- Blogs

- /

- Discover 8 Tips on How to Build Credit Without a Credit Card

Discover 8 Tips on How to Build Credit Without a Credit Card

Summary

Did you know that over 26 million Americans are ‘credit invisible,’ meaning they have no credit history? While credit cards are often praised as the go-to resource for establishing credit, they’re not the only credit-building resource.

In fact, several alternative credit-building resources can help you build a solid foundation for your financial empowerment.

Most people still believe the myth that credit cards are the only route to a robust credit score. However, several avenues like rent reporting, credit builder loans, and secured credit cards that can help you get the same results are a wealth of untapped potential waiting to be harnessed.

And today, we’ll show you some lesser-known strategies backed by data that prove there’s more than one way to build credit without swiping a card.

Let’s jump in.

Key Takeaways

- You can build your credit score by reporting your rent, using credit builder loans, and getting a secured credit card.

- Paying your car loans on time can impact your credit score, although the initial credit inquiry might cause a slight drop.

- Contrary to common belief, personal loans can help you build your credit score. You can also use them to consolidate high-interest debt and maintain timely payments.

- Rent reporting services can raise credit scores by reporting your rental payment history to the credit bureaus.

- If your primary account holder pays on time, becoming an authorized user of another person’s credit card can boost your credit score.

- Constantly monitor your credit report. It can help you detect errors and discrepancies, making maintaining an accurate credit profile easy.

- Your credit score is determined by your payment history, the amount owed, credit utilization, credit history, and credit mix.

- Reliable tools like GreatCreditFast, Self, and Experian SmartMoney can help you build your credit score.

8 Tips on How to Build Credit Without a Credit Card

1. Use Loans

A. Credit Builder Loans

Credit builder loans are among the best options for building your credit score. These unique installment loans are designed for folks struggling with building or rebuilding their credit scores.

You see, unlike traditional loans, where you get the money upfront, credit builder loans work a bit differently. How? First, the loan amount is deposited into a savings account controlled by the lender.

Next, you’ll make fixed monthly payments for a specified duration. You’ll only receive the full amount of the loan when the loan’s term is complete.

With a credit builder loan, you’ll typically receive between $300 and $3,000, which you must pay back within 12 to 36 months.

One thing that makes credit builder loans an excellent choice is that they don’t require a credit check. Once your credit builder loan is approved, make your monthly payment early.

Doing this can help you boost your payment history, which accounts for 35% and 40% of your FICO and Vantage scores.

You can always get a credit builder loan from Credit Unions, Community Banks, and online lenders like CreditStrong and Fizz Credit Builder.

B. Car Loans

Like credit-builder loans, a car loan can help you build your credit. An auto loan lets you purchase a vehicle and pay monthly installments. If you consistently make early payments, you could boost your credit score and get your car loan refinanced.

That’s because getting an auto loan meets all credit bureaus’ requirements for determining your credit score, from the amount owed to the length of credit history, credit mix, payment history, and new credit.

However, it’s worth noting that your credit score could drop slightly when you get a car loan. That’s because the lender performs a hard credit check.

An excellent credit score can help you qualify for car loans with the lowest interest rates. However, you can still get a car loan with a low credit score.

C. Personal Loans

Most people think a personal loan isn’t a great idea for building their credit without opening a credit card, but that’s far from the truth.

First, you must understand that personal loans are fixed amounts of money borrowed from banks or online lenders that are repaid in fixed monthly installments over a specified period.

Now, when you get the money from your loan, you can use it to consolidate your high-interest debt into a single, more manageable monthly payment.

However, how early and consistent you are with making your monthly payments could make or break the effects of the personal loan on your credit score.

Paying late or missing your monthly payment can negatively impact your credit score, while making consistent early payments can increase it.

D. Student Loans

Just like any other loan, your student loan can have a profound impact on your credit score. If you pay as agreed, your credit score will go up, but if you pay late or choose not to pay, it could hurt your score.

When you repay your student loans, your lenders will start reporting it to the credit bureaus, raising your credit score. Your ultimate goal here should be establishing a solid track record of managing your credit because it’d go a long way in boosting your score.

When it comes to student loan repayment, missing one payment won’t particularly affect your credit score. That’s because if you have a federal student loan, your servicers must wait 90 days before reporting it.

However, if you’ve got a private student loan, your lender can report it within 30 days. Plus, they’ll often start charging you late fees immediately after you miss a payment.

