- Blogs

- /

- What Happens if You Don’t Pay Collections?

What Happens if You Don’t Pay Collections?

Summary

Did you know that nearly 30% of Americans have debts in collections? These unpaid collections can lead to severe consequences if left unpaid. From damaging your credit score to facing potential legal action, the impact on your financial future can be significant.

It’s crucial to understand the situation and take steps to address unpaid collections before they spiral out of control. And the best way to tackle this issue effectively is by gaining professional insight into managing unpaid collections.

That’s why we’ll be breaking down everything you need to know about what happens if you don’t pay collections and how it can affect your financial well-being.

Key Takeaways

- Late payments and defaults can stay on your credit report for up to seven years.

- Always verify that you’re dealing with a legitimate collection agency by requesting written proof of their authorization to collect on behalf of the original creditor.

- Having unpaid collections on your report dramatically reduces your chances of securing loans with the best interest rates.

- You can repair your credit score even when facing collections.

- If you’re struggling with constant phone calls, you have the right to request collection agencies to stop contacting you through phone calls.

- Collection agencies may choose to file lawsuits against you, and the case results may lead to wage garnishment or property seizure.

- Debt settlement, debt management, and filing for bankruptcy can help you resolve unpaid collections.

Here’s What Happens if You Don’t Pay Collections

1. Adds a Default to Your Credit Report

Unpaid collections have significant negative impacts on your credit score. Failing to pay off debts sent to collections leads to late payments and defaults appearing on your credit report. These defaults can remain on your report for up to seven years, whether you pay it off or not.

2. Lowers Your Credit Score

Having negative reports can lower your credit score and make it challenging for you to secure loans or credit cards in the future, as lenders often view a low credit score as an indicator of financial risk.

But it doesn’t end there because even if you manage to secure a loan or credit card, having unpaid collections on your record will affect your ability to get the lowest interest rates.

Most folks with unpaid collection on their report applying for an auto loan end up with a 25% APR in interest for a used car. This happens because lenders consider them as high-risk borrowers and offer less favorable terms than someone with a clean credit history.

3. Can Trigger Legal Action

When dealing with debt collectors and unpaid debts sent to collections, understand that creditors can take legal action against you. This means they can file lawsuits to get judgments against you.

If the creditor files and wins the lawsuit, the court may permit them to take extra steps. For example, the court may allow the seizure of valuable assets or wage garnishment.

Wage garnishment is when your employer withholds a part of your earnings. They then pay this amount toward settling outstanding debts.

Federal law limits how much money creditors can deduct from your wages through this process. Facing wage garnishment due to unresolved debts can still impact your financial stability.

And if you’re facing wage garnishment because of unpaid collections, ensure you get legal advice. Doing so will help you understand your rights and explore practical options for resolving your debt.

4. Limits Your Employment Opportunities

Unpaid collections can create challenges when searching for jobs. This is because some employers perform checks as part of their hiring process.

Unresolved debts in collections on your credit report may raise concerns about financial responsibility. Certain employers may be less likely to hire you due to this.

Here’s How to Communicate With Collection Agencies

1. Always Validate Collection Agencies

Before engaging with them or making payments, you must verify that you’re dealing with a legitimate collection agency. Start by requesting written proof of their authorization to collect on behalf of the original creditor.

This step ensures you deal with a legitimate entity authorized to pursue collections on the specified debt.

Scammers often pose as legitimate collectors to exploit individuals facing financial challenges. By validating collection agencies before interacting with them, you reduce the risk of falling victim to fraudulent practices.

This cautious approach protects you from potential scams while allowing you to address valid debts responsibly.

