- Blogs

- /

- What is Medical Bankruptcy: Understanding, Filing, and Impact

What is Medical Bankruptcy: Understanding, Filing, and Impact

Summary

Did you know that many bankruptcies in the United States are tied to medical expenses? Healthcare costs have pushed many individuals and families into financial turmoil. It forces them to decide between their well-being and financial stability.

This harsh reality highlights the urgent need for accessible and affordable healthcare solutions.

Medical bankruptcies impact individuals. They also have broader implications for society as a whole.

For instance, they highlight systemic issues within the healthcare system. This raises questions about equity and accessibility. Join us as we uncover the sobering truth behind medical bankruptcies.

Key Takeaways

- Medical bankruptcy occurs when individuals face financial insolvency due to the inability to pay medical bills.

- Eligibility criteria consider income, assets, and previous bankruptcy filings. It is crucial to demonstrate income below a threshold. It is also vital to prove that medical debts exceed a percentage.

- In Chapter 7 bankruptcy, assets are liquidated to pay off debts. Meanwhile, Chapter 13 allows restructuring through a repayment plan.

- Legal assistance is crucial for navigating court hearings and creditor meetings. It is also essential for navigating negotiations in medical bankruptcy proceedings.

- Financial recovery post-bankruptcy is challenging. This is due to damaged credit. It’s also due to asset loss, limited employment opportunities, and potential wage garnishment.

- Filing can also significantly decrease credit scores, affecting future borrowing capabilities.

- Rebuilding credit requires strategic planning and may involve higher interest rates.

- Debt negotiation, assistance programs, and debt management plans offer alternatives to bankruptcy.

Understanding Medical Bankruptcy

Definition

Medical bankruptcies occur when individuals cannot pay their medical bills. It leads to financial insolvency. It can result from high healthcare costs and inadequate insurance coverage. Filing for bankruptcy is a legal process that relieves individuals burdened by medical debt.

There are two main types of bankruptcy: Chapter 7 and Chapter 13. Chapter 7 involves liquidating assets to pay off debts. Chapter 13 allows you to restructure your debts through a repayment plan. Both offer solutions for managing medical debt. Understanding their differences is crucial in addressing such debt.

Filing Process

To file for medical bankruptcy, you must petition the court, considering the local laws and regulations that apply to you. If you meet these regulations, report your financial status and any outstanding medical debt. This process usually requires a lot of paperwork and documents.

Remember, given the possible differences in the procedure and implications depending on local legislation, it is vital to obtain legal counsel. Speak with a local lawyer to simplify this intricate procedure and receive advice unique to your area or state.

Factors Leading to Medical Bankruptcy

A variety of factors can cause medical bankruptcy. One of these factors is high medical expenses. Others include a lack of health insurance and loss of income due to illness.

High medical expenses can quickly deplete savings, especially for severe or chronic conditions. They can also lead to overwhelming debt. Without health insurance, individuals may have to pay for medical treatment. They’d have to pay out of pocket. This can lead to financial strain.

Also, illness-related income loss can make paying medical bills and other expenses hard. This can ultimately lead to bankruptcy. These factors can create financial hardship for those facing medical issues.

Filing for Medical Bankruptcy

1. Eligibility Criteria

When considering filing for medical bankruptcy, meeting specific eligibility criteria is crucial. Income level, assets, and previous bankruptcy filings significantly determine eligibility. These could differ based on your location. Understanding these requirements is essential before pursuing a medical bankruptcy claim.

You must prove that your medical debts exceed a certain percentage of your income. And that your medical debts exceed a certain percentage of their overall debt load. These factors are crucial. They determine if someone qualifies for medical bankruptcy.

2. Required Documentation

Gathering required documentation is vital when preparing to file for medical bankruptcy. This includes collecting income records and billing statements from healthcare providers. Collect detailed documentation of all medical expenses.

Also, collect detailed documentation of all outstanding debts related to healthcare services received. Organizing all necessary paperwork ensures a comprehensive presentation of an individual’s financial situation during the filing process.

Detailed documentation is essential. It supports successfully filing a medical bankruptcy claim. Individuals can effectively demonstrate their financial hardship from overwhelming medical bills. They should provide accurate income, expenses, and debt records.

3. Legal Procedures

Medical bankruptcies involve legal procedures. These include court hearings, creditor meetings, and debt negotiations. Navigating these procedures requires strict adherence to specific timelines and regulations. The court system handling the case sets forth the regulations.

