- Blogs

- /

- How to Survive a Recession in 8 Easy Steps

How to Survive a Recession in 8 Easy Steps

Summary

The global economy is in constant flux, and several major nations are struggling to maintain a stable economy. This indicates there’s a pretty solid chance an economic recession may be around the corner.

As history shows, navigating economic recessions and depressions like the Great Depression of 1930 and the 2008 financial crisis demands specific skills, strategies, resilience, and foresight.

So, we’ve prepared this article as a reliable roadmap to help you understand how to survive a recession and emerge stronger.

Let’s dive in!

Key Takeaways

- Recessions are often short periods of economic decline marked by a severe reduction in consumer spending.

- Recessions are often marked by mass layoffs, growing inflation, and stock market crashes.

- Build an emergency fund and reduce debt to cushion the impact of a recession.

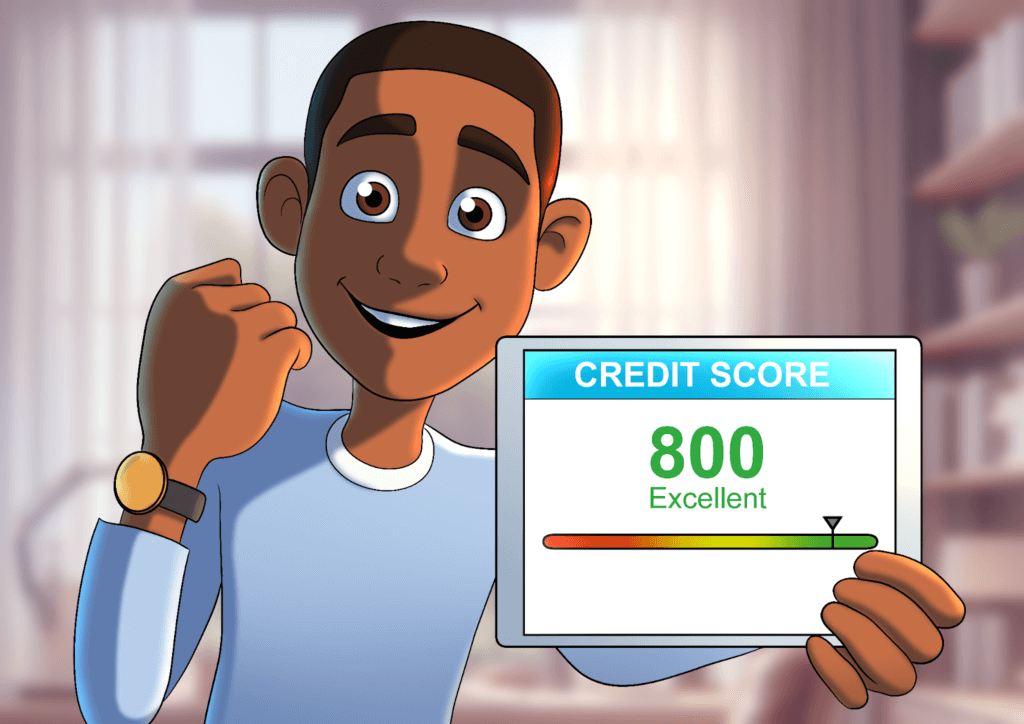

- Maintaining a high credit score can give you access to auto loans and mortgages, even during a recession.

- To navigate job insecurity effectively, stay updated on your industry’s trends and the changes in the job market.

- Always avoid making panic-driven choices during economic recessions.

- Create a long-term financial strategy that focuses on resilience and adaptability post-recession.

- Consider diversifying your investment portfolio to reduce risks and capitalize on opportunities.

What is an Economic Recession

An economic recession is a period of economic decline marked by a severe reduction in consumer spending. Various factors like high-interest rates or inflation often trigger recessions. And when people spend less money, businesses earn less.

That means companies may cut thousands of jobs during an economic downturn due to decreased profits. This reduction in employment impacts consumer spending and worsens the recession cycle.

