- Blogs

- /

- Discover What’s Dangerous About Taking Out a Payday Loan

Discover What’s Dangerous About Taking Out a Payday Loan

Summary

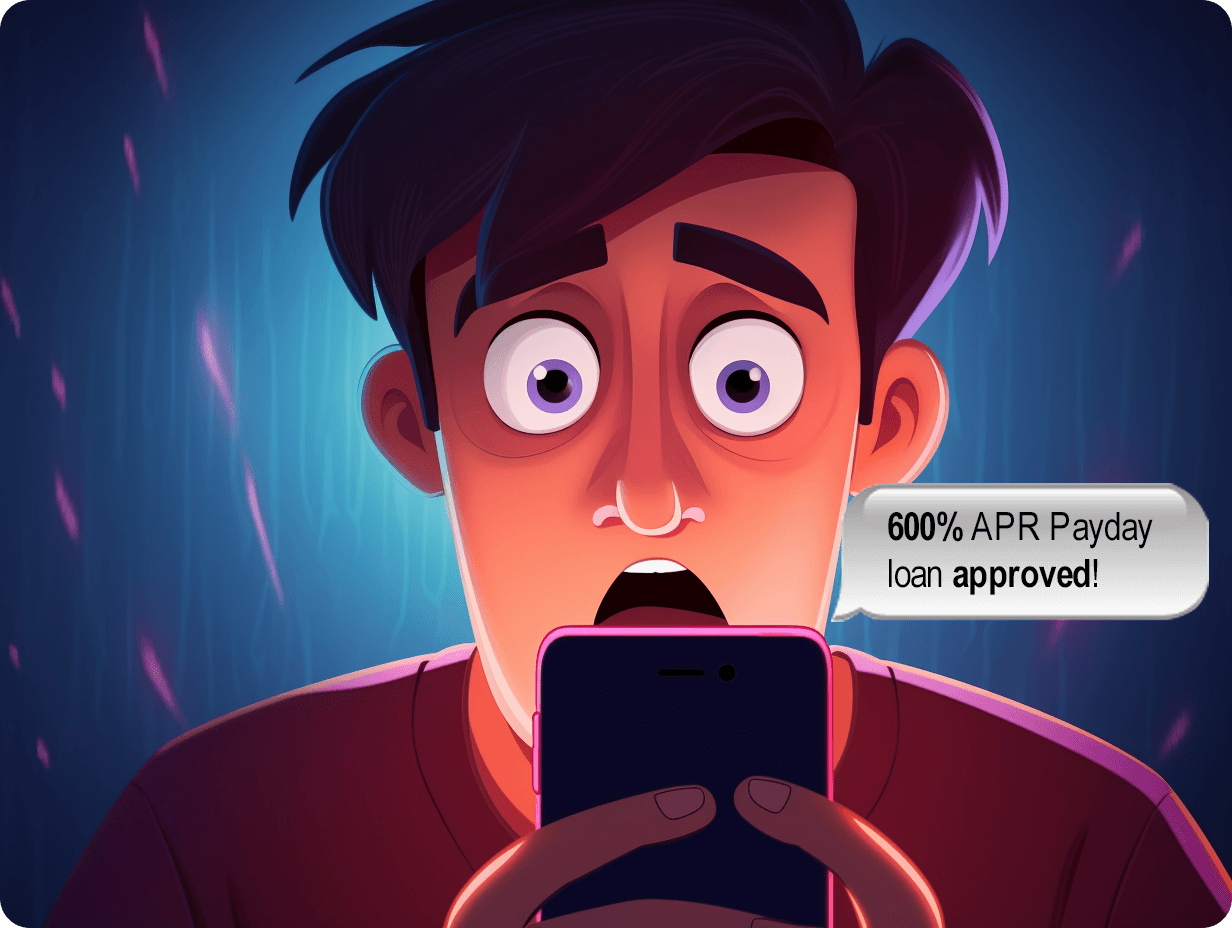

Did you know that the average interest rate on a payday loan is a staggering 391%, and according to the Consumer Federation of America, it can be higher than 780%? That’s right, over 780%! Our jaws hit the floor the first time we heard this.