Seeking legal representation is crucial when navigating the complexities of medical bankruptcy proceedings. It involves understanding intricate legal processes like court appearances and negotiations with creditors about outstanding debts arising from substantial healthcare expenses incurred by individuals facing dire financial circumstances due to illness or injury.

Legal counsel can also guide you through the eligibility criteria. They ensure that individuals are well-informed before initiating the process.

Impact on Credit and Finances

Filing for medical bankruptcy can significantly impact your credit score and financial standing. It can result in a substantial decrease in credit scores. This can affect future borrowing capabilities. Obtaining loans or mortgages could become more challenging.

Rebuilding credit after a medical bankruptcy requires strategic financial planning. It also requires responsible credit management. People who have filed for medical bankruptcy may face higher interest rates when applying for new lines of credit or loans. This can further strain their finances. Recognizing the potential effects on credit scores underscores the importance of informed decision-making about medical bankruptcy.

Furthermore, medical bankruptcies present significant challenges. Individuals grapple with overwhelming healthcare costs and debt burdens. Understanding the complexities of filing processes, legal procedures, and available assistance programs is crucial. This understanding is crucial in navigating this rugged terrain.

Individuals can embark on a path toward financial recovery by addressing systemic challenges. They can also advocate for preventative care and seek sound financial planning. Exploring support options would help, too.

Filing for Chapter 7 bankruptcy sometimes allows individuals to discharge certain debts entirely. It does this through liquidating assets. This relieves overwhelming healthcare debt. However, it also involves evaluating one’s assets comprehensively before filing.

Individuals considering Chapter 13 bankruptcy should know that it involves creating a repayment plan based on their income. The plan gradually settles outstanding debts over three to five years. This option allows them to retain their assets. They can work towards repaying creditors within a structured timeframe.

Debt negotiation is another avenue worth exploring. It enables individuals facing medical bankruptcies to negotiate with creditors directly. They can discuss repayment terms. They can even settle debts at reduced amounts than initially owed. It is essential to seek professional legal advice during these negotiations. This will ensure fair treatment and protection against aggressive collection practices.

Moreover, enrolling in debt management plans can provide structured approaches toward repaying debts. It can avoid bankruptcy filings.

Discharging Medical Debt in Bankruptcy

1. Chapter 7 Bankruptcy

Individuals overwhelmed by medical debt can file for Chapter 7 bankruptcy. This type of bankruptcy involves liquidating assets to pay off debts. Once the process is complete, remaining eligible medical debt is typically discharged. This means the debtor is no longer legally obligated to repay those debts.

One of the critical benefits of Chapter 7 bankruptcy is the speed at which it relieves overwhelming medical debt. Certain assets may be sold off to settle outstanding debts. Unlike Chapter 13, Chapter 7 allows for a quicker resolution. However, not everyone qualifies for this type of bankruptcy.

For example, a family with large medical expenses might choose Chapter 7 bankruptcy. This is if they have few valuable assets and can’t keep up with monthly payments.

In addition, some types of debt, such as student loans and child support, cannot be discharged through Chapter 7 bankruptcy. But most medical bills are eligible for discharge.

2. Chapter 13 Bankruptcy

Individuals may consider filing for Chapter 13 bankruptcy when facing substantial medical debt. It is an alternative to liquidating their assets under Chapter 7. This form of bankruptcy includes a three to five-year repayment plan. The plan is based on the debtor’s income and ability to pay.

In Chapter 7, assets may be sold off. But in Chapter 13, individuals can keep their property. They can repay creditors over time through manageable installments. The advantage here is keeping one’s home or car while working towards settling all financial obligations.

Consider this scenario. A person dealing with extensive hospital bills could choose Chapter 13 bankruptcy. This option is for people with valuable non-exempt property. Properties they want to protect from being sold during proceedings.

In conclusion, both bankruptcies relieve overwhelming financial burdens, including high healthcare costs. However, they differ significantly in asset retention and duration.

Alternatives to Medical Bankruptcy

1. Debt Negotiation

Debt negotiation is a way to settle medical debts for less than you owe. Negotiating with healthcare providers or collection agencies can lead to reduced payment amounts. You can contact the hospital’s billing department or doctor’s office. Explain your financial situation. They might be willing to lower your bill if they receive some payment rather than none.

Another option for debt negotiation is hiring a professional debt settlement company. These companies can work on your behalf. They negotiate with creditors to reduce the amount owed. However, it’s essential to be cautious when choosing this route. Not all debt settlement companies operate ethically.

