- Blogs

- /

- How to Get a Repo Off Your Credit Using 2 Easy Ways

How to Get a Repo Off Your Credit Using 2 Easy Ways

Summary

Understanding the effects of repossession on your credit score is essential and critical. Your car disappears overnight. Your credit score plummets. That’s the brutal reality of repossession. It’s a financial gut punch that can leave you feeling helpless.

The consequences can resonate throughout your financial stability. They can substantially change your future chances of obtaining credit. Repossession doesn’t only affect present loan approvals. It casts a long shadow over your entire financial health.

Learning how to get a repo off your credit report is more than a necessary step. It’s a lifeline to regaining financial control.

Discover two simple strategies for quickly removing a repossession from your credit report in this thorough article. These tried-and-true methods will help you restore your financial situation. They will pave the way for effective credit repair.

Key Takeaways

- Repossession affects your credit score. It can stay on your credit report for up to seven years. It hinders future credit approvals and leads lenders to view you as a risky borrower.

- Regularly obtain your credit reports from credit bureaus to identify repossession entries accurately. Ensure the information is up-to-date and dispute any inaccuracies.

- Seek guidance from financial advisors or credit counselors. Understand that settling debt might not guarantee repossession removal from your credit report.

- Consider goodwill letters or legal credit repair services to rectify repossession entries. Focus on addressing ongoing debt post-repossession. Avoid unnecessary credit applications to rebuild your credit.

- Explore credit builder loans or second-chance loans to show responsible borrowing behavior.

- Strive to qualify for new loans gradually. This includes auto loans and mortgages. You can improve your credit score and save for larger down payments.

- Recognize that repossession’s effects may persist and be patient during removal. Continuously practice good financial habits. Seek professional advice to mitigate long-term repercussions on your financial well-being.

Understanding Repossession

Repossession, or having your property taken back by the lender, can impact your credit. It can cause your credit score to drop. A repo may stay on your credit report for up to seven years, making it harder for you to get approved for new credit.

Lenders might see repossession as a sign that you cannot manage your finances well. This could make them hesitant about lending money to you in the future. However, addressing the repo can help lessen its negative effect on your credit.

It’s crucial to understand how repossession affects your credit. It’s also critical to take steps to reduce its impact.

How to Get a Repo Off Your Credit

A. Checking Your Credit Report

1. Obtaining Your Report

Getting a copy of your credit report is crucial to getting a repo off your credit. You can request a free copy from each central credit bureau. These include Equifax, Experian, and TransUnion. One way to do this is by visiting AnnualCreditReport.com. You’re entitled to one free report every 12 months.

Various online platforms and mobile apps offer convenient access to your credit report. Reviewing this report is essential. It allows you to identify repossession entries accurately.

It’s vital to ensure that the information on your credit report is up-to-date and accurate. Inaccurate details could harm your financial health. They could also impact future transactions, like getting loans or mortgages.

2. Reviewing for Errors

When reviewing your credit report for repossession entries, carefully examine the details. Look for any errors related to these entries. Look for inaccuracies in dates. Look for inaccuracies in amounts owed. Look for inaccuracies in other information regarding the repo entry.

If you spot discrepancies or incorrect information, dispute these with the respective credit bureaus. Keeping thorough documentation of this dispute process will help support your case. It will serve as evidence.

You will know if further action is needed to resolve these issues with the bureaus involved. Regularly monitoring your credit report ensures that any updates related to repossession entries reflect correctly. This is especially important after disputes have been addressed.

3. Identifying Repossessions

When reviewing your credit reports, look out for specific terms. Examples include “repossession” and “voluntary surrender.” These terms show when the lender returned an asset due to non-payment or default on a loan agreement.

Identify critical details like the date of repossession and the lender’s name associated with each entry. Do this on all three major credit reports.

The reports are available from different bureaus. Cross-referencing these repo entries across multiple reports helps ensure consistency in identifying them accurately.

Understanding how repossessions are reported within these documents gives you valuable knowledge. It helps when removing negative repo-related items from your credit history.