2. Handling Constant Calls From Debt Collectors

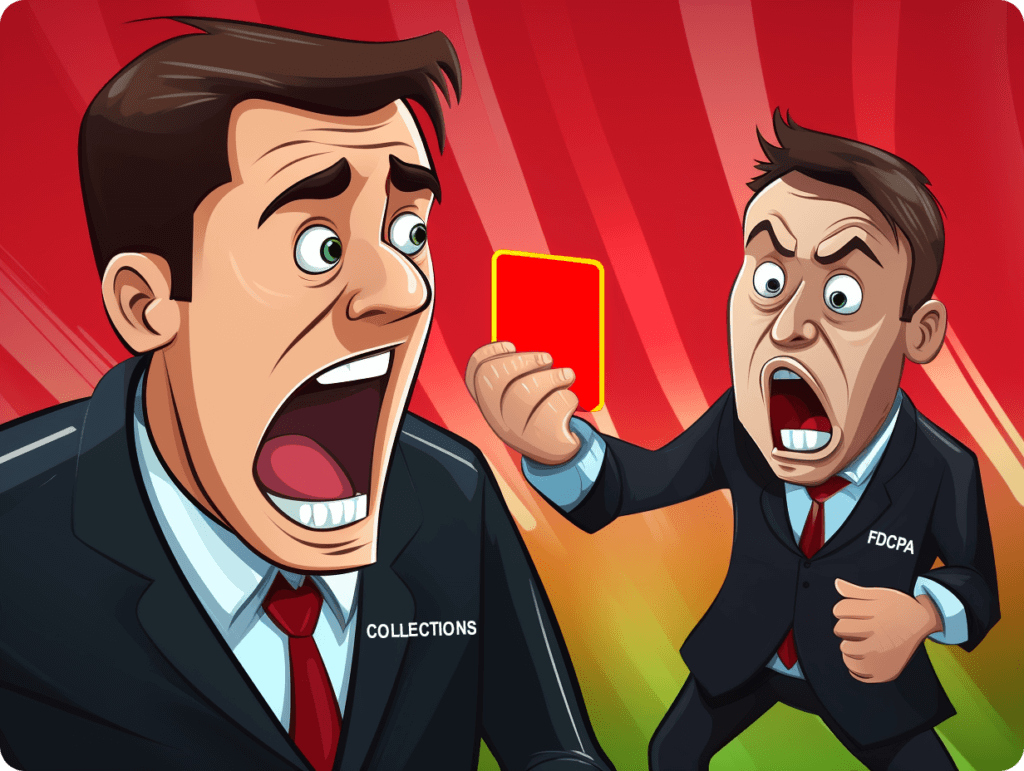

Collection activities include contacting individuals regarding unpaid debts. However, under the Fair Debt Collection Practices Act (FDCPA), collectors must abide by specific rules.

You need to be aware of your rights when dealing with collection calls. If a collector contacts you, you have the right to ask for written proof of the debt before taking any action.

This is important when keeping detailed records of all conversations and correspondence with the collection agency as evidence in case any issues arise.

Collection agencies are notorious for constant phone calls. So, if you’re tired of receiving calls from collection agencies, you have the right to make a written request for them to stop contacting you through phone calls.

Sometimes, the collection agency may ignore your written notice and contact you. In other cases, your debt may get passed to another collection agency, and you’d have to send a new cease and desist letter to stop them from contacting you via calls.

Responding appropriately to collection notices is vital to managing collection activities effectively. Failing to respond within a specified timeframe may lead to legal action being taken against you.

3. How to Respond to Collection Notices

You must respond promptly and accurately if you receive a collection notice via mail or email. Ignoring these communications can result in further complications and potential legal repercussions.

It’s crucial to respond and do so within a reasonable timeframe after receiving such notices from collection agencies or creditors.

Handling collectors is complicated and mentally exhausting. So, seek professional guidance if you’re unsure how to handle these situations. Doing this will give you peace of mind and assurance that you follow the appropriate steps.

4. Dispute Resolution

Don’t rush to pay off your debt after getting a call from a collection agency. First, ensure you ask them to verify the debt they’re trying to collect. The collection agency is legally required to send you a debt validation letter.

Study the debt validation letter you’ve received and try to identify any inaccurate or unfair claims made by the collection agency.

Once you’ve found an erroneous claim, you should address it immediately by starting a dispute. You have every right under the Fair Debt Collection Practice Act (FDCPA) guidelines to dispute inaccurate claims made by collectors.

We recommend you submit a written dispute directly with the collection agency and credit bureaus when challenging erroneous claims by collection agencies.

Also, ensure you provide all supporting documentation along with your dispute because it can significantly strengthen your position during this dispute process.

Your Rights Under the Fair Debt Collection Practices Act (FDCA)

The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects folks from abusive and unfair debt collection practices.

Let’s take a quick look at some of the key protections you have under the FDCPA:

1. Notification of Debt

Debt collectors must provide you with a written notice containing details about the debt, the amount owed, and your rights within five days of their initial communication.

2. Protection Against Harassment

Debt collectors are prohibited from engaging in harassment, oppression, or abuse. This includes threats of violence, use of obscene language, or repeated and excessive phone calls.

3. Protection Against False Statements

The FDCPA prevents debt collectors from using false, deceptive, or misleading representations to collect a debt. This includes misrepresenting the amount owed, falsely implying legal actions, or making false statements about your credit report.

4. Protection of Privacy

Debt collectors must respect your privacy. They’re not allowed to disclose your debt to third parties, except in specific situations like contacting your attorney or the original creditor.

5. Protection Against Unfair Practices

The FDCOA prohibits debt collectors from performing unfair practices like attempting to collect interest, fees, or charges that are not legally permitted.

Also, they’re not permitted to threaten you with seizing or garnishing property without intending to do so. Plus, they cannot deposit a post-dated check before the agreed-upon date.

