- Blogs

- /

- What Happens if I Stop Paying My Credit Cards: 7 Aftereffects

What Happens if I Stop Paying My Credit Cards: 7 Aftereffects

Summary

Life can be unpredictable and full of surprises. Those surprises may choose to arrive precisely on your minimum payment due date. However, before panicking and avoiding the issue, let’s talk over coffee (or something stronger). You must be curious about “What happens if I stop paying my credit cards?”

Contrary to popular belief, it’s not all dark and gloomy. But it’s also not a free pass to stop paying your debt and go wild. Our talk will cover late fees, interest rate increases, and the lurking credit score monster.

We’ll discuss how late payments affect your ability to rent that ideal apartment and how late payments affect your ability to get a fantastic car loan.

But don’t worry; we’re not here merely to terrify you. We’ll review some solutions for getting back on track and safeguarding your financial future.

So, whether you’re facing a mountain of past-due statements or not, strap up and join us on our journey into missing credit card payments.

Key Takeaways

- Credit card delinquency advances through various stages. It escalates from late payments to potential charge-offs and collections. This impacts credit scores. It could also lead to legal action from creditors or collection agencies.

- Late payments incur fees. They can elevate Annual Percentage Rates (APRs) and increase the debt burden.

- Delinquencies significantly lower credit scores, affecting loan approvals, interest rates, and borrower reliability.

- Delinquent accounts can remain on credit reports for up to seven years. They can affect future credit opportunities. They can also affect existing creditor relationships and the terms of new accounts.

- If you don’t pay, creditors may send debt collectors to contact you often. They could also take legal action, such as garnishing wages or placing liens on property.

- Negotiating repayment plans may prevent further delinquency. You can also consider debt consolidation and requesting due date adjustments.

- Effective negotiation tactics involve preparation. They also involve understanding consumer rights. It means weighing the pros and cons of settlement options.

- Professional guidance will help you manage credit card debt effectively.

Understanding Credit Card Delinquency

Late payments on credit card bills can lead to various stages of delinquency. Each stage has its own set of consequences. Initially, when a payment is missed, the account becomes delinquent. This typically occurs after 30 days from the due date.

As time progresses, the account may reach 60 days and then 90 days past due. At each stage, late fees and penalties increase. This worsens the cardholder’s financial burden.

As delinquency progresses beyond 90 days, creditors may take more severe actions. This could include reporting late payments to credit bureaus. It could also involve pursuing legal action against the cardholder.

Addressing delinquency early on is crucial. It prevents further complications and mitigates potential legal repercussions.

It’s crucial for people who have trouble paying debts on time to talk to their creditors. They should explore options like payment plans or hardship programs.

Addressing late payments early is essential. The potential for legal action as delinquency progresses shows why.

What Happens If I Stop Paying My Credit Cards

A. Consequences of Missed Payments

1. Increased APR

Missed payments on credit cards can lead to increased APR. This means the interest rate applied to the outstanding balance goes up. Any remaining balance will accumulate interest faster than before. This will make it harder to pay off your debt and more expensive to carry a balance.

For example, if you miss a payment, your card issuer might raise your APR from 15% to 25%. This could result in higher interest charges over time. These higher interest rates make it challenging for individuals struggling with their finances.

Increased APRs can lead to a cycle of growing debt. More money goes towards paying off interest. It doesn’t reduce the principal balance owed.

Understanding the terms and conditions of APR changes is crucial. Some creditors may negotiate lower APRs if you have a history of timely payments. They may also do so if you are experiencing financial hardship. Awareness of the potential long-term financial consequences of increased APRs is essential. They can make it harder to pay off your debt.

2. Late Fees

When you miss a credit card payment, your issuer charges you late fees. Late fees can vary depending on your credit card agreement. Typically, they range from $28 to $39 for first-time offenses. Subsequent late payments within six billing cycles can be up to $40.

Accumulated late fees can increase your debt burden if unpaid. Interest charges on these fees also compound monthly.