Many people taking these short-term loans find themselves stuck in a cycle of debt. This happens because of their exorbitant fees and interest rates. But what exactly makes taking out a payday loan so dangerous?

First, payday loans often lead to a spiral of never-ending debt, trapping borrowers in a cycle of borrowing just to stay afloat.

Aggressive collection practices and hidden fees can turn these loans into financial quicksand. This is especially true for those already struggling to make ends meet.

Key Takeaways

- Payday lenders often charge $15 for every $100 borrowed.

- Payday loans are high-interest loans that can reach over 780% in APR.

- Payday loans have a short repayment period, typically two weeks.

- Most people who use payday loans fall into a debt cycle because of renewal and rollover fees.

- Lenders don’t need to check your credit score before giving you payday loans.

- The short-term relief from payday loans can result in long-term consequences.

- Repairing your credit score can help you fix the damage payday loans do to your credit report.

Here’s What’s Dangerous About Taking Out a Payday Loan

1. High Fees and Rates

Payday loans often have exorbitant fees and interest rates. And that often leads to borrowers paying back way more than the borrowed amount.

The high cost of payday loans can lead to financial strain, making it challenging for borrowers to repay the loan on time. It takes the average payday borrower five months to repay the loan.

Excessive fees for payday loans can create a cycle of dependency. Borrowers continuously struggle to keep up with the payments.

For example, if someone borrows $300, they might pay back over $800 after all the fees and interest are added.

This significant increase in repayment amount can put immense pressure on folks already facing financial difficulties.