2. Secured Credit Cards

A secured credit card is a special one that almost everybody can get approved for. A secured credit card is backed by a cash deposit, which also serves as its credit limit.

How does this work? Let’s say you’re struggling to build your credit. If you take out a secured credit card with a $300 security deposit but can’t pay it off by the end of the month, the lender can take possession of your $300 deposit.

There are no restrictions to a secured credit card. You can use them wherever credit cards are accepted.

Yes, when you use a secured credit card, you may not enjoy the same perks and lower interest rates as those using unsecured cards, but see this as a sacrifice you’re willing to make to prove your creditworthiness and grow your credit score.

3. Apply for a Store Card

Besides getting a solid discount whenever you sign up for a store credit card, getting a store credit card can help you build your credit. It’s super easy to qualify for a store credit card, even if you’ve got a poor credit score.

Getting a store card can boost your credit score if you pay your bills on time, keep your balance low, and keep the account open for several years. That’s simply because credit and payment histories contribute 15% and 35% to your FICO credit score.

However, your score could take a nose dive if you use your store card irresponsibly by making late payments and carrying a high balance.

That said, there are generally two kinds of store credit cards: closed-loop cards, which can only be used at that store, and open-loop cards, which can be used anywhere, just like a regular credit card.

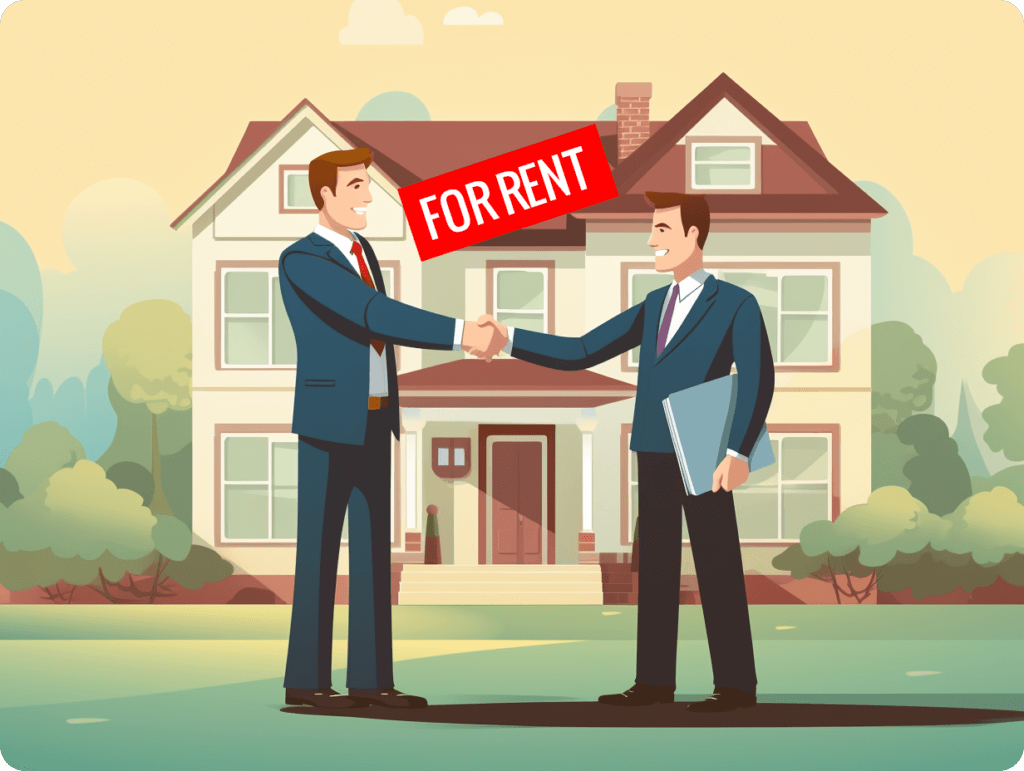

4. Rent Reporting Services

Using a rent-reporting service is the best way to boost your credit score. It reports your rental payment history to the credit bureaus and adds it to your credit reports.

Rent reporting services partner with landlords and property managers. They collect rental payment data directly from tenants and report it to the credit bureaus, which include it in the tenant’s credit file.

Adding your rent payment history to your credit report lets you show your financial responsibility. This approach is perfect for young folks and recent immigrants looking to get great credit fast.

So how does this work? First, you’d need to enroll in a rent reporting service through your landlord or the service provider. Enrollment typically involves providing consent to report rental payment data to credit bureaus.

