- Blogs

- /

- How To Start a Credit Repair Business

How To Start a Credit Repair Business

Summary

Unlock the secrets to a profitable credit repair business! Learn the legal requirements, expert strategies, and pricing models to start and grow successfully. Dive in now!

There’s a saying that goes: “As long as credit cards exist, people will always need to fix their credits.” Also, coupled with the fact that 1 in 3 Americans have incorrect credit reports, we can agree that there’s a business opportunity to capitalize on.

In addition, small credit card repair companies tend to make between $4,000 and $10,000 a month, and bigger companies make so much more. With this in mind, we can agree that aside from there being a business opportunity here, there’s a really profitable one, too.Now, we are sure that you have been dying to know how to start a credit repair business after learning about the opportunities that lie in the business. Not to worry, as this is why we are here. In this article, we will teach you everything you need to know about starting a credit repair business. With the information you learn here, you’ll be able to start your credit card business with no difficulty.

What’s The Appeal of Credit Repair Services

Just like we have mentioned before, many individuals have one or more mistakes in their credit reports. This means that some bad credit reports are unjustified. And as we all know, a low credit report makes it difficult for individuals to obtain credits. Moreover, for those who get lucky not to get their applications rejected, a bad credit score is likely to attract a higher interest on credit.

Furthermore, low credit scores have far-reaching implications across many institutions, from insurance to recruiters and landlords. To make matters worse, negative information on credit tends to stay on records for up to seven years. In light of this, consumers always look to deal with them as soon as possible.

8 Steps To Follow To Start a Credit Repair Business

Here are some steps to follow on how to start a credit repair business:

1. Follow All Credit Repair Laws Applicable

Before starting your credit repair business, you need to familiarize yourself with the legal requirements. It is of utmost importance that you stay compliant with all the laws that apply to you or your prospective business. This is to ensure that you avoid getting into trouble with the law during the course of your business.

It is important to know that credit repair laws are divided into two categories, which are federal and state laws. As a credit repair company, you must follow all federal laws regardless of the state you operate in. On the other hand, each state has its unique laws, and you only have to follow the laws of the state you are operating in.

First Legal Requirement: Credit Repair Organizations Act (CROA)

The most important law you need to be familiar with is the Credit Repair Organizations Act (CROA). The CROA is a federal law that was passed earlier in 1996. This act regulates every credit repair business in the United States. It also helps protect consumers from predatory credit repair consumers who might want to take advantage of them.

The US Federal Trade Commission (FTC) enforces the CROA. It also fines, penalizes, or even shuts down credit repair companies that violate the CROA. You can find the full text of the CROA on the government website.

Below are the three major points about CROA:

- You must maintain complete transparency with your clients regarding the services you provide the specific tasks you will undertake, and avoid making false claims or guarantees that you cannot fulfill.

- A written contract must be furnished to your client, and their signature is required to formalize the agreement. This contract should incorporate a provision allowing the client to cancel the agreement within a three-day window.

- Charging clients in advance is strictly prohibited. Typically, credit repair companies conduct an initial consultation and a thorough analysis of their credit report. Only after completing these steps should they charge a “getting started” fee.

Second Legal Requirement: Bonds

Depending on your state, you may have a legal obligation to secure a surety bond. This credit repair surety bond is designed to safeguard the interests of your customers by covering any potential harm resulting from your credit repair company’s actions.

The specific bond amount required can vary significantly between states, and some states may not mandate a bond at all. Typically, the cost of a credit repair services surety bond falls within the range of $200 to $300, with the exact amount contingent on the bond’s value.

Obtaining approval for this bond is a relatively straightforward process. It involves completing an application and paying the mentioned fee once your application is sanctioned. Approval relies on a few factors, including your credit score, financial assets, any tax liens or public records such as bankruptcies, the duration of your business operations, and the bond amount.

After submitting your application, the approval process is swift, with some cases being approved in as little as 24 hours. To fill out a bond application, you can visit BondsExpress.

Third Legal Requirement: Licensing and Registration

As a credit repair business, most states do not need you to get a license before commencing business. However, it is important to do your personal research as rules change every time. On the other hand, at least 25 of the 50 US states require that you register your business.

To register your business, you will need to fill out an application that registers your business as a Credit Service Organization in the state you want to set up. Remember that you’ll have to pay a registration fee.