The good news is that recessions don’t last very long. They’ve got an average lifespan of 10 months, and the most prolonged recession lasted 18 months.

How to Survive a Recession in Eight Steps

Step 1: Build Your Emergency Fund

Building your emergency fund is crucial to surviving an economic recession. Start by evaluating your income streams to see how much you can save regularly.

Ensure you review your debt obligations and prioritize paying off high-interest debts first. Doing this would save you from spending too much on these high-interest rates.

Also, analyzing your spending habits will help you prepare an accurate budget and identify areas where you can cut back. By reducing unnecessary expenses, you can increase the amount saved in your emergency fund.

Creating an emergency fund allows you to tackle unforeseen situations without financial stress. Imagine your car breaks down or you face sudden medical bills. Having savings ensures you can handle these emergencies without worry.

Trust us, your emergency fund is your safety net and financial security during tough times.

Step 2: Diversify Your Income and Investments

Diversifying your finances involves spreading your investments across different assets. We recommend you build a 60/40 portfolio. Allocate 60% of your income and investments to stocks and 40% to government bonds or fixed-income ETFs.

Doing this helps protect you from financial risk. During a recession, investing in historically resilient assets like gold or bonds offers extra protection against market volatility and can serve as a safety net.

Besides investment, one way to diversify your income is by exploring freelance opportunities or side gigs to supplement regular income sources.

Side hustles remain one of the best ways to boost your income during tough economic times. You can monetize your hobbies or skills by offering services or products on platforms like Etsy, Fiverr, or even through social media.

If you enjoy baking, you could sell homemade treats online for extra cash. We’ve seen many folks turn their hobbies for carpentry, pressure washing, and knitting into profitable side hustles.

Although starting a side venture can be a tremendous financial help during a recession, ensure you don’t overwork yourself or burnout. Also, watch for any legal and financial risks associated with your new side hustle.

Diversifying your income streams can enhance your financial security and create a safety net. Investing in passive income streams can help you build long-term wealth stability.

Step 3: Upgrade Your Skills and Education

During a recession, enhancing your skills and education is one of the best ways to maintain job security. Improving your skills and education continuously would make you more valuable in the job market. It would also make it easier to secure a job, regardless of the economic condition.

Pay attention to recession-resistant industries like healthcare, technology, or essential services. That’s because they remain relatively stable even during economic depressions.

So, ensure you’re consistently…

- Learning to improve your employability

- Focusing on upskilling as it can open doors to better opportunities.

- Getting new certifications because they’d boost your career prospects

The best way to achieve these is through online learning platforms like Coursera, Udemy, or LinkedIn Learning. These platforms offer many courses ranging from technical skills to soft skills development.

Upskilling can equip you with the tools you need for career progression, even during challenging times.

It’s worth noting that knowing how to network correctly is a critical ingredient. Networking can help you discover career growth opportunities during challenging economic periods.

As you build connections within your industry, you open doors for potential jobs or collaborations. This could help advance your career even during a recession. Expanding your network would help you discover more job opportunities. You would also enjoy the support of peers who can provide great recommendations.

Step 4: Evaluate and Renegotiate Recurring Bills

During a recession, it’s wise to negotiate with service providers. Ask for better rates or discounts on recurring bills, like internet or phone services.

Trust us. You’d be surprised how many companies offer great promotions or loyalty discounts. They could significantly reduce your monthly expenses. Contact your service providers. Politely ask about any available discounts or promotions that could lower your monthly bills.

Another effective way to cut costs during challenging economic periods is to identify and cut non-essential expenses. Check all your subscriptions, memberships, or other recreational spending. You can reduce or cancel them without impacting essential needs.

That said, ensure you build your negotiation skills. It’ll help you negotiate with service providers like cable companies or insurance agencies.

Step 5: Protect Your Credit Score

Maintaining a good credit score during an economic recession provides financial stability for the future. A high credit score makes it easy for you to secure a mortgage or auto loan with the lowest interest rate.