B. The Dispute Process

1. Filing a Dispute

Gathering evidence is crucial. If you believe the repo entry on your credit report is inaccurate. You need evidence to support your claim. This could include payment records or proof of voluntary surrender, if applicable.

Once you have all the necessary documentation, write a formal dispute letter. The letter should explain why you think the repo should be removed from your credit report. Include any relevant documents. Submit your dispute letter to all three major credit bureaus. Do this via certified mail or online platforms.

After submitting your dispute letter, following up with the credit bureaus is essential. This ensures they are processing your dispute. Regularly checking in will help keep the process moving forward. It will also demonstrate that you’re actively engaged in resolving the issue.

Sometimes, the credit bureaus could request more information when investigating your dispute. It’s essential to provide any requested documentation promptly. Maintain open lines of communication throughout this process.

2. Contacting Bureaus

To initiate the dispute process, start by finding the contact information for each of the three major credit bureaus: Equifax, Experian, and TransUnion. You can contact them via phone, mail, or online channels to discuss the repo entry on your report.

When contacting the bureaus, be prepared to provide personal identification and account details. They may ask for specific information about you. This is related to the repository entry as part of their verification process.

During these interactions with each bureau representative, you must ask for guidance on the steps required. Ask how to dispute or successfully remove the repo from your credit report. Keeping a record of their interactions will be valuable reference material throughout this process.

3. Following Up

It’s critical to regularly check progress when disputing a repossession entry on your credit report. Promptly follow up with any additional documentation requested by the bureaus.

Maintain open lines of communication throughout this journey to ensure a timely resolution. When pursuing the removal of an inaccurate repo from your credit report, stay persistent and assertive.

C. Negotiating with Creditors

Settlement Options

One option is to contact the creditor and discuss settlement options. You can negotiate a lump sum payment. You can also arrange a repayment plan that aligns with your financial situation.

It’s crucial to get any settlement agreement in writing before making payments. This protects you. But, even if you settle the debt, there’s no guarantee that the repossession will be removed from your credit report.

Consulting with a financial advisor or credit counselor can provide valuable guidance during these negotiations. They can offer insights into practical strategies for dealing with creditors. They can also help you navigate settling outstanding balances.

Seek professional advice to make informed decisions about your financial obligations and potential settlements. This will better equip you.

Understanding all available options is essential when considering settlement agreements. Settling may not remove the repo from your credit report. It offers an opportunity to address the outstanding debt.

Pay for Delete

Consider another approach. Discuss a “pay for delete” agreement with the lender when removing a repo from your credit report. This involves offering to pay off the remaining balance. In exchange, the repossession should be removed from your credit report.

Not all lenders are willing to take part in pay-for-delete arrangements. However, discussing this possibility directly with them could yield positive results. If they agree, document any arrangement in writing before proceeding with payments.

Seeking help from professionals experienced in credit repair can aid negotiations. This includes negotiations related to pay-for-delete agreements. These experts have comprehensive knowledge about navigating such discussions effectively. They also aim to maximize their chances of success.

D. Strategies for Removal

1. Goodwill Letters

Consider writing a goodwill letter to get a repo off your credit. In this letter, express remorse for the situation that led to the repossession. Take responsibility for any missed payments or financial difficulties. Highlight positive changes in your financial circumstances.

For example, talk about securing stable employment or paying off other debts. This can also strengthen your case. It’s important to include supporting documentation that demonstrates your improved financial situation. You can use pay stubs or bank statements.

Sending the goodwill letter to the lender or collection agency is crucial. After sending it, follow up with the recipient to inquire about the status of your request. This shows persistence and determination in rectifying past credit issues.

More examples of what to highlight in your goodwill letter include:

- You could mention how you lost your job but have since found stable employment.

- If there were justifiable circumstances like medical emergencies, provide documentation if possible.

- Express genuine regret for any missed payments. Emphasize steps taken to prevent future occurrences.

2. Legal Credit Repair

Another worthwhile avenue is seeking legal credit repair assistance. Reputable professionals are well-versed in credit law and regulations. They know about laws like the Fair Credit Reporting Act (FCRA).