6. Verification of Debt

If you dispute the validity of a debt, the debt collector must provide you with a debt validation letter. This debt validation letter must include information about the creditor, the amount owed, account numbers associated with the debt, and the debt collector’s name and address.

7. Cease and Desist Rights

You can request that a debt collector cease communication with you. When they receive such a request, the debt collector must stop contacting you, with some exceptions, like informing you about legal actions.

Now, you must know that the FDCPA only applies to third-party debt collectors, not the original creditors collecting their debts.

Three Solid Strategies for Debt Management

1. Use a Debt Management Plan

Setting up a debt management plan involves negotiating lower interest rates and monthly payments through a credit counseling agency.

Working with a credit counseling agency is crucial when considering a debt management plan. They can help negotiate lower interest rates and monthly payments on your behalf. This makes it easier for you to manage your debts over time.

Implementing a debt management plan requires dedication and commitment. You must be disciplined enough to make regular payments, as agreed through the credit counseling agency.

2. Consider Debt Settlement

Negotiating a settlement with collection agencies could allow you to pay less than the total amount owed. This process is called debt settlement. In debt settlement, any settlement offer must be in writing and clearly outline the terms of the agreement.

When negotiating a debt settlement, always ensure that everything is in writing. This includes all agreement terms between you and the collection agencies involved.

Be cautious about the potential tax implications associated with forgiven debt amounts. Settling debts may relieve immediate financial burdens. But, you may face tax issues since the forgiven amount can be considered income by tax authorities.

- Negotiating with Collectors

Negotiating with the collectors can be a viable option for resolving the situation when you have unpaid collections.

You can propose a lump-sum payment or suggest a payment plan that aligns with your budget. But before making any payments, it’s crucial to get written agreements. It’s also crucial to maintain records of all payments.

Negotiating payment terms with collection agencies provides an option for more manageable repayment. Assuming you owe $1,000, you might negotiate to pay only $500 as a lump sum or arrange monthly payments of $50 over 12 months.

Medical Debts Settlement

If you have unpaid medical debts, you can contact the billing department or seek help from a medical billing expert.

Hospitals and healthcare providers may be willing to settle for less than the full amount owed. This would lessen the financial strain on the patient.

Medical debts are often negotiable, offering patients an option to reduce their financial burden. Let’s say your hospital bills you $5,000; they might agree to accept $2,500 as a full settlement.

3. File for Bankruptcy

Bankruptcy may be a good option if unpaid collections and other debts become overwhelming. Now, understand that different types of bankruptcy filing options are available, depending on your financial situation.

Chapter 7 involves liquidating assets to repay creditors. Chapter 13 allows you to create a structured repayment plan over time.

If unpaid collections have put you in a bad financial situation, consult a bankruptcy attorney. It will help you determine if bankruptcy is the right step.

Final Thoughts

The consequences of not paying collections can have a lasting impact on your financial well-being. The repercussions can range from a damaged credit score and increased interest rates to potential legal actions.

Remember, ignoring collections doesn’t make them disappear; instead, it worsens the situation. So ensure you take proactive steps like negotiating a payment plan, seeking debt settlement, or verifying the debt’s validity.

Another thing: Take the time to understand your rights under consumer protection laws, like the Fair Debt Collection Practices Act (FDCPA), which empowers you to deal with collection agencies.

Remember, communication is vital. Keeping an open dialogue with creditors can lead to more favorable outcomes.

FAQs

1. What happens if you don’t pay collections?

If you don’t pay collections, it can severely damage your credit score and lead to legal action against you. Collection agencies may also continue their attempts to collect the debt, causing ongoing stress.

2. How should I handle communications from debt collectors?

You have rights under the Fair Debt Collection Practices Act (FDCPA). Communicate in writing and request validation of the debt. Keep records of all interactions, and consider seeking professional advice.

3. What are my rights under the Fair Debt Collection Practices Act?

The FDCPA protects you from abusive practices by debt collectors. It grants you rights such as requesting verification of debts, ceasing communication, and suing for violations.

4. What long-term effects can unpaid debts have on my financial situation?

Unpaid debts can result in a damaged credit score that affects your ability to secure loans or favorable interest rates. It may also limit housing options and job opportunities.

5. Can I repair my credit while dealing with collections?

Yes, it’s possible but challenging. Consistently making payments on time for other accounts and negotiating settlements with collection agencies can slowly improve your credit score.

Our Latest Blogs:

FREE Strategy Session to Fix Your Credit Blogs / Financial stability is the cornerstone of well-being, so understanding the...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Filing for bankruptcy could...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Did you know that...

ThisIsJohnWilliams

ThisIsJohnWilliams

ThisIsJohnWilliams