid unnecessary interest expenses.

Understanding your statement balance is crucial for effective credit card management. You can maintain a healthy financial profile and avoid unnecessary fees or interest charges by keeping track of your spending, monitoring your transactions, and paying off the balance on time.

Understanding the Difference Between Statement Balance vs. Current Balance

Knowing the difference between your statement and your current balance is crucial for effectively managing your credit card use. But what does the current balance mean?

Let’s dig deep and explore.

1. What is a Current Balance?

Unlike a statement balance that only includes charges from the previous billing cycle, your current balance gives you a real-time view by reflecting all the recent transactions on your credit card account, including purchases, payments, and any fees or interest charges made after the last billing cycle.

Simply put, your current balance is the total amount you owe the credit card company. This balance constantly changes with every new transaction and payment you make.

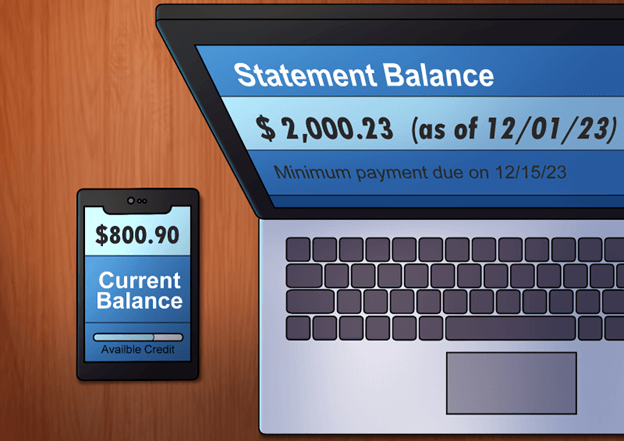

2. Current Balance May Differ from Statement Balance

It’s important to note that your current balance may be higher or lower than your statement balance. It all depends on the recent activities on your credit card account.

So, if you’ve made new purchases or received credits since your last billing cycle ended, your current balance will show those transactions, but your statement balance won’t.

To get a better understanding, imagine:

- You recently made a large purchase after receiving your monthly statement. In this case, it’d increase your current balance but won’t affect your statement balance until the next billing cycle.

- You returned an item or received a refund for any reason after receiving your monthly statement. In this case, your current balance would decrease without impacting your statement balance.

3. Managing Credit Card Usage Effectively

Understanding and keeping track of both balances regularly can help you avoid overspending and stay within your budget.

Here’s how you can effectively manage your credit card usage:

- Pay attention to both balances. Doing this will give you a complete picture of your financial obligations.

- Pay off your statement balance in full by the due date to avoid paying interest charges.

- Constantly monitor your current balance to stay aware of recent transactions and their impact on your debt.

Why Your Statement Balance May Be Higher Than Your Current Balance

When you check your account balance, you might be surprised that your statement balance is higher than your current balance. But don’t freak out just yet! There are three simple explanations for this difference.

1. Pending Transactions

When you make a purchase or a transaction using your credit or debit card, it doesn’t always appear immediately on your statement—often called a pending transaction.

Sometimes, it takes a little while for these pending transactions to go through and get processed by the bank or financial institution.

Pending transactions can cause your current balance to be higher than your statement balance because they haven’t been included in the calculation of the statement balance yet.

So even though you’ve made a purchase and it’s reflected in your current balance, it won’t show up on your statement until it’s been fully processed.

2. Interest Charges and Extra Fees

Another reason your statement balance may be higher than your current balance could be due to your interest charges and any other fees added after the billing cycle ends. Let’s break down what this means.

When you have an outstanding credit card debt or carry a revolving balance from month to month, the bank charges you interest on that amount. This interest is typically calculated daily based on the average daily balance of your account during the billing cycle.

So, even if you pay off most of your current balance before the end of the billing cycle, any interest charges accrued during that time will still be added to your statement balance.

If there were any other fees associated with your account, like annual fees or late payment fees, those would also contribute to a higher statement balance.

3. Late Payments or Returned Payments

Now, let’s talk about what we all want to avoid: late or returned payments. These can harm your overall statement balance.

And if you fail to make the minimum payment on your credit card by the due date, the bank will charge you a late payment fee. This fee will be added to your statement balance for the next billing cycle, making it higher than your current balance.

Similarly, suppose you made a payment that your bank later returned due to insufficient funds or any other reason. In that case, the amount of that payment will still be included in your statement balance.