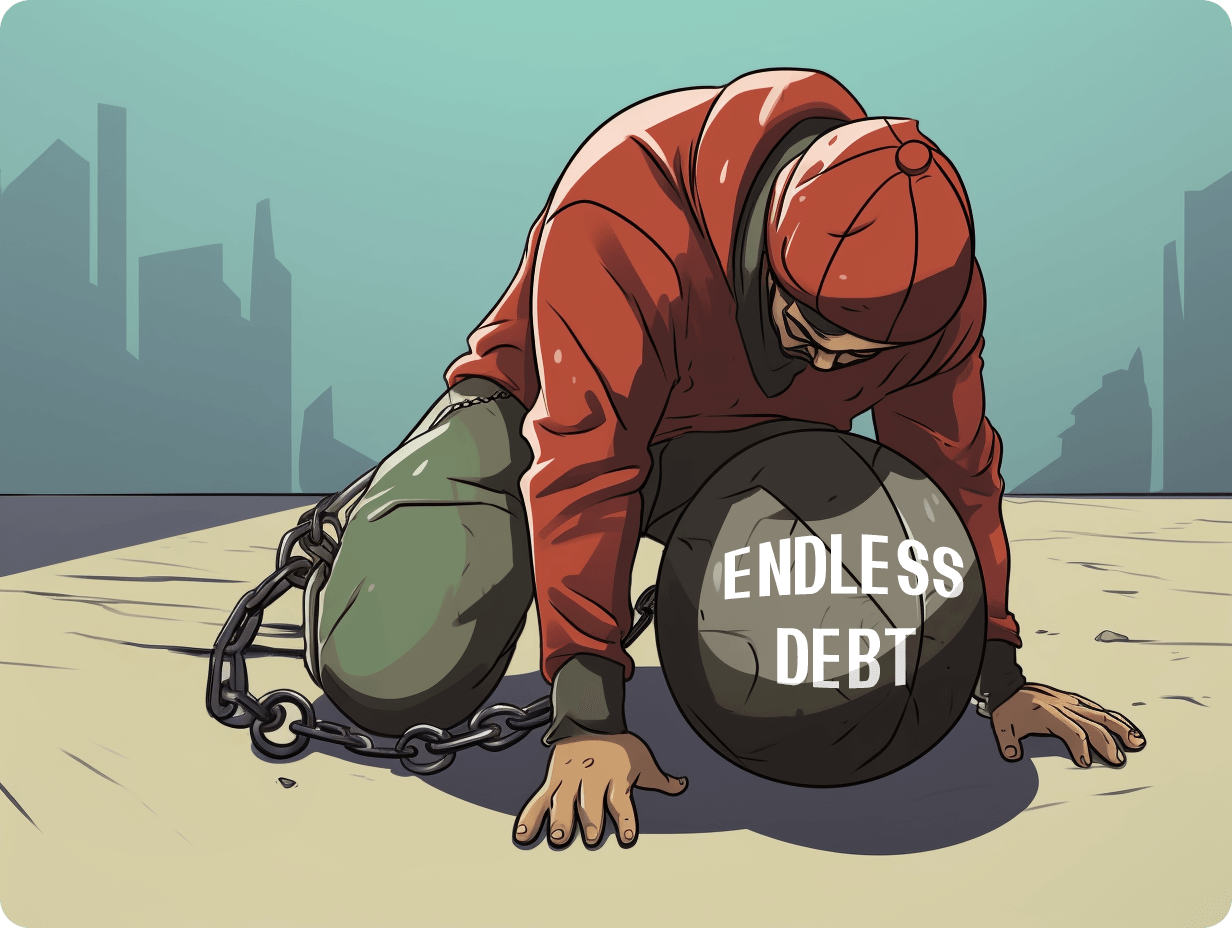

2. Debt Cycle

Taking out a payday loan can trap borrowers in a never-ending cycle of debt. Many borrowers repeatedly borrow to cover previous loan repayments. This leads to a cycle of dependency on payday loans.

And yes, the short repayment period of these loans—typically two weeks—makes it even more difficult for borrowers to break free from this cycle.

What does this mean? Let’s say someone cannot repay their initial loan by the due date. In that case, they may have no choice but to take out another loan just to cover that payment.

This puts them in a dangerous pattern. They’d become reliant on these loans every pay period. They cannot afford their basic living expenses without them.

3. Negatively Impacts Credit Scores

Defaulting on a payday loan can hurt your credit score. Late payments or non-payment of these loans can be reported to credit bureaus. This can damage your creditworthiness and make it harder for you to access other forms of credit in the future.

Defaulting on payday loans can lower your credit score. This may hurt your chances of borrowing money, securing housing, or finding a job. And that’s because some employers conduct credit checks as part of their hiring process.

4. Targets Low-Income Folks

Payday lenders often target low-income folks who are financially vulnerable. Their marketing strategies target people desperate for quick cash due to unexpected emergencies. These emergencies include medical bills or car repairs. And yes, this includes unforeseen expenses.

Low-income groups are more likely to fall into the trap of payday loans. They have limited financial resources when faced with urgent needs like rent or groceries.

Three Factors That Make Payday Loans More Dangerous

1. Weak Government Regulations

Payday loans operate with minimal regulation. And this makes it much easier for lenders to take advantage of borrowers. This lack of strict oversight creates an environment where predatory practices can thrive.

Consumers are especially vulnerable to unfair lending practices and excessive fees. This is because they lack proper regulations. As a result, folks already facing financial challenges may find themselves in even more dire straits after taking out a payday loan.

So far, we’ve seen predatory practices within the payday loan industry wreak devastating effects on borrowers. Some lenders resort to aggressive collection tactics. Others use misleading advertising to coerce people into borrowing money.

These exploitative strategies worsen the financial difficulties those seeking short-term financial help face. The lack of strict regulations doesn’t protect consumers from these harmful lending practices.

2. Predatory Practices

One of the most concerning aspects of payday loans is the abundance of predatory practices some lenders use. As we discussed, these crooked actions target vulnerable people. They exploit their precarious financial situations for profit.

Predatory lenders worsen the already difficult circumstances borrowers face. They do this by using coercive tactics. These tactics include deceptive marketing and intimidating debt collection strategies.