So, try your best to make timely bill payments. This demonstrates your financial responsibility to creditors and increases your creditworthiness.

Besides paying your bill on time, check your credit report regularly. Doing so will help you detect unauthorized activities or errors that could harm your score if left unaddressed.

One more thing. Avoid maxing out your credit cards; this is another way to safeguard your credit score during recessions. Always keep an available balance on your cards. This shows you’ve got responsible spending habits. It also protects your financial health.

Step 6: Build Your Mental and Emotional Resilience

Several studies show a strong correlation between stress and economic crisis. And if there’s anything recessions are known for, it’s how they come with oppressive amounts of stress.

Adding regular physical exercise to your daily routine is the best way to preserve your mental health. Exercise releases endorphins that boost mood and reduce stress levels significantly. Even a short walk or some stretching exercises can make a big difference in how you feel.

Doing physical activities like yoga or meditation can improve physical health. It can also enhance mental clarity and boost emotional resilience. Mindfulness practices, like journaling thoughts or practicing gratitude daily, can help you shift your focus from the negative to the positive.

But don’t stop with exercise and mindfulness. If you notice you’re stuck in an endless cycle of fear and worry, then get help from mental health resources or professionals.

Plus, several communities offer free or low-cost counseling services. These services are for folks struggling with financial hardships during an economic downturn.

Step 7: Make Your Business Flexible

If you’re running a business, keeping it flexible is one way to ensure it survives a recession. This means you must watch out and embrace unique opportunities. These opportunities can transform how your company creates, delivers, and captures value.

Let’s assume you’re running a brick-and-mortar store. You should consider using e-commerce to reach more customers. Embracing this change can help your business respond to the customers and adapt to economic changes.

Always think outside the box when searching for new, innovative ideas. Pay special attention to other industries. The idea that could revolutionize your business is most likely being used elsewhere.

One more thing you must never neglect is building a solid business culture. Doing this makes it a lot easier to create a supportive environment for your employees.

Step 8: Use Government Assistance Programs

Government assistance programs like unemployment benefits, tax incentives, and job training programs can be a crucial lifeline during an economic recession.

These government relief programs offer various forms of assistance. They include cash benefits, food stamps, housing vouchers, and healthcare subsidies.

These programs provide temporary relief to anyone. They have saved countless folks facing financial hardship during an economic downturn.

But, it’s worth noting that your eligibility depends on criteria like your income level, family size, and employment status. To qualify for each government program, you must understand its requirements.