So, not only do you have to deal with the returned payment and any associated fees, but it also affects your overall statement balance.

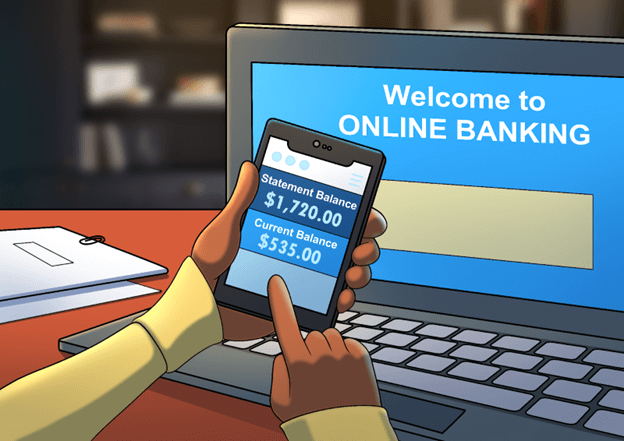

Finding and Managing Your Statement Balance and Current Balance

Now that we’ve understood the concept of statement balance and current balance let’s check out how to track these balances to stay on top of your financial goals and credit card activity.

1. Check Your Online Banking Platforms

To stay informed about your statement and current balance, use the online banking platforms provided by your financial institution.

These platforms offer a convenient way to access real-time information about your credit card account. Simply log into your online account to find your statement and current balance easily.

2. Always Review Your Monthly Statements

Always keep an eye on your monthly statements. Reviewing these statements is essential to identifying discrepancies or unauthorized transactions.

So, ensure you keep an eye out for:

- Emails or notifications from your bank informing you that your monthly statement is ready.

- Open your statement document through email attachments or logging into your online banking platform.

- Take note of the ‘Statement Balance’ mentioned at the top or bottom of each page.

- Compare this statement balance with previous billing cycles to identify any significant fluctuations.

Reviewing these statements will help you quickly spot any errors or fraudulent activity and ensure that you maintain control over your finances.

3. Regularly Monitor Your Current Balances

Yes, your statement balance provides a snapshot of your credit card activity for a specific billing cycle, but your current balance reflects the most up-to-date information.

Monitoring your current balance is crucial for staying aware of recent transactions and ensuring sufficient funds are available.

And you can do that by logging into your online banking platform, checking your current balance, taking note of any recent transactions, and comparing them with your receipts or purchase history.

This way, you can ensure that the current balance aligns with your expectations based on your recent financial activities.

Here’s How to Reduce Interest Charges on Your Statement Balance

To maintain good financial health and avoid unnecessary expenses, you must understand how to reduce interest charges on your statement balance.

Here’s how you can go about it.

Always Pay Off Your Entire Statement Balance

When you receive your credit card statement—which includes the total amount you owe for that billing cycle—try your best to pay off the entire statement balance by the due date.

Doing so will help you avoid paying interest on this balance, and this matters because it shows the credit card company that you’re not carrying any debt into the next billing cycle.

Avoid Carrying Over Payments

If you only make a partial payment or fail to pay off your statement balance in full by the due date, interest charges will start accruing on the remaining unpaid portion.

Credit card companies typically charge high-interest rates on unpaid balances, which can quickly add up and burden your finances.

It’s vital to note that even if you make the minimum payment required by your credit card company, any outstanding balances will still accrue interest.

Minimize Interest With Prompt Payments

Paying off your statement balance in full each month and avoiding carrying over any debt into subsequent billing cycles will minimize your interest expenses and keep you in good standing with your credit card company.

This responsible approach will help improve your credit score and demonstrate your financial discipline.

Here’s why you should always pay off your statement balance.

- To Avoid Interest Charges: When you pay off your entire statement balance promptly, you don’t incur any additional costs through interest charges.

- To Maintain Good Credit: Regularly paying off your statement balance demonstrates responsible credit card usage and can positively impact your credit score.

- To Avoid Late Fees: Paying your statement balance will help you avoid late fees imposed on missed payments.

- To Prevent Debt Accumulation: Paying off your entire statement balance prevents the accumulation of debt, allowing you to keep your financial obligations under control.

We understand that keeping track of your monthly payments could be tricky. So, to ensure you don’t miss your payments, set up autopay or reminders to help you stay organized.