2. Accurate Taxation

As a business, you will need to get your tax ID. You will also need to register with the federal government for an Employer Identification Number. The EIN works as your federal tax number. It is important to take care of all tax-related issues to avoid getting in trouble with the Internal Revenue Service (IRS).

3. Open a Bank Account With Banks That Approve Credit Repair

A lot of banks want to avoid opening accounts for credit repair businesses. This is because they consider the business to be risky. However, some banks and financial institutions do not have problems with credit repair companies. Here are some of them:

- Wells Fargo

- Bank of America

- Regions Bank

- Schools First Credit Union

- Navy Federal Credit Union

- BBVA

4. Get Training

As a credit repair professional, it is important that you get the right certification to improve your skills and reputation. You have an option of getting online training courses to get the skills you need. You can find great courses on Udemy.com. After your online training, you should also get certifications from prestigious educational providers. You can get certified by The National Association of Certified Credit Counselors or The Credit Consultants Association.

Here are some of the important things to learn:

- How to read and interpret the contents of a credit report.

- How to file dispute letters.

- How to save your clients money.

- How to get a banking and merchant account.

- How the three major bureaus work.

Organizations like the Credit Consultants Association and various trade associations offer cost-effective training and membership options. However, in exchange for these benefits, they require your commitment to strict adherence to all applicable laws and industry regulations. By obtaining their official endorsement, you distinguish yourself as an ethical and reliable credit repair expert.

5. How To Start a Credit Repair Business Using a Credit Repair Software

To run your credit repair business efficiently, it’s essential to have a robust business credit repair software platform in place. While there are various options available, one of the most commonly used platforms is DisputeBee. This software empowers you to optimize your productivity and deliver faster, more effective results to your clients, all while reducing the time you spend on manual tasks.

Quality business credit repair software allows you to handle each client’s disputes in as little as five to ten minutes per month. Your day-to-day operations will primarily involve onboarding new clients, offering consultations, creating and dispatching dispute letters to credit bureaus and furnishers, providing ongoing customer support, and keeping clients informed of their progress. Automating these tasks with software not only streamlines your operations but also provides the flexibility to scale your business when the time is right.

Here’s an overview of what to expect when using credit repair software:

- Customer Profile Creation: When a new client signs up, you create a profile for them within the software.

- Credit Monitoring: Encourage your clients to obtain credit monitoring services and provide you with the necessary credentials.

- Credit Report Upload: Upload your client’s credit report into the software for review.

- Dispute Letter Generation: Easily generate dispute letters using the software’s intuitive tools.

- Efficient Dispute Sending: In many cases, you can send these disputes directly from the software.

- Response Review: After approximately 30 days, review any responses received from credit bureaus and generate new dispute letters using the software.

- Repeat Process: Continue this process with each new client or customer.

One significant advantage of these software programs is their ability to swiftly identify negative items on credit reports, such as late payments, collections, inquiries, bankruptcies, and more. The automatic generation of dispute-ready letters saves your business substantial time and effort. Furthermore, most software programs conveniently provide the addresses of credit bureaus, furnishers, collections agencies, banks, and other creditors.

With just a click, you can send dispute letters via USPS-certified mail or standard mail without the need to download, print, or stuff envelopes. Utilizing credit repair software is the key to running a smooth and efficient business with the potential for significant expansion.

6. Create a Functioning Website

Your credit repair business’s website plays a pivotal role in shaping the first impression potential clients have of your services. It serves as a virtual storefront, making it essential to establish a professional and approachable online presence.

Here’s why your website is crucial and some valuable tips for maximizing its impact:

1. First Impressions Matter:

Your website is often the initial point of contact with potential clients. It’s essential to ensure that your site conveys professionalism and friendliness, both in its visuals and ease of navigation. A well-designed website instills confidence in your clients and prospects, making them more likely to engage with your services.

2. Lead Generation:

Your website should serve as a lead generation tool. It should feature a dedicated section for customer registration, allowing visitors to express interest in your credit repair services. This enables you to effortlessly follow up with potential clients via phone or email, converting them into satisfied customers.

3. Professional Web Design:

If your budget allows, consider hiring a professional web designer to create your company’s website. While it may involve an additional cost, it’s a worthwhile investment. Professional web designers can craft a visually appealing and highly functional website that aligns with your business goals and resonates with your target audience.

By focusing on these aspects, you can ensure that your credit repair business’s website not only makes a positive first impression but also serves as a powerful tool for attracting and retaining clients. It’s a vital component of your business’s success, and investing in its quality can yield significant returns.