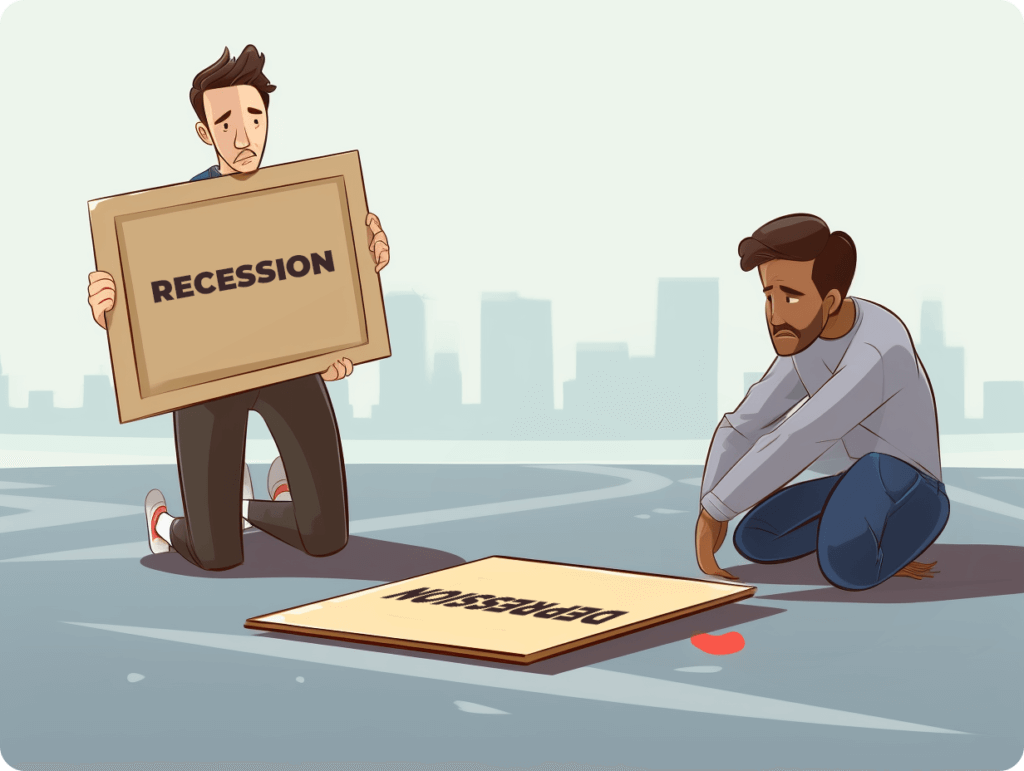

What’s the Difference Between Economic Recession and Depression

A recession is a short-term economic downturn. A depression is a long-term economic downturn. It’s characterized by high unemployment rates, reduced consumer spending, and declining GDP.

During a depression, businesses struggle to stay afloat. This leads to widespread job losses and financial instability for millions of folks.

Seven Warning Signs of an Economic Recession

Understanding the leading signs of an economic recession is crucial. It helps you stay prepared against its impact.

Here are a few factors you must watch for:

- Mass layoffs.

- Hiring freezes.

- Oil price hikes.

- Ever-rising Inflation.

- Excessive debt levels.

- Stock market crashes.

- Declining property sales.

- Increased credit card default.

Take Action! Secure Your Future

Planning for the worst-case scenario is the best way to stay on guard and protect yourself from an economic downturn. So, do everything you can to build a robust emergency fund, grow your credit score, diversify your investment, start a side hustle, and update your skills and education.

Take action now to secure your finances and future. Don’t wait for the recession to hit; prepare your income lifeboat before the waves get rough. Stay informed, stay proactive, and stay resilient. Your preparation today will determine your success tomorrow.

FAQs

How do I prepare for an economic downturn?

Start by building your emergency fund, reducing debt, and cutting unnecessary expenses. Diversifying your income sources and investments can also provide stability during tough times.

What are some strategies to manage finances during a recession?

During a recession, focus on essentials. Trim non-essential spending. Negotiate bills where possible. Explore ways to increase savings.

Keeping a close eye on your budget can help you navigate challenging times effectively. Also, always get professional financial advice if you run into any challenge.

How can I safeguard against making panic decisions during an economic downturn?

Always stay informed about the market. But, be careful not to obsess over daily market fluctuations.

Preparing a detailed financial plan can clarify and prevent impulsive actions driven by fear or uncertainty.

Is it possible to build a recession-proof life?

It’s impossible to shield yourself from all the effects of an economic downturn. But, adopting great financial habits can help you survive and thrive during a recession. Saving regularly, living below your means, and continuously learning new skills are important.

Is pursuing further education a good strategy during a recession?

Yes, investing in further education or certifications can enhance your skills in your industry. You can get great courses from affordable online programs that align with emerging industries or high-demand sectors.

How can I maintain mental resilience during tough financial times?

Focus on self-care activities like exercise, meditation, and connecting with loved ones. Seek support from counseling services if needed.

Are there government assistance programs available during an economic downturn?

Yes, several government assistance programs like unemployment benefits, food assistance programs (like SNAP), housing aid initiatives, and small business loans and grants help you survive the financial hardships caused by the recession.

Our Latest Blogs:

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Understanding the effects of...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary For most people, rent...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary A good credit score...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Your credit score is...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / In today’s digitally interconnected world, we all face the danger...