This way, you won’t miss any due dates and can avoid unnecessary interest charges or late fees.

Two Ways Your Balance Impacts Your Credit Score

Your credit card balance heavily impacts your credit score. Let’s dive into how it can affect your credit score.

Having a High Outstanding Balance

Having a high outstanding balance relative to your credit limits will negatively affect your credit score. That’s because credit bureaus pay special attention to your credit utilization ratio, the ratio between your card balances and total credit limit.

A high utilization ratio indicates that you’re using a large portion of your available credit, which may suggest financial instability or an increased risk of defaulting on payments. And that could result in lowering your overall credit score.

So, to maintain a healthy credit utilization ratio and improve your score:

- Keep an eye on your card balances. Keep them as low as possible compared to your total available credit.

- Regularly pay down any outstanding balances to decrease the amount owed.

Having a Low Statement Balance

On the flip side, maintaining a low statement balance compared to your credit limit can positively impact your credit score. Keeping a low balance demonstrates responsible credit card usage and shows you’re not relying heavily on borrowed funds.

That said, here’s how to maintain a low statement balance.

- Watch Your Spending: Track how much you charge on each card monthly.

- Budget Wisely: Always plan your purchases so you don’t overspend.

- Pay Multiple Times per Month: Instead of waiting for the due date, try making multiple payments throughout the billing cycle to keep the balance low.

Carrying a balance on your credit card puts you in a position where your card issuer charges you interest on the remaining amount, which can quickly add up and result in significant financial costs over time.

So, by consistently paying off your statement balances in full and avoiding carrying debt from month to month, you can avoid interest charges, save money, and boost your overall creditworthiness.

Plus, it demonstrates to lenders that you can manage credit responsibly and are less likely to default on payments.

To illustrate how important maintaining a low utilization ratio is, consider this:

Suppose you have two folks—let’s call them James and John—with different current balances but the same total credit limit of $10,000:

- James has a current balance of $2,000.

- John has a current balance of $8,000.

James has a lower utilization ratio because he’s only using 20% ($2,000 / $10,000) of their available credit. In contrast, John has a higher utilization ratio as he’s utilizing 80% ($8,000 / $10,000) of his available credit.

Now, imagine if both of them applied for new loans or lines of credit. Lenders will likely see James as more favorable because they have demonstrated responsible borrowing habits by keeping their balances low.

On the other hand, John could be seen as more risky due to their high level of debt relative to their available credit.

Keep Your Statement Balance in Check

Now that you’ve got a solid answer to the question, ‘What is a statement balance,’ take control of your financial well-being by regularly monitoring your statement balance and keeping it in check.

Make it a habit to review your credit card statements, track your expenses, and budget wisely. Remember, maintaining a low credit utilization ratio is vital to demonstrating responsible credit management.

So what are you waiting for? Go ahead, put what you’ve learned into practice, and watch as your financial confidence grows.

FAQs

What is a statement balance?

A statement balance refers to the total amount you owe on your credit card at the end of a billing cycle. It includes all your purchases, cash advances, and fees incurred during that period.

Why is it important to know my statement balance?

Knowing your statement balance is crucial for managing your finances effectively. It’ll help you understand how much you owe and allow you to budget accordingly.

And yes, you can avoid interest charges and maintain a good credit score by paying off your statement balance in full and on time.

How can I find my statement balance?

Log in to your online banking account or check your monthly credit card statement to find your statement balance. Both sources will provide you with the current amount due.

Can I pay only the minimum due instead of the total statement balance?

Yes, paying only the minimum due is technically possible, but it’s not advisable. Paying only the minimum will result in high-interest charges on the remaining amount, which can quickly accumulate over time. It’s always best to pay off your complete statement balance whenever possible.

When do I need to pay my statement balance?

The due date for paying your statement balance is often mentioned on your credit card statement or online account. So ensure you pay it by the due date to avoid late payment fees or negative impacts on your credit score.

Is there a penalty for not paying my total statement balance?

If you don’t pay off your total statement balance by the due date, most credit card companies will charge interest on the remaining amount.

This high-interest rate makes it more challenging to clear your debt. Consistently carrying a high outstanding balance may negatively impact your credit score over time.

How often does my statement balance change?

Your statement balance changes once per billing cycle, which is usually monthly. Each new billing cycle starts after you receive and make payment for the previous month’s bill.