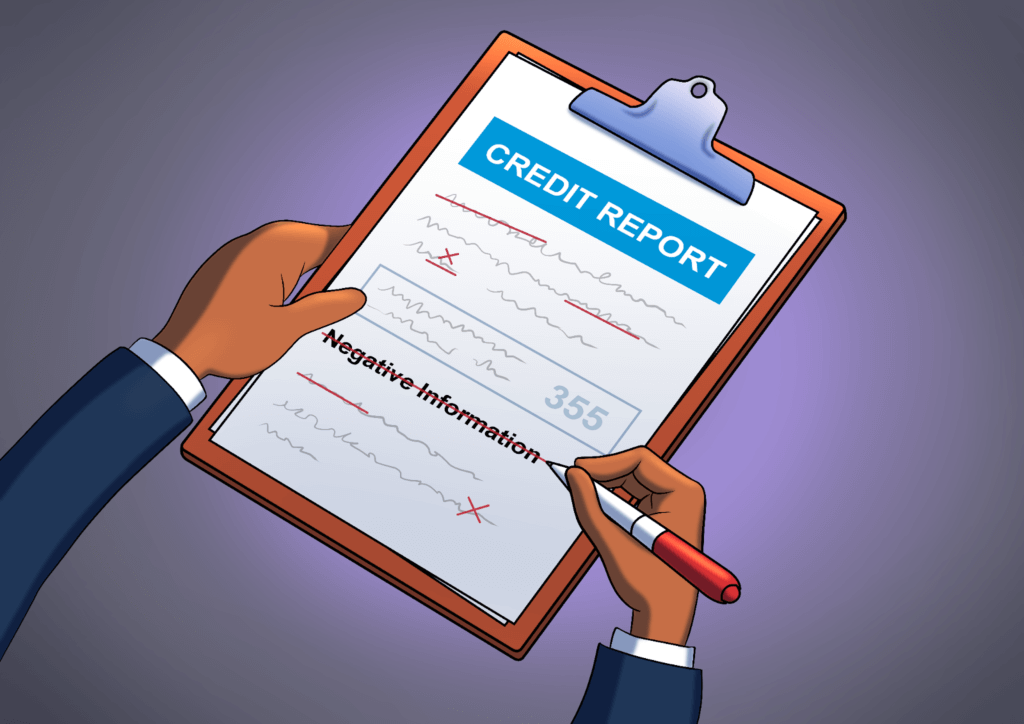

7. Strategies For Removing and Deleting Negative Information on Client Reports

Getting rid of mistakes on your client’s credit report is crucial for your credit repair business. Your clients trust you to remove inaccurate negative information and make their credit reports better.

Here are some simple strategies to help you do just that:

Strategy 1: Initial Credit Freeze

When you get a new client, freeze their credit with entities like LexisNexis and SageStream. This prevents others from accessing your client’s credit info. By doing this first, you increase your chances of deletions because the main credit bureaus can’t cross-check with these other entities.

Strategy 2: Remove Old Addresses

Right after your client signs up, remove any old addresses from their credit report. Old addresses might be linked to charge-off and collection accounts. Taking them off makes it harder for these accounts to be verified, potentially leading to automatic deletions.

Strategy 3: Dispute Collections and Charge-offs

Collections and charge-offs are common negative items. Disputing them involves using laws like the Fair Credit Reporting Act (FCRA). Sections 609 and 611 of the FCRA outline what credit reporting agencies must provide upon request and your rights regarding investigations. If any info is proven inaccurate, it must be corrected or removed.

Strategy 4: Dispute Inquiries

Disputing inquiries can be done by disproving access, proving identity theft, or showing a lack of permissible purpose. Section 604 of the FCRA defines a permissible purpose, detailing when entities can access consumer credit reports. Freezing your client’s credit report at SageStream is an additional strategy.

Strategy 5: Dispute Other Information

As you get more comfortable with credit reports, broaden your dispute range. Software like DisputeBee offers default letter templates for collections, inquiries, late payments, charge-offs, and certain public records like bankruptcies. With experience, you might create your templates that work best for you and your clients.

Remember, these strategies not only boost your client’s satisfaction but can also bring in more referrals, growing your credit repair business.

Onboarding Your First Client

Getting your first client is a thrilling moment, and navigating the entire client lifecycle is an exciting journey.