Consult with a knowledgeable attorney or credible credit repair agency. They can help you understand your rights. They can explain the relevant laws for removing repos from your credit report.

It’s essential to comprehend these rights. Be cautious of scams or unethical practices prevalent in the industry. Research thoroughly before choosing a service provider. Opt for those with proven track records.

Managing Debt Post-Repossession

1. Addressing Ongoing Debt

After a repossession, developing a plan to address any remaining debts is crucial. Start by prioritizing paying off outstanding balances to improve your overall financial health. This can involve creating a budget that allocates funds specifically for debt repayment.

Consider debt consolidation or negotiation options as effective ways to manage many debts. Debt consolidation involves combining many debts into one monthly payment. The new payment often has a lower interest rate. However, negotiation with creditors may lead to reduced payoff amounts or more manageable payment terms.

Seeking professional advice from a credit counselor or financial advisor is highly recommended. These experts can provide personalized guidance based on your unique financial situation. They can also help you establish an actionable plan for tackling your remaining debt.

Regularly monitoring your credit report is essential after addressing ongoing debt. This ensures accurate reporting of paid-off debts. It also lets you identify any errors that could negatively impact your credit score.

2. Minimizing New Accounts

To reduce the negative impact of repossession on your credit, you must limit new credit applications. Each application typically results in a hard inquiry on your credit report. This can further lower your score.

Instead of seeking new loans or lines of credit immediately after repossession, focus on rebuilding your credit first. This might involve making timely payments on existing accounts. Gradually improve your financial standing before pursuing additional financing options.

Avoid unnecessary purchases that may require additional financing. This will prevent accumulating more debt during this period of recovery post-repossession.

Another key strategy for minimizing the impact of repossession on your credit score is maintaining a low credit utilization ratio. It refers to the amount of available credit used at any given time. Keeping balances low on existing accounts demonstrates responsible borrowing behavior. It also positively influences how lenders perceive you as a borrower.

Secured credit cards and other credit-building tools, such as secured loans, can help rebuild damaged credit after a repossession. Secured cards require a cash deposit as collateral. They are generally easier to qualify for than traditional unsecured cards.