The rent reporting service then collects the rent data from your landlord or property manager and reports it to the credit agencies.

The best thing about rent reporting is that it can boost your credit score quickly and doesn’t take much effort to set up.

5. Peer-to-peer Lending

With peer-to-peer lending, you can borrow money directly from someone else, cutting out traditional lenders like banks, credit card companies, and credit unions.

Adding a P2P loan to your credit profile diversifies your credit mix, positively contributing to your credit score. That’s because the Vantage and FICO scoring model loves to see a mix of different types of credit.

That said, paying off your P2P loans on time demonstrates your responsible lending behavior, which is the most significant factor in boosting your credit score.

When you apply for a P2P loan, your credit score won’t see a slight drop. That’s because the pre-approval screenings often perform a soft credit check to check your eligibility.

And when you finally accept a P2P loan offer, the lender may perform a hard inquiry on your credit report before giving you approval.

6. Become an Authorized User

An authorized user is anyone permitted to use another person’s credit account. Becoming an authorized user of another person’s credit card is one of the most reliable ways to build your credit.

This method has helped countless folks with a weak credit score and short credit histories to raise their scores, rebuild their credit, and establish solid credit histories.

This option works well because it’s perfect for families where one spouse is trying to fix their credit score. It’s also an excellent option for parents trying to help their teenagers get a solid financial foundation.

7. Use Experian Boost and UltraFICO

Experian Boost and UltraFICO are excellent credit-building tools that work slightly differently but can ultimately help you improve your credit score.

Here’s how they work

Experian Boost

Experian Boost allows you to add your utility and telecom payments, such as phone, cable, and electricity bills, to your Experian credit report. And yes, these payments aren’t typically included in traditional credit reports and scoring models.

And just by adding these payments, Experian Boost can quickly increase your credit score by showing lenders that you’ve got a positive payment history for your everyday bills.

To use Experian Boost, you’d have to link your bank account securely. Doing this allows Experian to access your payment history for eligible bills.

Once that’s done, you can review and confirm the bills you want to add to your credit report. Once these bills are added, Experian automatically recalculates your credit score to reflect the impact of the added payments.

UltraFICO

UltraFICO is a credit scoring model developed by FICO, the company behind the widely used FICO credit scores. It aims to provide an additional scoring option for people with limited credit history or less-than-perfect credit.

How does it do that? Simple: UltraFICO reviews your checking, savings, or money market accounts and determines how long they’ve been open, how often you make bank transactions, evidence of cash at hand, and whether you’ve had a history of positive account balances.

FICO uses all this information to calculate your UltraFICO score, which is a combination of your payment history, credit mix, amount owed, credit history, and bank data.

If you’re new to building credit or have a credit score between 500 and 600 points, you can gain a lot by using Experian Boost and UltraFICO.

5 Habits for Building Credit Without a Credit Card

1. Always Make Timely Payments

Timely payments are the cornerstone of a healthy credit profile. Paying on time shows reliability and responsibility. It doesn’t matter whether you’re making rent, utility bills, or loan payments; late payments can harm your credit score. So, focus on meeting deadlines to keep a good payment history.

2. Always Keep Your Credit Utilization Low

Credit utilization ratio refers to the amount of credit you’re using compared to your total available credit.

Keeping this ratio low—ideally below 30%—shows lenders that you’re not overly reliant on credit. To achieve this, aim to pay off balances in full each month and avoid maxing out credit lines.

3. Always Watch Your Credit Report

Monitoring your credit report regularly lets you find errors and fraud. It also helps with discrepancies that could hurt your credit score.

Take advantage of the free credit reports from major bureaus like Equifax, Experian, and TransUnion to address any inaccuracies and promptly maintain an accurate credit profile.

4. Diversify Your Credit Mix

Lenders prefer to see a diverse mix of credit types, including installment loans (such as auto loans and student loans) and revolving credit (like credit cards).

By diversifying your credit portfolio, you demonstrate the ability to manage various types of credit responsibly. However, avoid taking on unnecessary debt solely for the sake of diversification.

5. Avoid Opening Too Many Accounts at Once

While opening multiple accounts to boost your available credit may be tempting, doing so can seriously backfire. That’s because each new credit inquiry generates a hard inquiry on your credit report, temporarily lowering your score.

Opening many accounts within a short period may signal financial instability to lenders. Instead, focus on managing existing accounts effectively before considering new ones.