But, the consequences of these predatory tactics extend beyond immediate financial strain. They can perpetuate long-term cycles of debt and economic instability for borrowers.

People find it increasingly challenging to break free from the burdensome cycle created by payday loans. And that’s because they face unfair and exploitative lending tactics.

3. No Credit Checks

Unlike traditional lending institutions, payday lenders typically don’t conduct thorough credit checks on potential borrowers. This may seem like great news for anyone with poor credit histories or limited access to other forms of credit. But, it also poses significant risks.

How? The absence of comprehensive credit assessments means that loans may be given to folks who lack the means to repay them responsibly.

This lax approach to assessing borrower eligibility increases the likelihood that recipients will face difficulties repaying their debts. It also leads them into deeper financial turmoil.

Compounding Debt: The Biggest Danger of Payday Loans

Payday loans can be extremely dangerous due to their high-interest rates and short repayment periods. This combination often leads to a spiraling debt situation for borrowers.

Payday lenders often offer their loans at an interest of $15 – $20 for every $100. So, if someone borrows $500 with a fee of $75, they must repay $575 within two weeks.

If the borrower cannot pay off the total amount, they may have to renew the loan by paying an additional fee. This cycle continues, causing the total amount owed to increase rapidly.

The compounding effect of these high-interest rates makes it challenging for borrowers to escape this debt trap. As a result, people may find themselves borrowing more money just to cover existing debts and everyday expenses.

This creates a never-ending cycle of increasing debt that becomes overwhelming and unmanageable.

Payday loans are easy to get with few requirements. Most people facing financial difficulties see them as a quick solution. They turn to payday loans without fully understanding the potential consequences.

Most of these folks might not realize how quickly small payday loan amounts can become significant financial burdens. This happens because lenders charge exorbitant interest rates.

Ultimately, this vicious cycle can lead people into deeper financial trouble. It does not provide the relief they initially sought when taking out these loans.

Negative Effects of Payday Loans on Your Credit Profiles

Short-Term Gains, Long-Term Losses

Yes, taking out a payday loan is a quick fix for immediate financial needs. But, short-term relief can lead to long-term financial struggles.

For instance, borrowers facing urgent expenses may turn to payday loans. They may not fully understand the loans’ high costs and fees. And although they’d be able to meet their needs in the short term, it often results in prolonged financial instability.

Borrowers who rely on payday loans may be trapped in a debt cycle due to the super-high interest rates and short repayment periods.

This cycle can make it challenging to meet their ongoing expenses or save money for future needs. Essentially, what seems like an easy solution at first can lead to long-lasting negative consequences.

Credit Score Implications

Defaulting or making late payments on payday loans can severely affect an individual’s credit score. That’s because it reflects poorly on their credit history when borrowers cannot repay their payday loans as agreed.

A lower credit score from such actions can limit access to favorable interest rates when applying for other types of credit. That includes credit cards, mortgages, and car loans.

Also, getting a low credit score due to payday loan mismanagement could hinder your opportunities when renting a home or getting a job.

This happens because landlords and employers often perform background checks. The checks assess a person’s financial responsibility. The impact of these negative marks on your credit report may persist for years. It will affect various aspects of your financial well-being.

The Vicious Cycle of Payday Debt

Renewal and Rollover Fees

Renewal and rollover fees are the key tactics payday lenders use to lure borrowers into endless debt. That’s because when borrowers cannot repay the loan by their next paycheck, some lenders offer the option to renew or roll over the loan.

But, this seemingly helpful feature comes with additional fees that can significantly increase the overall cost of borrowing. These fees further burden already struggling borrowers and extend their debt repayment journey.

For example, if someone initially borrows $500 and is unable to repay it in full by the due date, they might be offered an extension for an additional fee.

This means that while they get more time to pay back the original amount, they also have to pay even more on top of what they already owe.

These extra charges make breaking free from the payday debt cycle harder. Each renewal or rollover adds more financial strain. As a result, borrowers find themselves trapped in a continuous loop. They borrow and repay at increasingly higher costs.