Here’s a step-by-step guide on how to onboard your first client:

1. Initial Consultation:

- Review your client’s credit report to assess their suitability for your services.

- Identify negative information on their credit report and pinpoint potentially inaccurate or unverifiable items.

- Keep the initial consultation concise and focused, informing your client about the information you’ll be disputing and managing their expectations.

- Many credit repair companies offer this consultation for free.

2. Client Contract:

- Have your client sign your credit repair contract, ensuring compliance with the Credit Repair Organization Act.

- The contract must be signed before you can start providing credit repair services.

- Clearly outline the terms and conditions, adhering to legal requirements.

3. First Work Fee:

- As per the Credit Repair Organization Act, refrain from charging fees before rendering a service.

- Define your first work fee in the contract, covering initial document processing.

- Once you’ve provided the agreed-upon service, bill your client for the initial first work fee.

4. Monthly Dispute Cycle:

- Initiate your monthly dispute cycle, focusing on disputing inaccurate negative items on your client’s credit report.

- Continue this process until all disputes are resolved, or your client decides to cancel your services.

- Ensure transparency and regular communication with your client throughout the dispute cycle.

By following this timeline, you’ll not only provide effective credit repair services but also build a positive client experience, setting the stage for a successful client relationship.

Is the Credit Repair Business Profitable?

Yes, a credit repair business can be profitable. The demand for these services is often high, as many individuals need help improving their credit scores. The profitability depends on several factors, including the pricing of your services, your operational efficiency, your marketing strategy, and the successful outcomes you can deliver for your clients.

You can also take a sneak peek of how a credit card company works in a previous blog we wrote. It’s critical to comply with all relevant legal regulations in this field to maintain a sustainable business model.

How Much To Charge My Clients For The Best Credit Repair

Navigating the pricing strategy for your credit repair business is crucial for success. Let’s break down the key aspects:

1. Scaling Your Business:

- In the credit repair industry, scaling is achieved through reasonable pricing, excellent service, and satisfied clients who not only pay for your services but also refer others.

- Focus on gradual and methodical growth rather than aiming for excessive charges.

2. Calculating Potential Earnings:

- Utilize the Credit Repair Business ROI Calculator for pricing projections and to gauge potential earnings.

- Recurring revenue is the key to accumulating wealth in this business, emphasizing the importance of keeping existing clients satisfied while continually adding new clients.

3. Recurring Revenue Secret:

- The secret lies in maintaining happy paying clients and consistently acquiring new clients each month.

- By doing so, your revenue will naturally increase every month, showcasing the power of recurring revenue in a credit repair business.

4. Payment/ Pricing Models:

- Two primary payment models are prevalent in the credit repair industry: Monthly and Pay-Per-Delete.

- Compliance with applicable state and federal laws, including the Telemarketing Sales Rule (TSR), is crucial.

5. Monthly Subscription Model:

- Most successful credit repair businesses opt for a recurring monthly subscription.

- Monthly fees typically range from $59 to $179, with $99 considered a balanced and affordable middle ground.

- A setup fee is charged after completing the initial setup work, followed by a recurring monthly fee.

6. Pay-Per-Delete Model:

- This model involves charging a setup fee and a specific fee for each type of deletion.

- While effective, it can be challenging, as clients may owe a substantial amount if numerous deletions occur.

- Discuss payment plans with clients beforehand to avoid issues and consider working on specific items at a time.

In conclusion, finding the right balance in pricing, adhering to legal guidelines, and choosing suitable payment models are essential steps in establishing a successful credit repair business.

Conclusion

The credit repair business presents a unique and lucrative opportunity, provided that you stay equipped with the necessary tools, software, and strategies to deliver tangible results for your clients. Understanding the process from client onboarding to dispute management and pricing models can ensure the growth and success of your business. By maintaining a customer-centric approach and adhering to legal guidelines, you can build a profitable credit repair business while helping individuals achieve their financial goals. The use of credit repair software, a well-designed website, strategic removal of negative information, and transparent onboarding processes will go a long way in attracting and retaining clients. Remember, the key to success lies in providing consistent value, building trust, and ensuring the satisfaction of your clients.

Our Latest Blogs:

FREE Strategy Session to Fix Your Credit Blogs / It’s no longer a secret that credit scores are a...

ThisIsJohnWilliams

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Say you’ve finally found...

ThisIsJohnWilliams

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Unlock the secrets to...

ThisIsJohnWilliams