Sometimes, healthcare providers may offer internal programs to reduce medical bills. These programs are often designed for patients who cannot afford medical bills due to financial hardship.

2. Assistance Programs

Many hospitals and healthcare facilities offer assistance programs for people with medical debt. These programs help patients who can’t afford their medical bills. They’re also known as charity care or financial aid programs.

You must provide detailed financial information to qualify for these assistance programs. You must also show that paying the total amount would cause significant financial hardship. If approved, the hospital may forgive part or all of your outstanding balance.

Furthermore, government assistance programs, like Medicaid, play a crucial role in helping individuals manage medical expenses. They prevent bankruptcy. Medicaid provides health coverage for eligible low-income adults and children. It also covers pregnant women, elderly adults, and people with disabilities.

3. Debt Management Plans

A debt management plan (DMP) involves working with a credit counseling agency. The agency negotiates with creditors on your behalf. They create a repayment plan that fits your budget. This approach is beneficial if you have many sources of debt. It goes beyond just medical expenses.

The credit counseling agency will review your finances and develop a plan. You will make one monthly payment towards an account managed by the agency. The agency will then distribute payments among various creditors. This will happen according to an agreed-upon schedule.

A DMP offers reduced interest rates and waived fees from participating creditors. This makes it easier for individuals overwhelmed by high-interest debts. It is beneficial for those with unexpected medical costs.