Rebuilding Your Credit Score

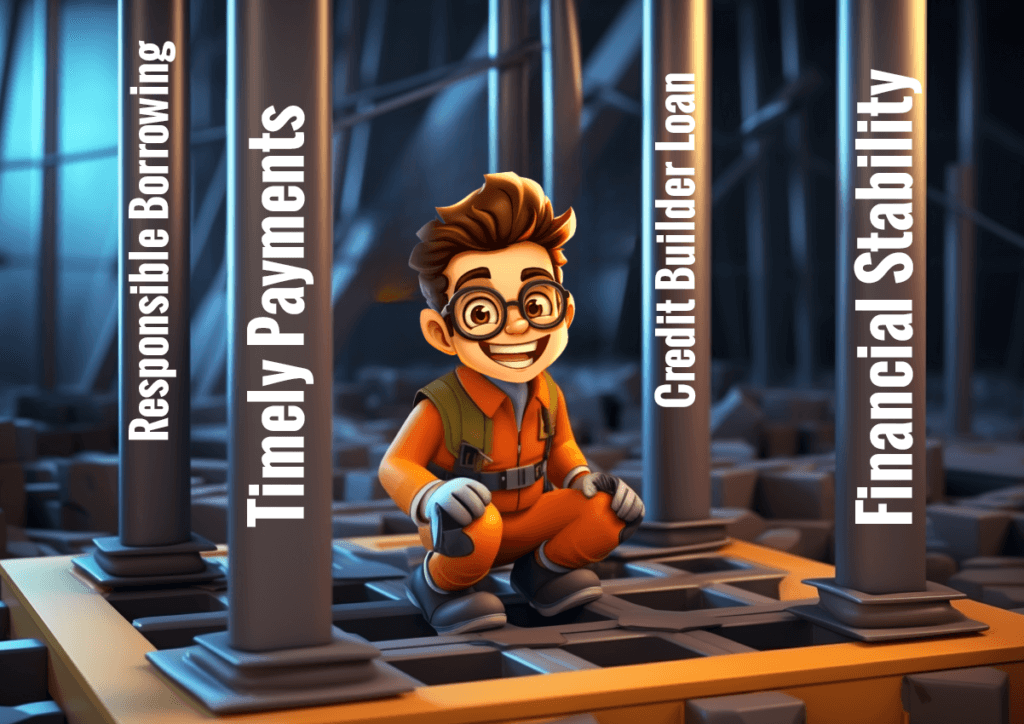

1. Credit Builder Loans

Credit builder loans are an excellent option for individuals who want to rebuild their credit. Banks and credit unions offer these loans. They help people build or rebuild their credit history. By making regular payments on time, you can demonstrate responsible borrowing behavior. The lender reports your payment activity to the credit bureaus. This can positively impact your credit score.

These loans allow you to showcase financial responsibility. You can improve your credit score through consistent and timely payments.

It’s essential to use the loan funds responsibly. Avoid taking on more debt during this time. This approach helps gradually improve your financial standing. It also rebuilds a positive credit history.

One key advantage of opting for a credit builder loan is that it allows individuals with poor or no credit scores to start building a positive track record with lenders. Establishing a pattern of on-time payments can create a strong foundation for future borrowing needs.

2. Second-Chance Loans

Second-chance loans provide an alternative path for those struggling with bad credit. The loans help people rebuild their financial reputation. It’s essential to research lenders offering these types of loans. They often have higher interest rates and stricter terms than traditional lending options.

Making timely payments on second-chance loans is crucial. It demonstrates improved financial responsibility and works towards rebuilding your credit score. You can refinance the loan as you continue making regular payments and showcasing better money management skills. You can do this once your credit score improves significantly.

Second-chance loans allow people with past money problems to prove they’ve learned from their mistakes. They are committed to managing their finances more effectively. Using these opportunities wisely can lead to improved access to financing. It can also pave the way for enhanced overall financial well-being.

Qualifying for New Loans

Auto Loans After Repo

Getting approved for an auto loan after a repo can be challenging. It’s essential to understand that lenders may view you as a higher-risk borrower. This is due to the previous repossession.

Therefore, it’s crucial to work on improving your credit score before applying for a new auto loan. You can demonstrate responsible financial behavior by making timely loan payments.

Another effective strategy to enhance your chances of approval is to save for a larger down payment. When you provide a sizeable down payment, future lenders perceive it as a commitment from your end. This reduces their perceived risk in lending to you. Consider alternative options like buy-here-pay-here dealerships or seeking cosigners if necessary.

Furthermore, be prepared for the likelihood of facing higher interest rates. You may also get less favorable loan terms due to the repo on your credit history. This may seem discouraging at first glance. Remember that these challenges are not insurmountable with diligent effort and time.

- Understand that getting approved for an auto loan after a repo may be challenging.

- Work on improving your credit score before applying for a new auto loan.

- Save for a larger down payment to increase your chances of approval.

- Consider alternative options like buy-here-pay-here dealerships or cosigners if necessary.

- Be prepared for higher interest rates and less favorable loan terms due to the repo.

Mortgages with Repossession

Similarly, getting approved for a mortgage after repossession requires significant time and effort. You need to rebuild your credit and overall financial situation. Rebuilding your credit score involves consistent efforts. For example, make timely payments towards existing debts. Avoid taking on additional debt unless necessary.

When considering applying for mortgages after repossession, saving for a sizeable down payment is wise. This demonstrates financial responsibility. It also reduces the lender’s perceived risk of approving your mortgage application.

It’s crucial to consult with multiple lenders. This will help explore different mortgage options based on current circumstances like income stability post-repo and employment history consistency.

Other factors are also relevant in determining eligibility criteria set by various lenders. They offer different types of mortgages tailored towards borrowers who have experienced past financial setbacks like repossession.