B. The Impact on Your Credit Score

1. Lowering of Credit Score

Your credit score is a numerical representation of your creditworthiness. Your payment history heavily influences it. When you stop paying your credit cards, the missed payments can lower your credit score. Even a single late payment can have a negative impact. Consistently missed payments will have an even more substantial effect.

Late or missed payments are reported to the major credit bureaus. They are reflected in your credit report. This information is then used to calculate your credit score. It determines your borrower’s reliability. Missing payments signal to lenders that you may default on future loans or lines of credit.

Delinquent accounts show financial irresponsibility and can lead to a lower credit rating. A low credit rating affects your ability to get new credit. It also affects the terms and interest rates associated with new accounts.

2. Long-Term Effects

If you don’t make timely payments, delinquent credit card accounts can haunt you for years. The negative impact of delinquency doesn’t disappear once you catch up on payments. It lingers on your credit report for up to seven years.

Potential lenders reviewing your application will see this poor payment history. They may hesitate to extend new lines of credit or offer favorable terms. Evidence of past financial mismanagement, like delinquency, makes it hard to get loans. It can also make it challenging to secure attractive interest rates.

Obtaining new lines of credit isn’t the only impact. The long-term effects also include influencing existing relationships with creditors. Creditors might reduce credit limits or raise interest rates. This is due to concerns about repayment risk.

3. Difficulty Obtaining Future Credit

Delinquencies appearing on your credit report act as red flags for potential creditors. This makes them wary about extending extra credit or favorable terms.

This difficulty extends beyond traditional revolving lines, like credit cards. It also impacts other types of financing, such as mortgages, auto loans, and personal loans.

Qualifying for new financing despite past debt issues won’t be all rosy. This is because you’ll likely face higher interest rates. Creditors find lending money to be riskier when evidence suggests possible repayment problems.

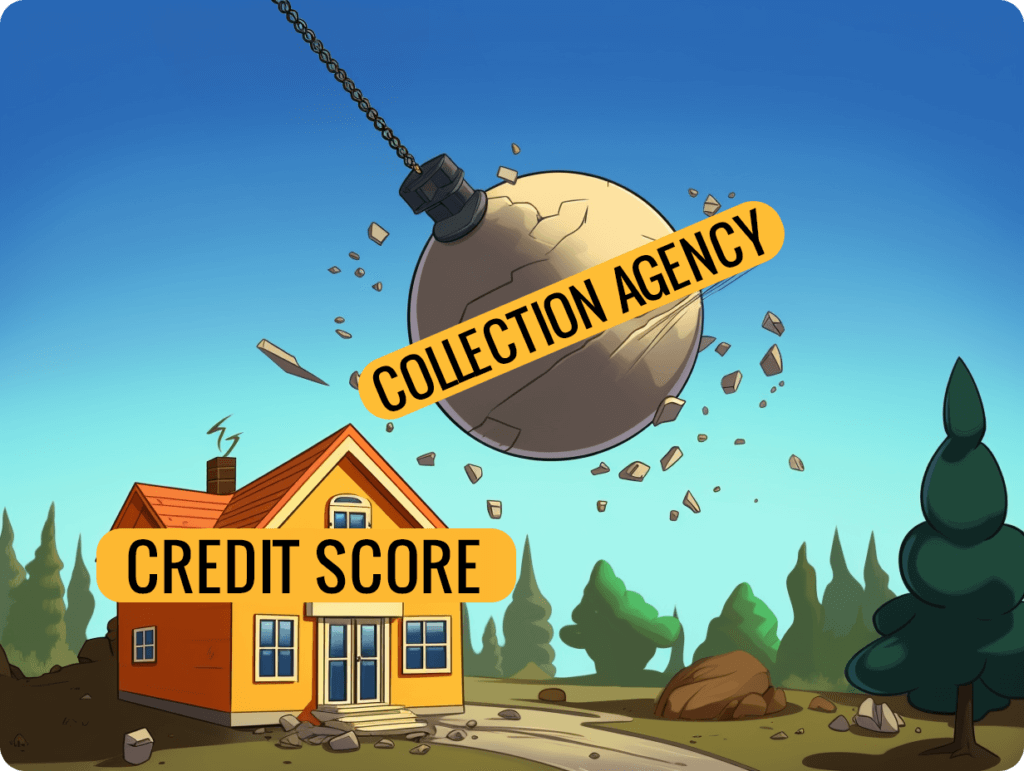

C. Debts Could Go to Collections

If you stop paying your credit cards, creditors may send your account to collections. This means that a third-party debt collection agency will collect your outstanding debt. These agencies use various tactics to recover the money owed. They make frequent phone calls and send letters demanding payment.