The Role of Bankruptcy Attorneys

1. Legal Advice

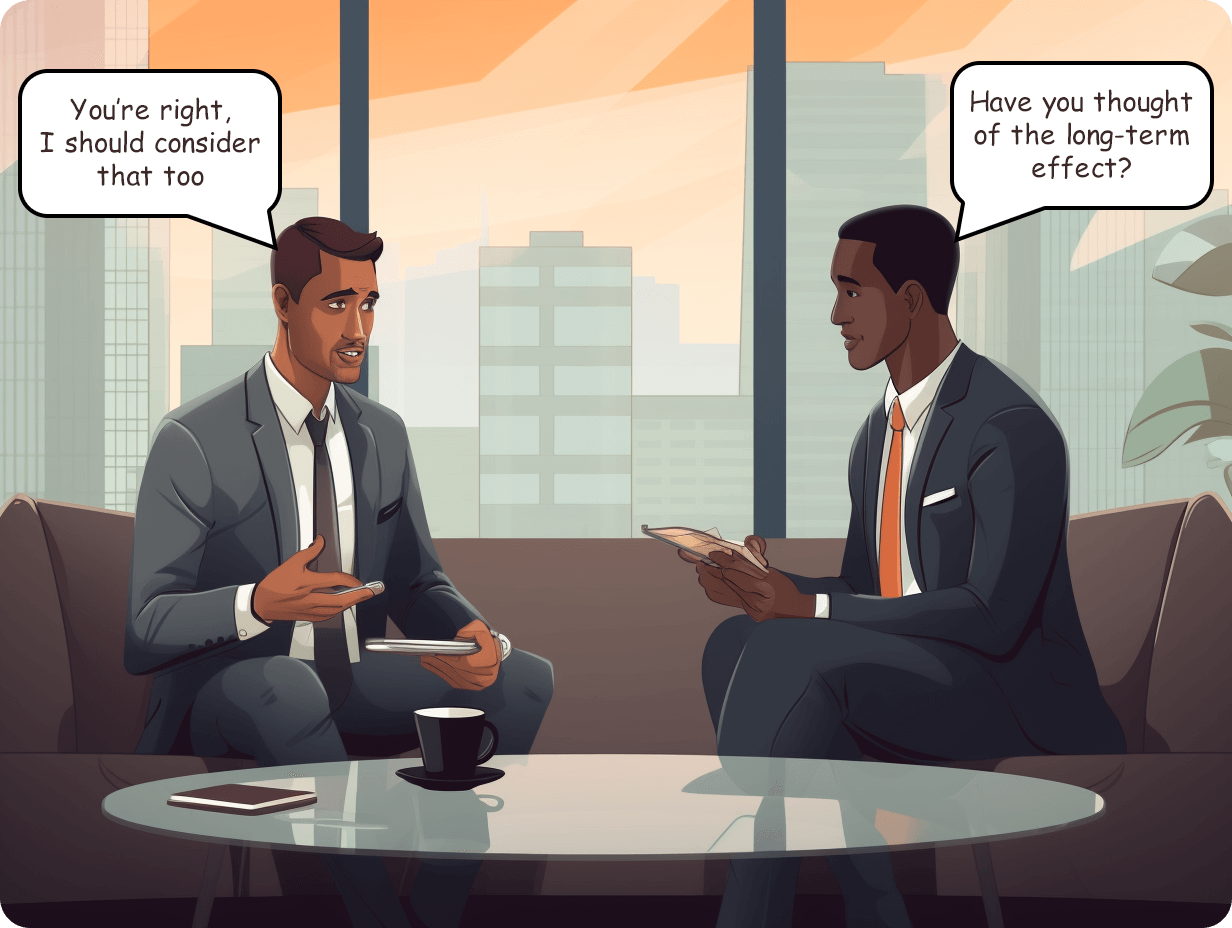

When facing medical bankruptcies, seeking legal advice from a bankruptcy attorney is crucial. These professionals can guide the best course of action based on individual circumstances. For instance, they can recommend filing for Chapter 7 or Chapter 13 bankruptcy, depending on the client’s financial situation and assets.

Bankruptcy attorneys offer expertise in navigating complex legal processes. They ensure individuals understand their rights and obligations throughout the bankruptcy proceedings. They help clients understand the complicated paperwork involved in filing for bankruptcy.

These attorneys provide legal counsel. They also assist with negotiations between debtors and creditors. They can communicate with healthcare providers, insurance companies, and other parties involved in medical debts. They negotiate favorable terms for repayment or even seek debt forgiveness where applicable.

2. Debt Management

In medical bankruptcy cases, a bankruptcy attorney’s primary role is to help individuals effectively manage their debts. These professionals check a client’s financial situation. They develop strategies for addressing outstanding medical bills. They also protect essential assets like homes and vehicles.

Bankruptcy attorneys work closely with clients. They create workable repayment plans that align with their income and financial capabilities. This may involve restructuring existing debts. It may also involve developing arrangements allowing individuals to pay off medical expenses gradually.

Moreover, these professionals are skilled at identifying potential issues within an individual’s financial landscape. Bankruptcy attorneys contribute significantly to alleviating the overall impact of medical-related financial challenges. They use strategic debt management techniques. They address concerns such as excessive credit card liabilities or mortgage arrears.

3. Court Representation

Medical bankruptcies often lead to legal action. Bankruptcy attorneys play a pivotal role in representing their client’s interests in court. They represent their clients in court proceedings.

These professionals serve as staunch advocates for individuals grappling with large medical debts. During bankruptcy hearings, they may litigate against aggressive creditors. They may also advocate for fair treatment.

Bankruptcy attorneys have extensive experience appearing before judges and handling courtroom procedures. They specialize in bankruptcies caused by very high healthcare costs.

Their representation ensures that clients receive fair treatment under relevant laws. It also safeguards them from potential exploitation by creditors seeking disproportionate recompense.

Furthermore, these legal experts know how to navigate complex judicial systems efficiently. They pursue resolutions that resolve medical bankruptcies.

Structural Issues in Healthcare

1. Policy Gaps

Medical bankruptcies often stem from policy gaps within the healthcare system. These gaps can include limited insurance coverage for specific medical conditions or treatments. They can also include high deductibles and out-of-pocket expenses. And also lack comprehensive support for individuals facing overwhelming medical bills.

For example, some insurance plans may not fully cover essential medications. They may also not cover specialized treatments. This leaves patients with large financial burdens.

Furthermore, policy gaps can also lead to inadequate regulations on pricing and billing within the healthcare industry. The lack of regulation can lead to high medical and prescription drug costs. This adds to the financial strain for people dealing with major health issues.

As a result, many people are forced into bankruptcy. These unaddressed policy gaps fail to protect them from overwhelming medical costs.

Additionally, healthcare providers often lack standardized guidelines for financial assistance program eligibility. Individuals facing extensive medical expenses may struggle without clear criteria and transparent processes for accessing these programs.

They may find navigating the complex landscape of available assistance options challenging. This ambiguity worsens their financial distress. It increases the likelihood of resorting to bankruptcy to manage their healthcare-related debts.

2. Systemic Challenges

Medical bankruptcies are common. They highlight deep-rooted problems in healthcare. One such challenge is the absence of universal access to affordable healthcare services.

In some areas, access to quality care depends on an individual’s financial standing or employment status. People without enough money may end up with overwhelming medical debt. This can lead to bankruptcy.

Moreover, systemic challenges encompass disparities in healthcare delivery. These disparities exist across different regions or demographic groups. For instance, rural areas might lack essential medical facilities and specialists compared to urban centers.