Here are the Two Major Types of Credit

What is Credit

Credit is a financial agreement between a borrower and a lender. It allows the borrower to obtain funds or goods with the promise to repay the lender at a later date, often with added interest.

Credit is a fundamental element of our financial life and significantly shapes our everyday transactions and activities.

Here are the two major types of credit.

1. Revolving Credit

Revolving credit is a type of open credit. That’s because it lets you borrow a fixed amount of money over a specified period.

You can then make payments based on the amount you’ve borrowed. And yes, you can use revolving credit as much as you need, and the credit limit will be replenished as you repay.

Credit cards are the most common example of revolving credit. Each purchase made with a credit card increases the outstanding balance, which must be repaid either in full by the due date or in part with interest.

2. Installment Credit

Installment credit is a type of credit in which you borrow a fixed amount of money upfront and repay it over a period in regular installments. Borrowers know the total amount they owe and the repayment schedule at the time of borrowing.

Some examples of installment credit are mortgages, auto loans, personal loans, and student loans. These kinds of loans have fixed terms and fixed monthly payments.

For a mortgage, you’d have to repay the borrowed amount and interest over a specified period, like 15, 20, or 30 years.

Why is Good Credit Important

1. It Opens Up More Financial Opportunities

A high credit score unlocks a new realm of financial possibilities, like holding the key to your prosperity. An excellent credit score gives you easy access to loans with favorable terms and low-interest rates.

Whether your goal is purchasing a car, acquiring a home, or launching a business venture, lenders eagerly collaborate with borrowers with excellent credit scores.

2. Unlocks the Lowest Interest Rates

One of the most significant advantages of having a high credit score is that it allows you to enjoy the lowest interest rate whenever you apply for credit facilities like auto loans, mortgages, or a new credit card. Getting loans with low interest rates allows you to save more money in the long run.

3. Get the Best Insurance Rates

Your credit score has a significant impact on your insurance premium. That’s because insurance companies consider credit scores when deciding rates for your home, car, or life insurance policies.

Insurance companies do this because they view you as a responsible person who’d be less likely to file claims.

4. Increase Your Credit Limits

Maintaining an excellent credit score incentivizes lenders to extend higher credit limits, which means you’d be in a better position to boost your spending power and financial flexibility.

That said, it’s vital you exercise caution to avoid excessive spending. Remember, having a high credit limit does not mean you must max it out.

5. Get Access to the Best Credit Cards

With an excellent credit score, you can access top-tier credit card offerings. These elite cards frequently include travel privileges, cashback rewards, and personalized concierge services tailored to your preferences, so you’ll be able to enjoy premium rewards programs, exclusive perks, and increased credit limits.

Factors That Determine Your Credit Score

Payment History

Your payment history is the most significant contributor to your credit score. And if there’s anything every lender wants to know before lending money, it’s how reliable the borrower is to pay back.

Your payment history contains vital information about your credit accounts, such as the accounts you’ve paid on time, if your payments are overdue, if you’ve had any past-due items, and how long it’s been since you had delinquencies. Plus, it contributes 35% and 40% to your FICO and Vantage scores, respectively.

That said, we understand paying bills can feel like a struggle, especially during tough times. However, one way to stay consistent is to create and stick to a budget. You can also set up automatic payments to pay your bills consistently.

Amount Owed

The amount of debt you carry affects 30% of your FICO and Vantage scores. When lenders look at your debt, they often check the amount you owe on all accounts, how much you owe on specific accounts, and how many of your accounts have a balance.

Credit Utilization

Credit utilization is crucial to your creditworthiness. That’s because it represents the percentage of your available credit that you are currently using. Understanding credit utilization is vital for maintaining a healthy credit profile and maximizing your credit score.

That’s because it accounts for about 30% of your FICO credit score and reflects how responsibly you manage your available credit.

Now, the general rule of thumb is to keep your credit utilization below 30%. This means using no more than 30% of your available credit at any given time. So try to maintain a low credit utilization ratio below 10% because it can significantly help your credit score.

Credit History

Your credit history is a comprehensive record of your borrowing and repayment behavior over time. It’s a critical component of your credit reports and significantly determines your credit scores.

That’s because it reflects a detailed account of your past borrowing activities, including the credit accounts you opened, your payment history, credit inquiries, and account statuses.

Having a positive credit history shows that you’re reliable and trustworthy. It also makes qualifying for loans, credit cards, and favorable interest rates easier. Meanwhile, having a negative credit history will limit your access to low-interest loans.