Debt collectors can be persistent, contacting you daily to secure payment. If these efforts are unsuccessful, they might take legal action against you. This could result in a lawsuit against you for failing to repay what you owe on your credit card.

In some cases, if legal action is taken and a judgment is made against you, it could lead to wage garnishment. It could also lead to liens being placed on your property. Wage garnishment involves having your employer withhold a part of your paycheck. This part is sent to the creditor until the debt is repaid.

Consumer Rights

If dealing with persistent debt collectors, understand that regulations protect consumers like you. The Fair Debt Collection Practices Act (FDCPA) outlines specific rules. Debt collectors must adhere to these rules when attempting to collect individual debts.

Under this act, guidelines exist on when and how often they can contact you about the debt owed. They are prohibited from using abusive language or deceptive practices. They must not use them while communicating with you.

Understanding these rights empowers individuals facing debt collection agencies. It allows them to recognize when their rights under the FDCPA have been violated. They can then take appropriate action.

D. Legal Repercussions of Unpaid Credit Cards

If you stop paying your credit cards, creditors could take legal action against you. This can result in severe financial consequences.

Lawsuits filed by creditors can lead to judgments against you. These judgments could result in wage garnishment or liens on your property.

Legal actions due to unpaid credit card debts can be devastating. If creditors get a judgment against you, they may seek wage garnishment to collect the debt owed.

Strategies for Managing Credit Card Debt

When you stop paying your credit cards, creditors may review your income. They do this to determine the best collection strategy. They want to understand how much money you earn and if it’s enough to repay the debt.

Creditors might be more likely to take legal action against you if you have a higher income. They see you have the means to pay.

Creditors use your income level as a basis for their actions. If they see you’re earning well, they might pursue aggressive measures. This could include legal action or hiring a collection agency. This is because they believe that you should be able to make payments on time with a good income.

Navigating Minimum Payment Difficulties

1. Payment Alternatives

You can explore several payment alternatives if you can’t pay your monthly minimum. One option is negotiating a repayment plan with your creditors. This involves discussing and agreeing on a new payment schedule. One that would better fit your financial situation.

Another alternative is enrolling in debt consolidation or settlement programs. These programs allow you to combine many debts into a more manageable payment. You can also negotiate with creditors to settle the debt for less than you owe.

Exploring these options can relieve the burden of high monthly payments. It can also help prevent further delinquency on your credit cards.

Take proactive steps to address your difficulties. This way, you can avoid negative consequences. These include late fees, increased interest rates, and damage to your credit score.

It’s essential to reach out to your creditors as soon as possible. When facing challenges with making minimum payments, have open communication and be transparent. This can often lead to beneficial solutions for you and the creditor.

2. Due Date Adjustments

Besides exploring payment alternatives, requesting due date adjustments from creditors can also help. Some lenders may change due dates because of their customers’ financial circumstances.

Adjusting the due date of your credit card payments can help with missing due dates. It can align them with the timing of income from work or other sources. This alignment makes it easier for individuals. Especially those who receive paychecks at specific times during the month. It ensures funds are available when their credit card bills come due.

Navigating Financial Hardship

Financial hardship can show early signs indicating difficulty paying credit card bills. These signs include receiving past-due notices and exceeding credit limits. It could also include borrowing money to pay bills.

Understanding personal financial circumstances is crucial. For instance, a job loss or unexpected medical expenses can lead to missed payments. It would help if you recognized these trouble signs. Taking proactive steps before the situation escalates is essential. Assessing and managing financial difficulties before they worsen is vital.