Be prepared mentally and financially for stricter requirements. They might include providing more extensive documentation to address past repossessions. They might also encounter higher interest rates. This is compared to conventional circumstances where no adverse credit events occurred.

Long-Term Credit Management

Waiting for Removal

When repossession entries appear on your credit report, it’s crucial to understand that they don’t vanish overnight. It takes time for these negative marks to be removed from your credit history.

Therefore, it’s essential to monitor your credit report regularly. Keep an eye out for any updates or changes in the status of the repo entry. Be patient during this process. Continue practicing good financial habits. Make timely payments and keep low account balances.

It’s essential to follow up with the credit bureaus. This is important if the repo entry remains on your report beyond the reporting period specified by law. You can request them to remove outdated information from your report.

Maintaining documentation of all correspondence related to the removal process can be helpful. It can provide evidence of communication with the credit bureaus later.

Suppose you’ve been monitoring your credit report diligently. You notice a repossession entry hasn’t been removed after seven years. The maximum reporting period is seven years. In this scenario, following up with the credit bureau could aid in removing the repossession. Provide documented proof of when the repossession occurred.

Long-Term Impact Analysis

Recognizing that repossession can have long-term consequences on your financial future is crucial. When a vehicle or other property is repossessed due to missed payments or defaulting on a loan, it impacts one’s ability to qualify for new loans in the future.

This affects borrowing opportunities and interest rates offered by financial institutions. It also affects insurance premiums.

It’s vital to understand how repossession affects these aspects. It helps individuals take proactive steps to lessen its impact over time. Individuals can rebuild their damaged creditworthiness by making timely payments on existing debts. They can also maintain low balances on credit accounts.

Seek professional advice for long-term credit repair strategies. This may also benefit those dealing with repossession entries on their reports. Financial advisors or reputable credit counseling services can provide guidance tailored to individuals’ circumstances. They can also help develop effective plans for improving their financial health.

Staying committed to responsible financial habits is critical. It mitigates the long-term impact of repossession entries. This is true despite past setbacks.

Final Thought

By understanding the impact of repossession, checking your credit report, and navigating the dispute process, you can take proactive steps toward improving your credit standing. You can also negotiate with creditors.

Remember, it’s essential for long-term financial stability to manage debt post-repossession. You should also rebuild your credit score.

Now armed with these strategies, it’s time to take action. Start by implementing the tips provided and monitoring your progress regularly. Don’t let a repossession define your financial future. With determination and persistence, you can work towards qualifying for new loans. You can also master long-term credit management. Your journey to financial freedom begins now!

FAQs

1. How does repossession affect my credit score?

Repossession can damage your credit score. It’s like a big red flag on your financial record, signaling to lenders that you may be high risk. It could make qualifying for new loans or lines of credit challenging.

2. Can I dispute a repossession on my credit report?

Yes, you can dispute a repossession on your credit report for inaccuracies or errors. Providing evidence to support your dispute is crucial. If successful, the repossession could be removed from your report. This would improve your credit standing.

3. What strategies can I use to remove a repo from my credit history?

One approach is negotiating with creditors. You offer settlements in exchange for removing the repo from your record. Or, explore goodwill letters or seek professional help from reputable credit repair agencies.

4. Will managing debt post-repossession help improve my credit score?

Absolutely! You prove improved financial behavior by responsibly managing any remaining debts. You also show it by making timely payments. Over time, this positive activity will contribute to rebuilding your overall creditworthiness. It will also enhance your creditworthiness.

5. How long does it take to qualify for new loans after a repossession?

The timeline varies based on individual circumstances. This includes efforts to rebuild a credit score. It also covers the specific requirements of potential lenders. Generally, demonstrating responsible financial behavior over time increases the likelihood of qualifying for new loans.

Our Latest Blogs:

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Did you know that...

ThisIsJohnWilliams

ThisIsJohnWilliams

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Have you ever wondered...

ThisIsJohnWilliams

FREE Strategy Session to Fix Your Credit Blogs / Facebook Twitter Linkedin Instagram Share Summary Unlock the secrets to...

ThisIsJohnWilliams