The Consumer Finance Protection Bureau reported that 80% of payday loans were rolled over, and borrowers defaulted on 20%.

Collection Practices

Some payday lenders resort to aggressive collection practices when borrowers struggle with repayment. Instead of offering support or understanding, these lenders engage in harassment tactics. They make constant calls demanding payment and even threaten delinquent borrowers.

Imagine constantly receiving intimidating phone calls from a lender. They demand immediate payment when you’re already facing financial hardship. It’s stressful and emotionally draining.

This often only makes the borrower’s financial stress worse. It could push them to borrow elsewhere to repay the payday debt. It can also lead people into deeper anxiety about their finances and create an overwhelming sense of hopelessness.

Taking out a payday loan can quickly become a nightmare. People are caught in a web of increasing debt due to high fees and relentless pressure from lenders.

Three Reliable Alternatives to Payday Loans

1. Personal Loans

Getting personal loans from traditional financial institutions like banks and credit unions remains one of the best alternatives to payday loans. These loans typically come with lower interest rates and more extended repayment periods than payday loans.

Before resorting to payday loans, explore the potential of securing a personal loan from banks or credit unions. By opting for a personal loan, you can avoid the renewal and rollover fees plus the super-high interest rates of payday loans.

Traditional financial institutions offer more favorable terms than payday lenders. Personal loans provide extended repayment periods. This allows borrowers to manage their finances more effectively. It helps them avoid the trap of perpetual debt caused by frequent payday loan rollovers and extensions.

2. Payment Plans

People facing financial hardship can consider another alternative. They can negotiate flexible payment plans with creditors and service providers.

Instead of turning to payday loans, exploring payment plan options can provide temporary relief. It can also help borrowers avoid accruing more debt through high-cost, short-term lending.

Many creditors are willing to work with individuals experiencing financial difficulties. They offer tailored payment plans that fit the individuals’ current circumstances. This approach helps manage immediate expenses. It prevents the need to take out a predatory payday loan that could lead to long-term financial repercussions.

3. Community Assistance

Those needing financial support have another option. They can seek help from local community organizations and charities instead of using payday loans.

These organizations may offer emergency funds. They may provide valuable financial counseling or connect people with other community aid forms.

Community assistance programs often aim to empower individuals financially. They also aim to foster stability within local communities.

By using these resources, you can access safer alternatives. They prioritize your long-term well-being over the quick-fix solutions predatory lenders offer.

Two Reliable Ways to Protect Your Financial Health From Payday Loans

1. Budgeting and Emergency Funds

Building an emergency fund is crucial for protecting yourself from the dangers of payday loans. Setting aside a small portion of each paycheck can create a financial safety net to cover unexpected expenses.

For example, if your car breaks down or there’s a sudden medical bill, having savings in place means you won’t have to take out a high-interest payday loan.

Besides emergency funds, effective budgeting is equally important in helping you avoid the need for payday loans.

Carefully plan how you spend your money. Prioritize essential expenses. This can help you avoid desperate situations that lead to considering payday loans.

And yes, this could mean cutting back on non-essential purchases or finding ways to reduce monthly bills. Budgeting and saving are the best practical steps to instill financial discipline. They can help you avoid borrowing at exorbitant rates.

2. Get Financial Advice and Plan

Another way to protect yourself from payday loan pitfalls is to seek professional financial advice. Knowing how much you could save each month towards an emergency fund or retirement is an integral part of the planning process. It can help you in the long run.

Consulting with experts, such as financial planners or advisors, can provide valuable insights. It can help in managing personal finances more effectively.

These professionals can help you develop strategies for creating sustainable budgets. They can also help you responsibly manage debt and build emergency funds.

Developing a comprehensive financial plan under the guidance of these experts promotes long-term stability. It identifies potential risks and provides solutions to mitigate them.

The Government’s Stance on Payday Lending

Regulations and Protections

Advocating for stricter payday lending regulations is crucial. It protects consumers from predatory behavior. Stronger regulations can limit excessive fees. They can also ensure fair lending practices and enhance borrower protection.