As a result, residents in these underserved areas might struggle to get timely diagnoses and treatments for severe health conditions. These factors could significantly contribute to their potential economic hardship.

Additionally, navigating the healthcare system is complex. This presents another systemic challenge. It leads individuals towards bankruptcy due to unmanageable medical expenses. For instance, the intricacies of insurance coverage can overwhelm individuals. Differences in billing practices can also confuse them. This is especially true with healthcare providers.

The lack of clear information and guidance amid these challenges can hinder patients. It can make it hard for them to manage costs effectively and increase their risk of medical bankruptcy.

Preventing Medical Debt

1. Preventative Care

Focusing on preventative care is one of the best ways to prevent medical bankruptcies. This involves taking proactive measures to maintain good health. It also means preventing illnesses before they occur. Individuals can catch potential health issues early.

They can do this by prioritizing regular check-ups, vaccinations, and screenings. This helps prevent the issues from escalating into expensive medical emergencies.

Furthermore, a healthy lifestyle can significantly reduce the risk of developing chronic conditions. Regular exercise and a balanced diet are crucial. For instance, encouraging children to engage in physical activities and promoting nutritious eating habits can help establish a healthy future. This may minimize the need for costly medical interventions later in life.

Educating individuals about self-care can contribute to overall well-being. Providing access to mental health support services can also help. Address mental health concerns promptly through therapy or counseling sessions when needed.

This can help people avoid making conditions worse. This could result in significant financial strain due to prolonged treatment requirements.

Investing in preventative care promotes better health outcomes. This is crucial in mitigating the financial burden associated with unexpected healthcare costs.

2. Financial Planning

Another essential aspect of avoiding medical debt is thorough financial planning. This includes understanding insurance coverage options. These are available through employers or government programs like Medicaid or Medicare.

People can also make informed decisions on their healthcare financing. They can do this by carefully evaluating the benefits and limitations of different plans. This evaluation should be based on individual or family needs. For example, it should consider prescription drug coverage or specialist visits.

Moreover, creating an emergency fund adds an extra layer of financial security. This fund is specifically for potential medical expenses. Regularly setting aside funds ensures you won’t have to borrow money to pay for unexpected healthcare costs. This also prevents accumulating high-interest debts via credit cards or personal loans.

In addition to building an emergency fund, it’s wise to explore alternative payment arrangements with healthcare providers before receiving services. This is another prudent approach toward managing potential medical debt scenarios.

Negotiate payment plans directly with hospitals or clinics. This allows individuals facing financial constraints more flexibility. They can settle their bills without resorting to drastic measures.

By emphasizing preventive care practices and implementing sound financial strategies tailored towards proactively managing healthcare expenses, you can minimize the likelihood of falling victim to crippling medical bankruptcies. This ultimately leads to improved well-being.

Immediate Relief Options

1. Emergency Assistance

If you’re facing medical bankruptcy due to overwhelming medical bills, seeking emergency assistance can provide immediate relief. Many hospitals and healthcare facilities offer financial aid programs. They help patients struggling to pay their medical expenses.

These programs often consider your income, family size, and the amount of medical debt you have. Contact the hospital’s billing department or financial assistance office for these options.

Some communities have local charities or non-profit organizations. These groups provide emergency financial assistance to individuals experiencing medical bankruptcies. These charities may offer grants or direct financial support.

This will help cover medical bills and related expenses. Contact local community centers, religious organizations, or social service agencies. They can help you find these resources.

Sometimes, state and federal government programs can also provide emergency assistance. They help individuals facing medical bankruptcies. Medicaid is a program funded by both the state and federal governments. It provides health coverage for low-income individuals. In some cases, it also covers past medical bills.

Furthermore, the Temporary Assistance for Needy Families (TANF) program offers cash assistance to families with dependent children. Families facing financial hardship.

Seeking immediate relief through emergency assistance can alleviate the burden of overwhelming medical debt.

2. Charity Programs

Various organizations offer charity programs. They can be a valuable resource for individuals grappling with medical bankruptcies. Non-profit foundations, such as The Leukemia & Lymphoma Society and CancerCare, provide financial assistance. They target helping cancer patients manage their treatment-related costs.

These charitable organizations may offer grants to cover co-pays and insurance premiums. They may also help with transportation expenses related to treatment visits. It also helps cover other costs associated with battling cancer.

Disease-specific foundations like the American Heart Association or American Diabetes Association often have funds to assist patients with heart disease or diabetes-related complications.

Furthermore, these funds help patients navigate their mounting medical bills. People with high medical bills can contact these charities through their websites or helplines for financial help.