Credit Mix

The Credit mix refers to the variety of credit accounts and loan types in your credit history. Your credit mix shows the diversity of credit you’ve used. And that includes installment loans, revolving credit, and retail accounts.

A diverse credit mix shows that you can manage different types of credit. Lenders love customers with a diverse credit mix since it indicates they’re stable and adaptable.

One of the best ways to build your credit mix is to avoid closing old accounts since they contribute to the diversity of your credit mix.

Five Reliable Tools for Building Your Credit Score

GreatCreditFast offers personalized credit repair services for anyone trying to build their credit scores.

We work with clients to identify inaccuracies or negative items on their credit reports and dispute them with the credit bureaus. But that’s not all. We also provide 24/7 expert guidance that helps you build good credit habits.

Our credit monitoring, debt negotiation, and educational resources have helped thousands of Americans repair their credit score and take control of their credit.

RentTrack is a quick and easy way to build your credit score by simply reporting your rent payment to credit bureaus. Using RentTrack can help you build a consistent payment history on your credit report.

All you have to do is sign up, and RentTrack automatically starts reporting your rent payments to the three major credit bureaus. Using rent reporting tools will help you build your credit and motivate you to pay your rent early.

Self is another reliable tool that offers credit-builder loans to people who want to improve their credit. One thing that makes Self special is that it’s a valuable tool for people with no credit history or poor credit who want to improve their scores.

When you apply for a credit-builder loan with Self, you’d need to make fixed monthly payments over a set term, usually 12 to 24 months.

Self reports your activity to the credit bureaus as you make these payments, helping establish a positive payment history. At the end of the loan term, you receive the funds you’ve been saving, minus fees and interest, as a lump sum or in installments.

Experian SmartMoney is a financial management tool offered by Experian, one of the major credit bureaus.

Experian SmartMoney is excellent at providing personalized insights into your credit report. It can help you spot key factors that influence your credit score and potential areas for improvement.

With SmartMoney, you can track your credit score over time, monitor changes, and get instant alerts for suspicious activity.

It also has good budgeting features, bill payment reminders, and credit monitoring services that help you manage your finances and build credit.

Although it’d cost you $5 per month, Kikoff takes a unique approach to credit building. First, Kikoff offers a $750 credit limit that can only be used to buy products from its online store. Think of it like a secured credit card that can only be used to buy products from Kikoff and its partners.

When it comes to building credit, Kikoff offers three products: a secured credit card, a credit-builder loan, and a line of credit. The best part is that Kikoff’s credit-building products come with a 0% APR, so there’s no need to worry about dealing with more debt.

Follow the Eight Steps

Yes, building credit without a credit card is difficult, but following these eight strategies we’ve discussed will make the process much smoother.

So, take your time to explore credit builder loans, apply for personal loans, consider car loans, repay existing loans, report your rent payments, and gain insights into secured credit cards.

Also, remember to consider becoming an authorized user, paying your bill on time, and managing your debt-to-credit ratio effectively. Doing this will help you quickly improve your creditworthiness.

But remember that these steps require discipline and commitment but can significantly impact your financial future.

FAQs

How can credit builder loans help improve my credit score?

Credit builder loans are designed to make it easier to build a positive payment history, which is crucial for building credit without using a traditional credit card.

When you make timely loan payments, you demonstrate responsible financial behavior, which will improve your credit score over time.

Can becoming an authorized user on someone else’s credit card benefit my credit score?

Yes, becoming an authorized user on someone else’s credit card can help boost your credit score.

However, you may only see positive effects on your credit profile if the primary account holder maintains good payment habits and low utilization rates.

How do secured credit cards work in establishing or rebuilding my credit history?

Secured credit cards require a cash deposit as collateral. This makes them an excellent option for folks with limited or poor credit history.

Using the card responsibly and making timely payments can gradually demonstrate reliable repayment behavior and improve your overall credit standing.

Will I benefit by reporting other payments when trying to build or establish new lines of credit?

Reporting other payments you make, such as rent, utilities, or phone bills, can provide additional data points for creditors to assess your financial responsibility.

This comprehensive view of your payment history can help strengthen your credibility and increase opportunities for building new lines of credit.

Our Latest Blogs:

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Your credit score is...

ThisIsJohnWilliams

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Financial stability is the cornerstone of well-being, so understanding the...

ThisIsJohnWilliams

ThisIsJohnWilliams