Creating a budget is an effective strategy. Prioritizing essential expenses and exploring additional income sources are also effective strategies. Seek professional advice from credit counselors or financial advisors. They can give valuable insights into managing debt and improving financial stability.

If you struggle to meet credit card payments, seek professional advice. It’s essential. Credit counseling agencies offer guidance on creating a workable budget. They also help negotiate with creditors for lower interest rates or reduced payments. Plus, they provide education on managing finances effectively.

Proactive Communication

Proactive communication with creditors when facing financial difficulties is vital. Explaining the situation and seeking help can help ease immediate financial pressure. Making alternative arrangements can also help.

Document all communications with creditors. This ensures clarity on agreements made during discussions. Agreements on modified payment plans or temporary relief options.

Maintaining open communication with creditors leads to many potential benefits. For example, creditors might waive late payment fees. They might do this if you resolve outstanding balances promptly.

Strategies for Unpaid Bills

A debt management plan can be a helpful solution. These plans are designed to merge and repay debts in an organized manner. Individuals can develop a structured repayment plan with reputable credit counseling agencies. The plan will align with their financial situation.

Debt management plans involve negotiating with creditors. This can lead to reduced interest rates or waived fees. It makes it easier for individuals to pay off their debts. This approach simplifies the repayment process. It helps avoid collection calls and potential legal actions due to unpaid bills.

Working with a reputable credit counseling agency is crucial. They offer professional guidance and support throughout the debt management process. They assess an individual’s financial situation. Then, they provide personalized advice. They also ensure that the chosen strategy aligns with long-term financial goals.

Consider factors like income, expenses, and outstanding debts. Also, consider the ability to make regular payments. This assessment will help you determine eligibility for a debt management plan. Before proceeding, it’s essential to determine whether this approach suits one’s financial circumstances.

Enrolling in a debt management plan may initially impact credit scores. This is because closing accounts or renegotiating terms with creditors can lower scores. However, completing the program can show responsible financial behavior over time. This upbeat track record can improve credit scores in the long run.

Seeking Credit Card Relief Programs

If you stop paying your credit cards, various relief options can help. Seeking professional credit counseling services is one option. These services provide guidance and support for individuals struggling with credit card debt. Bankruptcy may be an alternative for those facing overwhelming debt.

Credit counseling services offer personalized help in managing credit card debt. Counselors can help you create a budget. They can also develop a repayment plan that suits your financial situation. They can even negotiate with creditors on your behalf to reduce interest rates or fees.

Consider bankruptcy if you can’t pay off your debts. This includes those from credit card companies. But, it’s essential to understand the long-term consequences of filing for bankruptcy. Make this decision only after proper research.

When considering relief options, it’s crucial to weigh the pros and cons of each approach:

Pros

- Professional guidance and support from credit counseling services.

- Potential reduction in interest rates or fees through negotiation with creditors.

- Bankruptcy provides a legal process to end or restructure debts.

Cons

- Negative impact on credit score due to missed payments.

- Limited eligibility for specific relief programs based on individual circumstances.

It’s essential to seek help early. This can prevent the situation from escalating further with card providers.

Credit Counseling Benefits

Seeking professional credit counseling offers several benefits. This is especially true when struggling with mounting credit card debt. These benefits include personalized assistance tailored to your specific financial situation.

Credit counselors work closely with individuals experiencing financial challenges. They help people struggling to pay off debts owed to various credit card companies. They assist in creating a budget that aligns with income levels. They also address existing financial obligations. This includes monthly bills and outstanding balances on credit cards.

Enlisting a credit counselor has a significant advantage. They can negotiate directly with creditors. For example, they can ask card issuers to lower interest rates or late payment fees.

These professionals collaborate with clients. They develop manageable repayment plans for their unique circumstances. By providing ongoing support throughout the process, they empower individuals. They offer valuable resources and strategies to achieve financial stability over time.

Signs You Need Help

Persistent late payments and increasing balances are red flags. They show you need help with credit card debt. If you struggle to keep up with due dates or notice that your balances are rising, seeking help is crucial.