Lastly, many pharmaceutical companies operate patient assistance programs. These are designed to help uninsured and underinsured patients access necessary medications at little to no cost. This is when faced with dire economic circumstances due to excessive healthcare expenditures.

Long-Term Consequences of Medical Bankruptcy

1. Financial Recovery

Medical bankruptcies can have long-lasting financial implications for individuals and families. Filing for bankruptcy may provide immediate relief from overwhelming medical bills. However, it also impacts the individual’s economic well-being.

One of the most significant long-term consequences is the damage to the individual’s credit score. Even after getting quick relief through bankruptcy, individuals may still struggle to get credit or loans in the future. This is because their credit history is damaged.

Moreover, medical bankruptcies often result in the loss of assets and property. This is part of the bankruptcy process. This loss can be emotionally distressing. It can also make it challenging for individuals to rebuild their financial stability. The inability to secure new lines of credit or loans further complicates efforts to recover financially after a medical bankruptcy.

Another aspect that affects an individual’s ability to achieve financial recovery is limited employment opportunities. Employers sometimes conduct credit checks as part of their hiring process. This could hurt job prospects for people with a history of medical bankruptcy.

Furthermore, even if individuals secure employment post-bankruptcy, they may face wage garnishment. Creditors seek repayment through court-ordered deductions from their paychecks. This financial strain makes it difficult for individuals and families impacted by medical bankruptcies to achieve long-term stability.

2. Emotional Impact

Experiencing a medical bankruptcy takes an emotional toll. This toll extends far beyond its initial occurrence. People in this situation often feel more stress, anxiety, and depression because their finances are unstable. Uncertainty about finances can lead to constant worry. This includes meeting basic needs like housing, food, and healthcare expenses.

Many people who undergo medical bankruptcies report feeling shame and embarrassment. They often feel unable to manage mounting medical debt effectively. This emotional burden can strain relationships with family members and friends. It can impact self-esteem and overall mental well-being.

Moreover, children within these households are not immune to emotional repercussions. They are associated with a parent or guardian’s struggle after a medical bankruptcy. They might feel more anxious about their family’s future security. They may also feel isolated due to limited activities when funds are tight.

Final Remarks

You now understand the complexities of medical bankruptcy. You also understand its causes and long-term implications. Navigating the treacherous waters of medical debt can be daunting.

However, you’re equipped with knowledge to steer you toward informed decisions. Remember to seek professional advice. Also, explore alternative relief options for managing medical debt. You can safeguard your financial well-being by taking proactive measures. You can also protect it by understanding your rights.

Don’t let the burden of medical debt weigh you down. Take charge of your financial health. Seek support and explore all available avenues for relief. Your journey to financial stability begins with informed choices and proactive steps. Stay informed and empowered. Remember, you’re not alone in pursuing a secure financial future.

FAQs

What are the main factors that lead to medical bankruptcy?

High healthcare costs, loss of income due to illness, and inadequate insurance coverage can cause medical bankruptcy. Even people with health insurance may face financial strain. This can come from copays, deductibles, and out-of-network care.

How does filing for medical bankruptcy impact credit and finances?

Filing for medical bankruptcy can discharge eligible debts. However, it may significantly impact credit scores. It’s crucial to weigh the benefits against potential long-term consequences. Consider consulting a financial advisor or attorney before deciding.

What are some alternatives to medical bankruptcy?

You can negotiate payment plans with healthcare providers or seek financial assistance programs. You can also explore debt consolidation options. These may be viable alternatives to filing for medical bankruptcy. These approaches help manage medical debt without resorting to the legal process of bankruptcy.

How do structural issues in healthcare contribute to the prevalence of medical bankruptcies?

Structural issues in healthcare, such as high treatment costs, lack of comprehensive insurance coverage, and limited access to affordable care, contribute significantly to the burden of medical debt on individuals and families. Addressing these systemic challenges is crucial in reducing instances of medical bankruptcy.

What immediate relief options are available for those facing overwhelming medical debt?

Immediate relief options include negotiating with healthcare providers for reduced bills or extended payment timelines, applying for hospital charity care programs, or seeking assistance from nonprofit organizations specializing in supporting individuals with significant medical expenses.

Our Latest Blogs:

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / A statement balance is the total amount of money a...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / In today’s economy, credit repair specialists are indispensable. Creditworthiness is...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Did you know that...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Struggling with bad credit can feel overwhelming and discouraging, leaving...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary How to recover from...