For example, in many states, lawmakers are working to implement laws that cap interest rates and fees charged by payday lenders.

All these measures aim to prevent borrowers from falling into a cycle of debt caused by high-cost loans.

Pushing for legislative changes is vital in curbing the dangers associated with payday loans. Authorities can safeguard vulnerable folks from getting trapped in a never-ending cycle of borrowing and debt. They can do this by imposing stricter rules on lenders.

This also requires lenders to assess a borrower’s ability to repay the loan without facing financial hardship or default.

Legal Consequences for Lenders

Protecting borrowers’ rights is vital. Holding lenders accountable for unfair practices through legal action is crucial. Lawsuits against predatory lenders can result in penalties. They can also result in compensation for affected folks who were subjected to exploitative lending terms.

In many states, legal consequences deter unscrupulous payday loan companies. They avoid engaging in aggressive collection tactics or deceiving consumers about their rights.

How to Always Make Informed Loan Decisions

Understand the Terms and Conditions

Understanding the terms and conditions of a payday loan is crucial. Before signing any agreement, borrowers must carefully understand the loan’s terms and conditions.

Hidden fees, high-interest rates, and strict repayment obligations are standard in payday loans. Failing to spot these details can lead to unexpected financial burdens.

For example, suppose a borrower fails to understand that there are additional fees for late payments. They may not realize the full extent of the interest rates.

In that case, they may face much higher repayments than anticipated. This lack of understanding can quickly turn what seemed like a manageable loan into an overwhelming financial strain.

Consider Loan Affordability

Before taking out a payday loan, borrowers must assess whether they can repay it within the given timeframe. Borrowers can determine if they can afford a payday loan by looking at their income, expenses, and other financial obligations. They can avoid adding financial strain.

For instance, if someone borrows an amount that exceeds what they can comfortably repay based on their income and expenses, they might struggle with subsequent bills.

They might also struggle to afford necessities like food or rent. This cycle of debt could lead them into more severe financial trouble in the long run.

Knowledge is Power

It’s crucial to understand the dangers of payday loans to protect your financial well-being. Payday loans have significant dangers. They can damage credit profiles and trap hard-working folks in a cycle of debt.

That’s why it’s essential to explore alternative options and make informed decisions when considering borrowing money.

As you navigate your financial journey, remember that knowledge is power. Protect yourself from the dangers of payday loans. Seek reputable financial advice and explore alternative lending options.

You should prioritize your financial health. Stay informed and make conscious choices. By doing so, you can avoid the dangers often linked to payday loans.

FAQs

What’s dangerous about taking out a payday loan?

Taking out a payday loan comes with significant risks. These risks include high-interest rates. They could potentially negatively impact your credit scores. You could also get trapped in a cycle of debt due to the short repayment terms.

How do payday loans affect my credit profile?

Payday loans can negatively impact your credit profile if not repaid on time. Defaulting or late payments can be reported to credit bureaus. This can lower credit scores and make it harder to access financial products like car loans and mortgages in the future.

What are some alternatives to payday loans?

Before opting for a payday loan, consider several alternatives. For example, seek assistance from family or friends. Also, explore low-interest personal loans from banks or credit unions.

You can also negotiate payment plans with creditors or seek financial counseling services.

How can I protect my financial health against the dangers of payday loans?

The best way to safeguard your finances against the dangers of payday loans is by creating an emergency fund for unexpected expenses.

Create a budget with savings goals. Also, always prioritize essential spending over non-essential ones.

What is the government’s stance on payday lending?

Governments often regulate and monitor payday lending practices due to concerns about consumer protection. Some jurisdictions have implemented restrictions on interest rates and fees charged by lenders to protect consumers from predatory lending practices.

Our Latest Blogs:

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Becoming a homeowner is...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Did you know that...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Financial stability is the cornerstone of well-being, so understanding the...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Struggling with bad credit can feel overwhelming and discouraging, leaving...

ThisIsJohnWilliams

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary A good credit score...