Consistently missing payment deadlines can result in extra fees and higher interest rates. This can make it even more challenging to pay off the debt. Increasing balances suggest that the current approach is not effectively addressing the issue. It could lead to a cycle of escalating debt.

Feeling overwhelmed by your financial situation can affect your mental well-being. It also affects your overall quality of life. You may also need professional help if you feel overwhelmed or unable to progress on your debt.

Recognizing these signs early on allows for timely intervention. It can prevent the situation from worsening.

Finding Reputable Counselors

When seeking help with credit card debt, you must research organizations accredited by the NFCC. This will help you find reputable counselors or agencies. Accreditation ensures that the organization complies with industry standards and provides reliable services. NFCC-accredited agencies adhere to strict guidelines on ethical practices. They ensure consumers receive trustworthy help.

Look for counselors with experience dealing with credit card debt issues when seeking help. Experience in this area indicates a deep understanding of the complexities associated with credit cards. This includes high-interest rates and minimum monthly payments. Knowledge of Penalty fees and potential impacts on credit scores too.

Negotiating Your Credit Card Debt

1. Debt Settlement

Debt settlement is a process. Individuals negotiate with their creditors to pay less than the amount they owe. This option can provide relief for those facing significant financial hardship.

Suppose someone has a large credit card balance. They struggle to make payments. Opting for debt settlement can be a solution. This can help reduce the amount owed.

Yet, it’s important to note that debt settlement may hurt your credit score. Debt settlement offers potential relief from overwhelming card debts. But, individuals must weigh the pros and cons before pursuing this option. It’s essential to consider its impact on personal finances and future financial opportunities.

2. Negotiation Tactics

Effective negotiation tactics are crucial for better outcomes. They are essential when dealing with creditors during debt settlement. Being prepared, organized, and persistent is vital to successful negotiation. This is especially true when addressing credit card bills.

Having all relevant financial information available is vital before negotiating with card companies. This includes income sources, expenses, and other outstanding debts or obligations. It helps present a comprehensive picture during negotiations besides the existing card balances.

Understanding one’s rights as a consumer when negotiating with creditors is also essential. Individuals can leverage these rights during negotiation. It can help them navigate challenging discussions about unpaid credit card bills.

Conclusion

So, what happens if you stop paying your credit cards? It’s not just about the immediate impact on your credit score. There are also potential legal repercussions. It’s about understanding the ripple effect it can have on your financial well-being.

Managing credit card debt requires proactive steps. These steps include managing debt collection and seeking professional advice. You must take these steps to regain control of your finances. Remember, it’s never too late to take action and seek support.

Take charge of your financial future today. Explore debt relief programs. Seek professional advice. Consider negotiating your credit card debt. You can work towards a brighter, debt-free tomorrow by taking proactive steps.

FAQs

1. What is credit card delinquency?

Credit card delinquency happens when you don’t make the minimum payment for a certain period. This can lead to late fees. It can also lead to increased interest rates and negative impacts on your credit score.

2. How does unpaid credit card debt affect my credit score?

Unpaid credit card debt can significantly lower your credit score. This makes securing loans or favorable interest rates harder. It reflects negatively on your financial responsibility and may take years to recover.

3. Can I negotiate with my creditors if I can’t pay my credit cards?

Yes, you can negotiate with your creditors to work out a repayment plan that is more manageable for you. They may be willing to reduce the amount owed. They may also create a new payment schedule based on your financial situation.

4. What are some strategies for managing credit card debt?

Consider consolidating high-interest debts. Create a budget to focus on payments. Seek professional advice from financial counselors. Explore relief programs offered by creditors or government agencies.

5. Is seeking professional debt advice important when dealing with unpaid credit cards?

It’s crucial to seek professional debt advice. It helps you understand all available options and their potential consequences. A qualified advisor can guide you through negotiation processes. They can also help prevent further damage to your financial well-being.

Our Latest Blogs:

ThisIsJohnWilliams

ThisIsJohnWilliams

ThisIsJohnWilliams

ThisIsJohnWilliams

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Did you know that...